Ah, what a curious spectacle we behold! VanEck’s April 2025 Digital Assets Monthly recap reveals that Bitcoin (BTC), that rebellious asset, dared to outshine the stock market in a tumultuous month. Could this be a glimpse of its true potential as a refuge from the stormy seas of traditional finance?

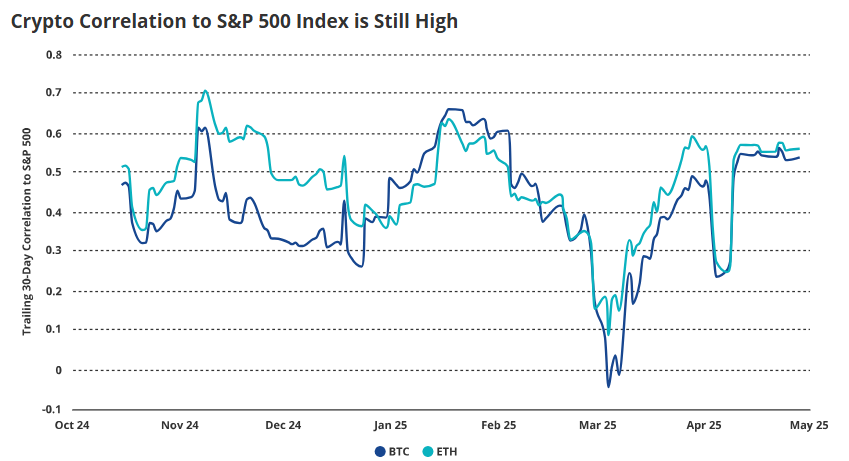

But alas, dear reader, Bitcoin’s flight from its stock market shackles was but a fleeting affair. The illusion of independence was shattered as it swiftly returned to its familiar chains, suggesting it’s not quite ready to sever ties with the risky markets just yet.

Bitcoin Triumphs Over Stocks During April’s Market Panic

In a rare and shocking moment, Bitcoin broke free from the shackles of traditional markets like stocks and equities. Yet, the question remains: was this a true emancipation, or just a temporary escape?

“Bitcoin showed signs of decoupling from equities during the week ending April 6,” wrote Matthew Sigel, VanEck’s Head of Digital Assets Research, as though the market were an old tyrant and Bitcoin its would-be liberator.

At this dramatic juncture, US President Donald Trump unleashed a barrage of tariffs, sending the global markets into a frenzy. While the S&P 500 and gold stumbled in confusion, Bitcoin, like a heroic knight, surged from $81,500 to over $84,500, hinting at a possible shift in investor sentiment.

But wait—this moment of glory was short-lived! As the month rolled on, Bitcoin’s price action rejoined its trusty allies in the equity markets. VanEck, citing data from Artemis XYZ, observed that the BTC-S&P 500 correlation, which had dipped below 0.25 in early April, shot back up to 0.55 by month’s end. A fickle hero, indeed!

“Bitcoin has not meaningfully decoupled,” the report bluntly asserted, as if to say, ‘Not so fast, my friend!’

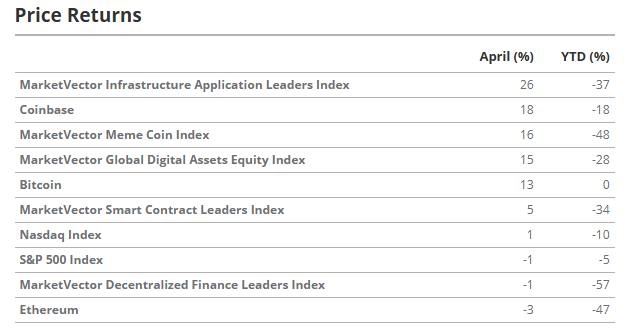

Bitcoin finished the month with a respectable 13% gain, outpacing the NASDAQ’s 1% loss and the S&P 500’s lackluster performance. What’s even more intriguing, however, is that Bitcoin’s volatility dropped by 4%, while the equity markets were caught in a storm of volatility, doubling their own instability as geopolitical tensions and trade uncertainty mounted. Could it be that Bitcoin is slowly learning how to be a more stable companion to its investors?

Yet, while the short-term picture remains murky, VanEck sees signs that a more profound transformation is underway. There’s a growing appetite for Bitcoin as a sovereign, uncorrelated asset—a long-term hedge against the chaos of traditional markets.

“Structural tailwinds are forming. Bitcoin continues to find support as a sovereign, uncorrelated asset,” Sigel boldly proclaimed. A pronouncement fit for the annals of history!

VanEck also pointed to the curious case of Venezuela and Russia, who have begun using Bitcoin in international trade. Perhaps this is the dawn of a new era, one where Bitcoin becomes the noble currency of the oppressed nations!

Corporate Bitcoin Hoarding Takes Flight in April

And lo! The corporations have joined the fray. In a most splendid display of financial acumen, corporate Bitcoin accumulation soared in April. Notable purchases included 25,400 BTC by Strategy (formerly known as MicroStrategy), as well as fresh investments by Metaplanet and Semler Scientific.

Even the likes of Softbank, Tether, and Cantor Fitzgerald have embarked upon the creation of a new firm, 21 Capital, with plans to acquire $3 billion worth of Bitcoin. Truly, a league of financial titans has united under the banner of Bitcoin!

These developments follow Standard Chartered’s bold assertion that Bitcoin is now emerging as a hedge against the traditional finance system (TradFi) and the risks tied to US Treasury bonds. Could Bitcoin be the savior of portfolios, standing strong against the fickle forces of fiat currency?

“I think Bitcoin is a hedge against both TradFi and US Treasury risks. The threat to remove US Federal Reserve Chair Jerome Powell falls into Treasury risk—so the hedge is on,” said Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, as though speaking from the mountaintop of financial wisdom.

Alas, not all was rosy in the crypto world. Altcoins, it seems, could not share in Bitcoin’s glory. Meme coins, speculative DeFi AI tokens, and Layer-1 networks like Ethereum and Sui fell precipitously. The MarketVector Smart Contract Leaders Index plummeted 5% in April and has now dropped a staggering 34% year-to-date.

Yet, not all was lost. Solana stood tall as a rare victor, gaining 16% due to network upgrades and a growing interest from institutional treasuries. Meanwhile, Ethereum languished, its fee revenue share shrinking dramatically, from a lofty 74% two years ago to a mere 14%. Alas, how the mighty have fallen!

Meanwhile, the altcoin market, full of speculative fervor, continued to fade. Trading volumes in meme coins plummeted by a staggering 93% between January and March, with the MarketVector Meme Coin Index suffering a 48% decline year-to-date.

In the end, Bitcoin’s relative strength in April may hint at a future where it stands apart from the pack. VanEck’s report concludes that while Bitcoin has not yet fully shaken free from the risk asset crowd, the seeds for a long-term decoupling are quietly being sown. A new chapter awaits… perhaps even a more dramatic escape in the future!

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- USD ILS PREDICTION

- Invincible’s Strongest Female Characters

- USD RUB PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- How to Reach 80,000M in Dead Rails

2025-05-06 11:10