Bitcoin Stocks: The Ostentatious Dance of Wealth and Folly

In the dim corridors of financial grandeur, there exists a curious spectacle: 34 venerable institutions boasting a trove of 699,387 BTC—valued at over $72 billion. MicroStrategy, the grandmaster of this peculiar game, holds 555,450 BTC, enough to make even the most seasoned investor raise an eyebrow. Ah, the charm of digital gold—so alluring, yet so perplexing, like a jest in court where the punchline keeps changing.

While some herald Bitcoin as the messiah of bullish fervor, the charts whisper a tale far more nuanced. Adding BTC to the treasury is no divine recipe for everlasting prosperity. Outliers like Metaplanet have skyrocketed by over 3,000%, perhaps in a fit of divine madness, yet many others have languished or fallen into the abyss of modest gains or outright declines. It’s as if the gods of finance play a cruel joke, blending hope with despair.

Metaplanet Inc.

Metaplanet, a once humble hotelier from Japan, has transformed—like a butterfly from a caterpillar—into a fierce cryptocurrency devotee. It demonstrates how some old-world firms are donning digital armor, chasing the elusive promise of Bitcoin riches.

Since launching its BTC Income Generation strategy in late 2024, the company’s fortunes have been a rollercoaster—88% of its Q1 FY2025 revenue, amounting to ¥770 million ($5.2 million), now stems from the artful harvesting of Bitcoin option premiums. Truly, the art of turning digital dust into gold.

In April 2024, Metaplanet first clasped Bitcoin to its bosom, holding 5,555 BTC, valued at just over half a billion dollars. Since then, the company’s stock has ascended more wildly than a hero in an opera—over 3,000%, with recent filings showing a 15-fold increase in share price in a single year. Ah, the sweet intoxication of financial bet-hedging!

Their aggressive quest for 10,000 BTC by year’s end has captivated investors and expanded their shareholder assembly—by a staggering 500% in twelve months, no less. Yet, even amid the celebrated gains, the shadow of Bitcoin’s volatile whispers causes some to swallow their pride and count unrealized gains of ¥13.5 billion, trusting in their long-term crypto faith.

NEXON

Then there is Nexon, the venerable Japanese gaming titan behind Dungeon & Fighter and MapleStory. In April 2021, it dipped into Bitcoin waters, acquiring 1,717 BTC—worth about $178 million. 🤔

Alas, perchance the gods of finance were unkind: despite this sizable fortune, Nexon’s stock has tumbled nearly 29% since then, proving once again that crypto exposure is no enchanted talisman for wealth but rather a dicey gamble in the grand casino of Wall Street.

Meanwhile, Nexon’s core business—its games—continues to be the true breadwinner. In its Q1 2025 report, revenues climbed modestly by 5%, reaching ¥113.9 billion, with operating income soaring 43%, driven by their beloved titles and a cunning reduction in costs. Ah, success in the realm of pixels and pixels alone.

Semler Scientific (SMLR)

Semler Scientific, a name lesser known in the grand halls, embarked on its Bitcoin voyage in May 2024, collecting 1,273 BTC—worth about $132 million. A financial Peter Pan, daring to fly amidst giants.

Since then, its shares have grown over 55%. Not quite a fairy tale, but enough to make shareholders chuckle with a mix of hope and disbelief. Though small, its bold accumulation makes it a noteworthy act in the theater of corporate crypto adoption.

Alas, the latest earnings reveal a bittersweet symphony: revenue down 44%, to $8.8 million, and a widening gap in operating losses—$31.1 million—amidした expenses of $39.9 million. Meanwhile, a $41.8 million unrealized loss from Bitcoin’s fickle moods contributed to a total net loss of $64.7 million. 😅

Undeterred, the brave company vows to expand its crypto stash with a $500 million ATM and a $100 million convertible note—perhaps hoping that faith, like humor, can withstand the absurdity of market whims.

Tesla (TSLA)

Elon Musk’s Tesla, a titan of innovation—or chaos—has tangled with Bitcoin since January 2021. Musk, the modern-day wizard, cast spells of optimism on crypto markets, influencing sentiment with a flick of his wand and a tweet or two. 🧙️

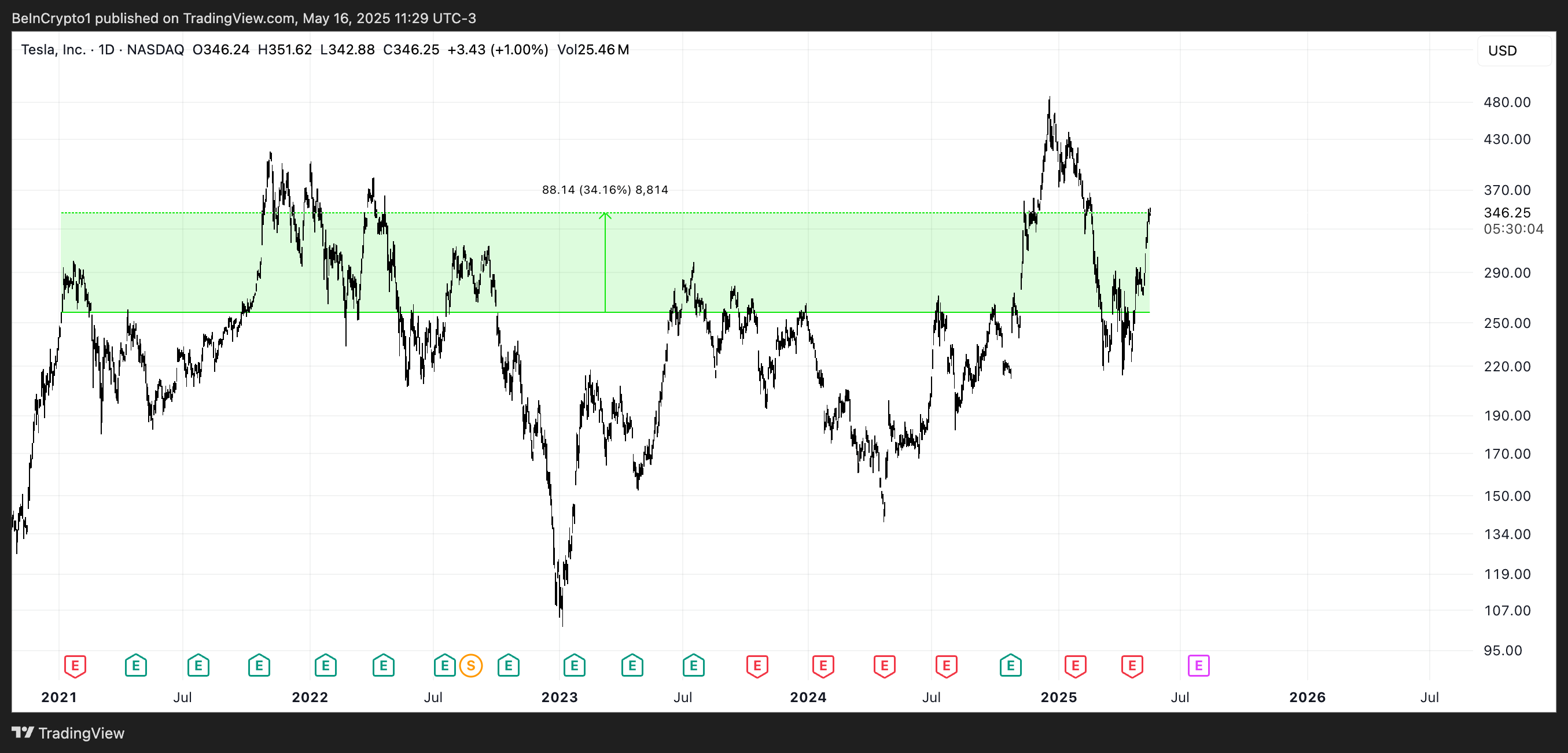

Their crypto saga has been turbulent: Tesla’s stock up 34%, yet the price of BTC has risen 212%, with Tesla’s shares swinging wildly from near $480 to below $107—like a ship tossed by stormy seas.

Latest earnings reveal a somber note: automotive revenues down 20%, total revenue faltering, and net income cut by 71%. A precarious balancing act amid rising tariffs and political storms. Still, progress in energy storage and AI whispers hopeful future stories.

Perhaps the most dramatic act—Tesla’s shares down 41% YTD and Musk’s political ventures stirring the pot—leaves investors clutching their popcorn, waiting for the next spectacle. Meanwhile, the robotaxi revolution faces its own delays, like a long-winded comedy in a grand theater.

Block Inc. (formerly Square)

And so, to the humble beginnings of Jack Dorsey’s Block, which, in October 2022, gratefully welcomed Bitcoin into its treasury—8,485 BTC, worth $881 million. The company that pioneered Bitcoin on Main Street. Or so they say. 🤓

Its stock? A rollercoaster—rising a meek 3.8%, with wild peaks above $100 but also dips down to $38.5 amid broader market tempests. Who needs certainty, anyway?

Q1 2025 brought mixed feelings: revenues missed expectations, but gross profit beat hopes—$5.77 billion is an approximate high-wire act. Yet, guidance remains cautious amid macro storms, tariffs, and global chaos. Meanwhile, Cash App’s profits climb thanks to flashy features and new ventures, keeping spirits somewhat afloat.

And so, dear reader, in this curious spectacle of wealth, folly, and digital dreams, the dance continues—where fortunes are made and lost faster than a jest at court. Who knows what tomorrow holds? Perhaps only the gods—and a few clever investors with a sense of humor. 😏

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- USD ILS PREDICTION

- Invincible’s Strongest Female Characters

- USD RUB PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- How to Get 100% Chameleon in Oblivion Remastered

2025-05-17 00:11