Will Bitcoin Take a Nosedive? The Juicy Details Inside! 🚀📉

Ah, Bitcoin! The digital darling currently struttin’ its stuff at $102,980, boasting a market cap of a cool $2.04 trillion. With a 24-hour jolly jig of $23.32 billion and swinging between $102,801 and $104,263, it’s as if the crypto market is having a gentle nap after a sprint. Consolidation – fancy word for ‘just chilling, folks’ – follows its recent upward boogie.

Bitcoin

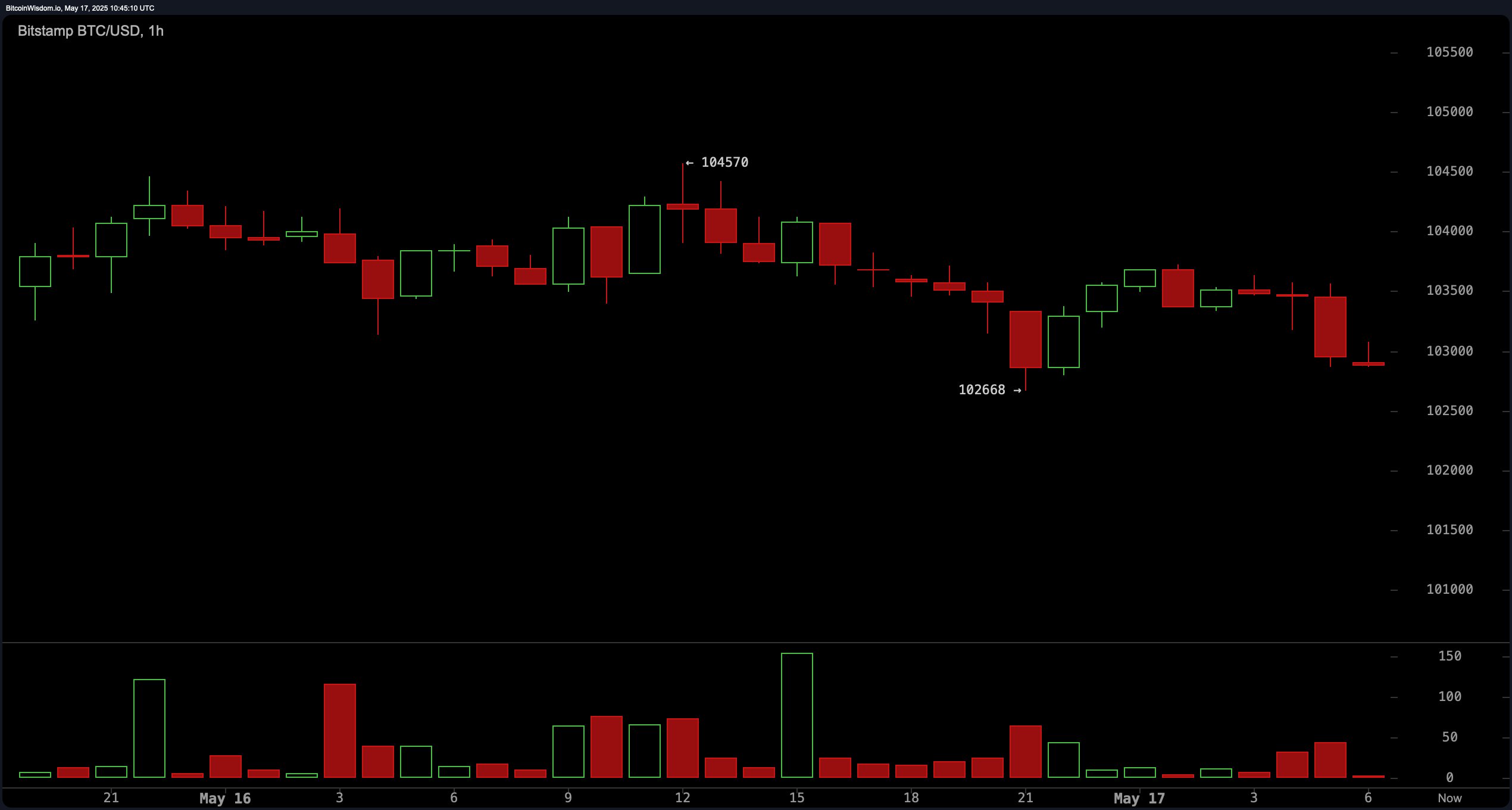

The 1-hour chart paints a picture that would make a cat with a yarn ball look calm. A clear short-term downtrend is in play, with the price making lower highs than your Aunt Agatha’s gossip. It’s testing the $102,668 level as a possible bounce point, though volume—like a shy debutante—has noticeably waned, hinting that the buying ballyhoo is losing steam. Resistance beckons between $103,800 and $104,000, where bearish engulfing patterns are lurking like uninvited in-laws, ready to serve a quick short. If Bitcoin can cling to support at $102,600 with volume spiking like a New Year’s Eve party, scalpers might just have a playdate.

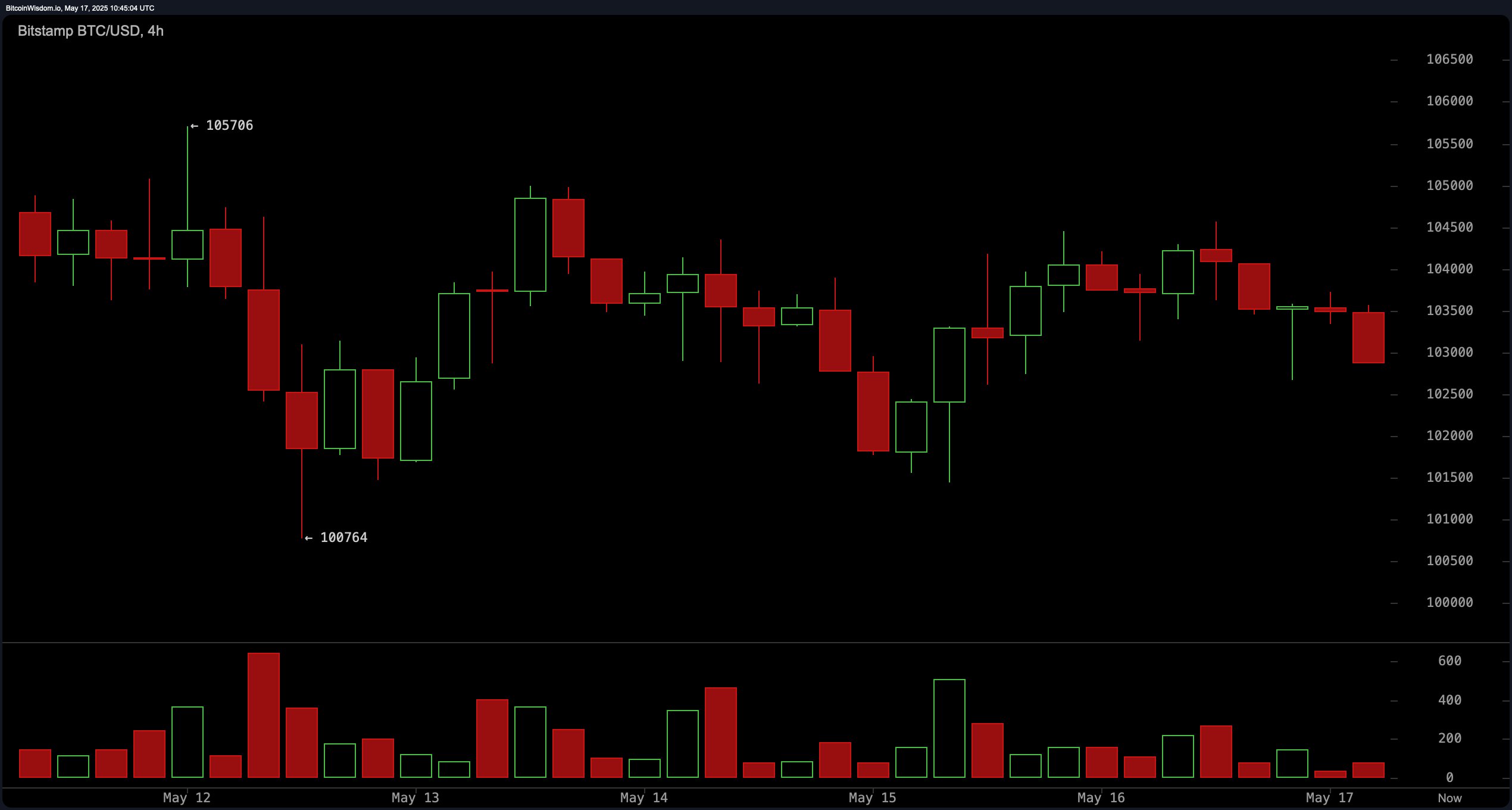

Switch to the 4-hour chart—more of a mixed bag than Aunt Agatha’s fruitcake. A brief rally to a lofty $105,706 has turned tail and run, leaving behind a lower high and a lower low, like a sad puppy. Down candles are packing a punch with heavy volume, indicating the bear’s grip isn’t just in your imagination. Resistance remains stubborn at $104,500; only a shiny hold above this level would make the bulls think they’re in the game. Support at $100,500 to $100,800 is the come-and-go zone where the plot thickens—either as a launchpad or the beginning of a holiday from the highs.

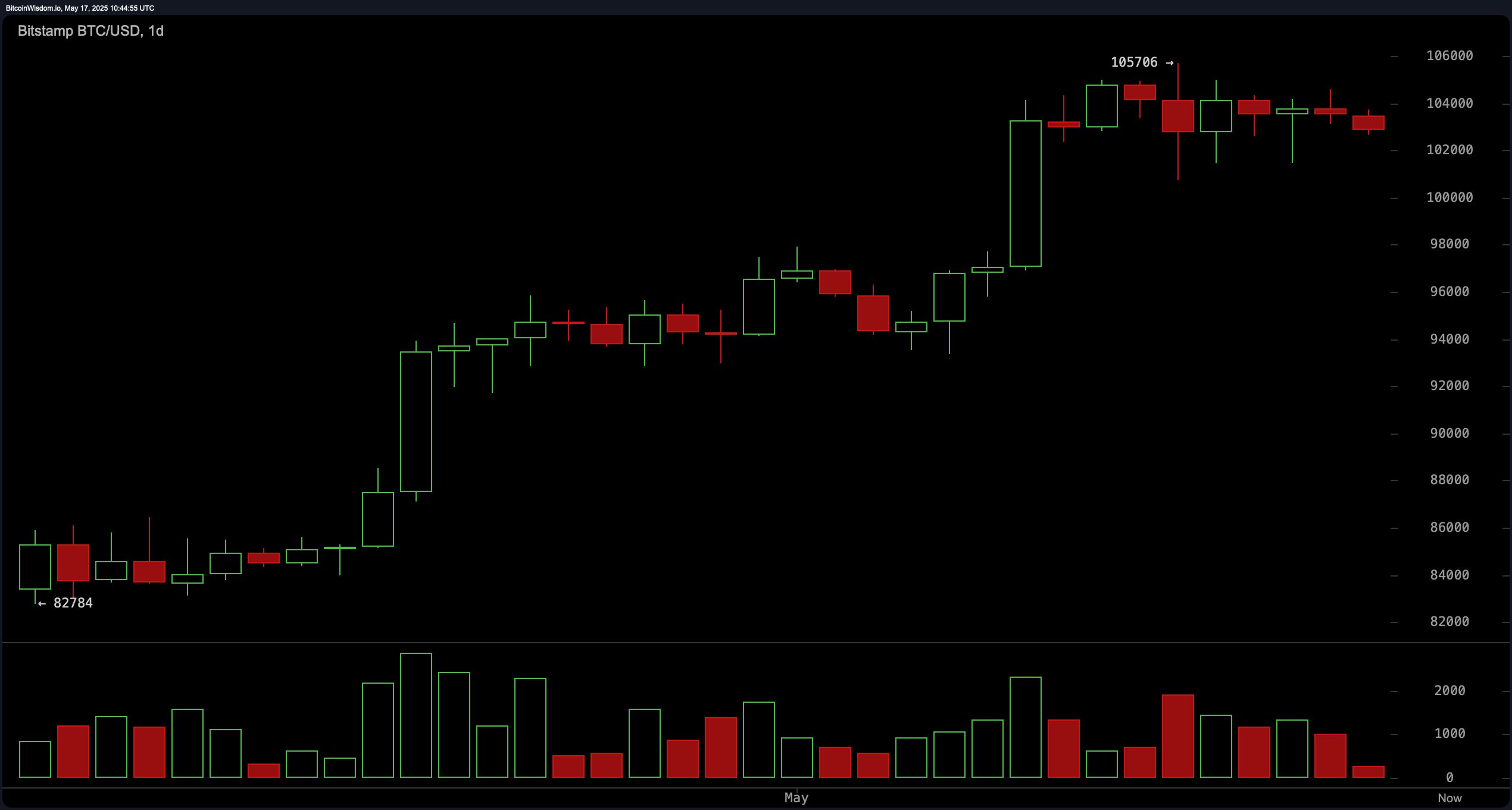

Peering through the “bigger picture” lens—think of it as zooming out and realizing your house is indeed on fire—Bitcoin has been climbing since late April from around $82,784 to a peak of $105,706. But, as vegetarians might say about a steak, even the best run can tire. A fresh batch of indecision shows up in small candles and upper wicks, like the smoke from a doubtful cigar. Trading volume near recent highs has mysteriously dropped—bad news for those hoping for a full-on rally. The support zone of $96,000 to $98,000 is like a trusty old safety net, while $105,700 remains a wall that, if battered down, could open the floodgates for a serious climb.

From the wise old standpoint of technical indicators, most are behaving as neutrally as a Sunday afternoon. RSI, Stochastic, CCI, ADX, and the Awesome oscillator are showing a polite “meh”—not much excitement. MACD, however, is singing a bearish tune, which might make you want to grab your popcorn. Meanwhile, the moving averages are singing a different tune—namely, bullish. EMAs across the 10, 20, 30, 50, 100, and 200 periods are indicating support, apart from the sassy 10-period SMA which is flashing a bearish sign like a neon sign in Vegas. The longer EMAs above their SMAs paint a picture of overall bullishness—if Bitcoin ever gets out of its own way and stays supportive above $100,000, the next leg up could be a doozy.

Bullish Banter:

Our dear old Bitcoin is still hobnobbing in the uptrend club, boosted by those exuberant exponential moving averages. The daily chart’s macro view since late April confirms the higher highs and higher lows. If Bitcoin can hold onto the $100,500–$102,600 zone and jab through $105,700 with the supporting volume, the bullish bandwagon might just keep rolling. All aboard! 🚂🎉

Bearish Bluster:

But hold your horses—short- and medium-term charts whisper warnings. Volume is waning faster than a summer romance, and resistance at $104,500–$105,700 is more stubborn than Aunt Agatha’s stubborn refusal to admit she’s wrong. Failure to retake these levels, along with a dive below the $100,000 mark, could turn this bullish picnic into a bear’s buffet—so beware, my friend. 🐻⚠️

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- AI16Z PREDICTION. AI16Z cryptocurrency

2025-05-17 14:59