- Bitcoin’s Open Interest Delta is showing déjà vu from past bull runs.

- A drop in the 180-day Delta may signal a juicy market bottom – or maybe just more chaos.

Ah, Bitcoin. Always the drama queen of the financial world. And here we are again, staring at its Open Interest Delta, which seems to be hinting at another round of ridiculous price surges. Sounds familiar, doesn’t it? Of course, it does.

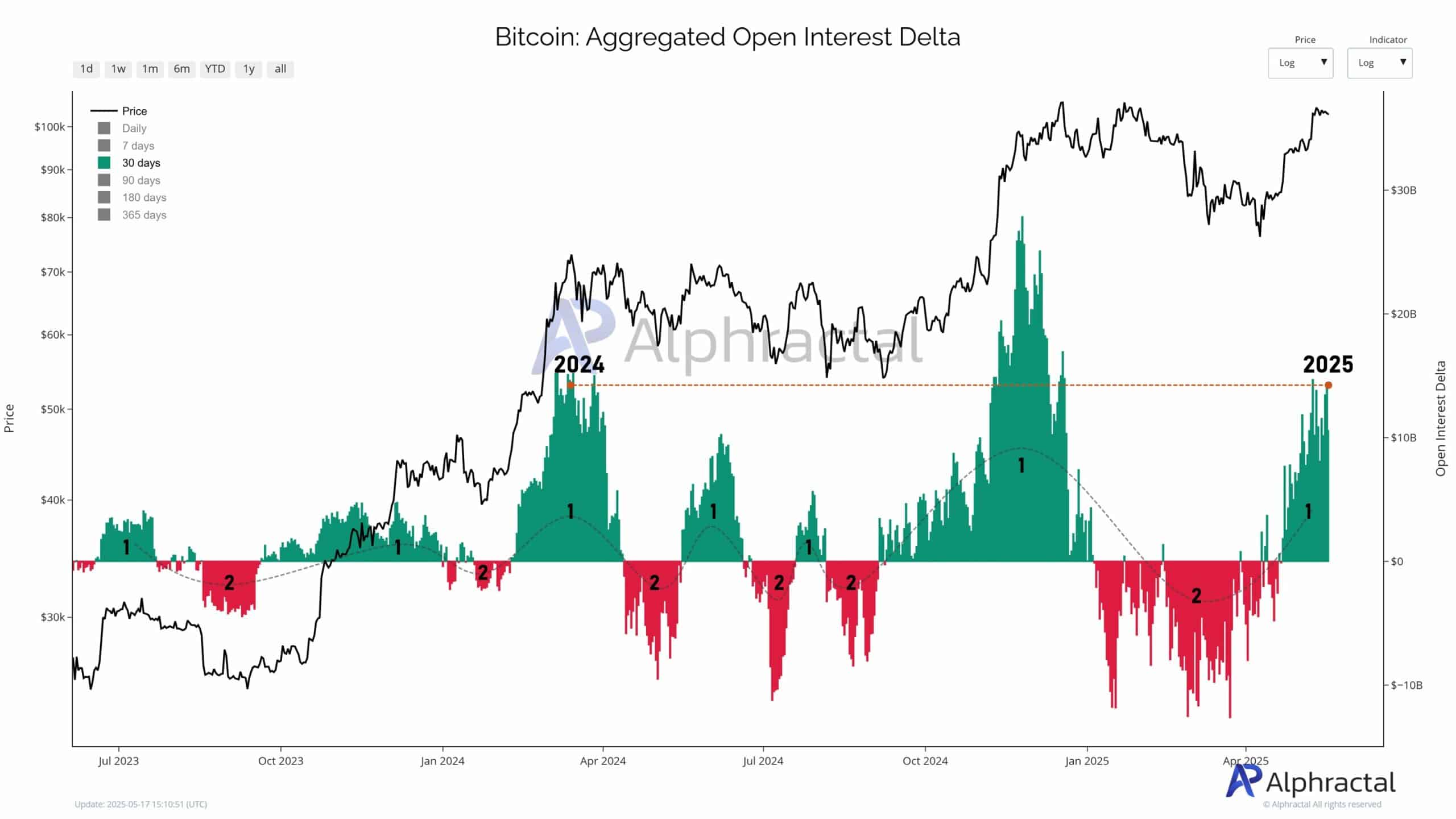

The 30-day consolidated Delta is doing that thing it always does before a monumental spike—reaching levels we haven’t seen since 2024, when Bitcoin rocketed above $73K to its glorious peak. We’re all hoping it’s a repeat performance, but let’s not get too carried away just yet, shall we?

And lo and behold, history might actually be repeating itself, as the same patterns start to show up across those ever-so-reliable derivatives metrics. Hold onto your hats!

Two Phases: It’s Like Watching a Slow-Motion Train Wreck

Analysts, in their infinite wisdom, have categorized the Open Interest (OI) cycle into two phases. Phase 1? A mad scramble for positions, usually marked by a positive Delta (basically, everyone is piling in, like that guy at the buffet who takes half the shrimp). Phase 2? The grand unwinding, where things go south, and suddenly the Delta goes negative (it’s like watching your entire investment portfolio evaporate in front of you).

Currently, Alphractal’s data is suggesting we may be entering Phase 1 again. Oh joy, the same frenetic pace that comes just before a Bitcoin bull run. But remember, it’s not an entirely smooth ride—we’ll just have to wait and see if it ends with a champagne toast or a crash landing.

What the 180-Day Delta Can Teach Us (Hint: Not Much, But We Look Anyway)

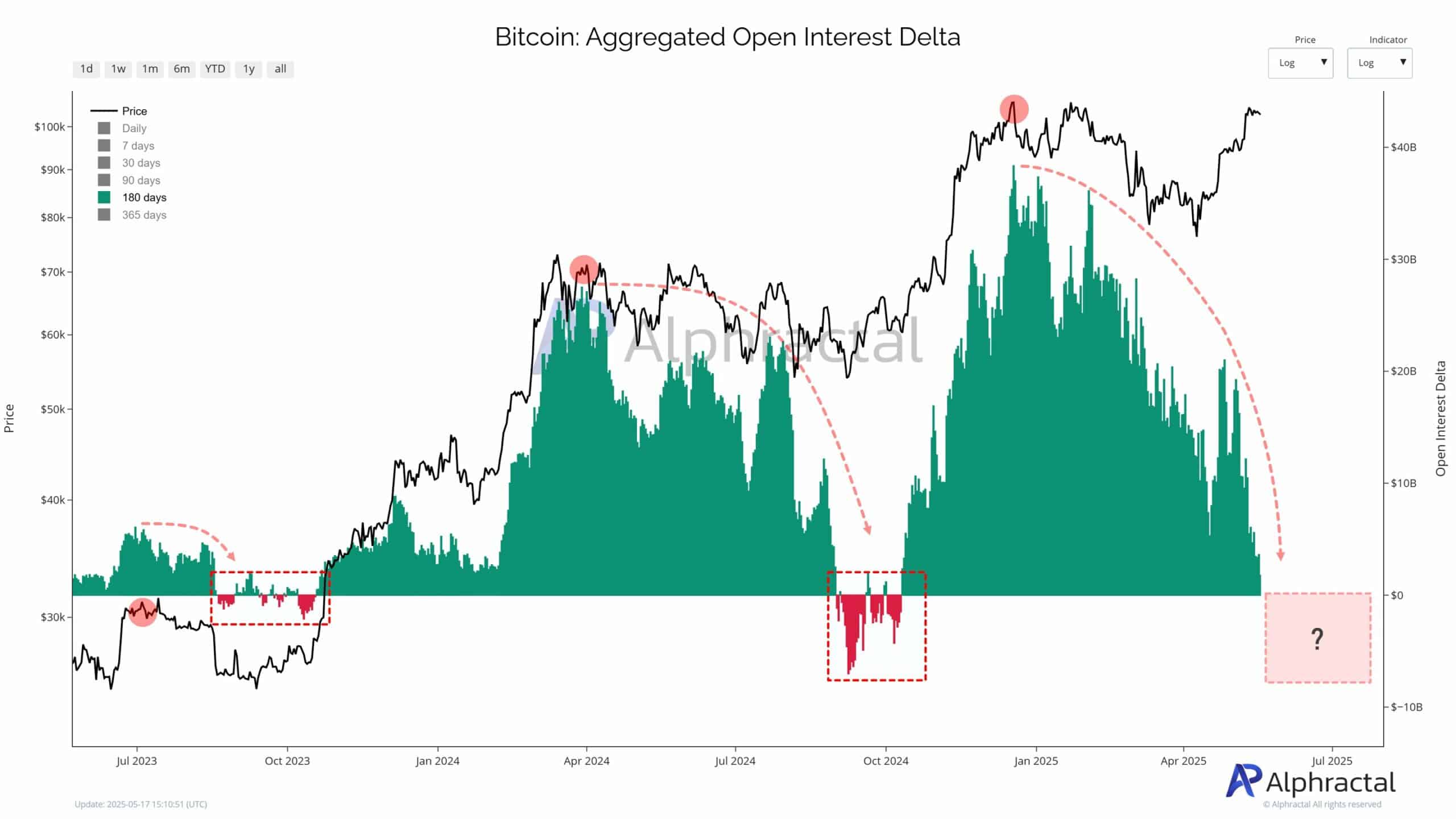

If you want the long story on Bitcoin’s mood swings, you have to look at the 180-day OI Delta. It’s the kind of thing you’d have to squint at to understand, but if you manage it, it can offer some real insight. In the past, those sudden drops in Bitcoin Delta have tended to preempt catastrophic liquidations. You know, the kind that wipe out over-leveraged long positions and leave a trail of tears. But hey, they also happen to coincide with market bottoms. Isn’t that convenient?

Right now, the 180-day Delta is hovering just above zero, like a tightrope walker on a windy day. If it flips red, get ready to make your move—another accumulation phase could be coming. Or, you know, it could all go up in smoke. Either way, it’s an exciting time for the big spenders who secretly stock up during these quiet moments.

Whales Are Watching, But Are They Acting?

Remember those clever whales that have been maneuvering Bitcoin like a chess match? Well, they’re at it again. Over the last two years, similar Delta shifts have been the prelude to Bitcoin’s most glorious rallies. Think October 2023 and early 2024. The Open Interest spikes, the bulls come out to play, and next thing you know, Bitcoin is breaking records and champagne corks are popping.

This time, though, things are a little different. The OI isn’t spiking as dramatically. In fact, it’s barely a blip on the radar. The whales are being sneaky. They’re still driving the market, but they’re playing it cooler, making their moves with the subtlety of a cat burglar.

In the world of Bitcoin, keeping an eye on the whales is like tracking a master thief—they might not make a spectacle of their movements, but when they do strike, you’ll want to be there with your wallet wide open. 📉💸

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- REPO’s Cart Cannon: Prepare for Mayhem!

- USD ILS PREDICTION

- Invincible’s Strongest Female Characters

- AI16Z PREDICTION. AI16Z cryptocurrency

2025-05-19 01:22