Crypto ETFs Defy Gravity: $329M for Bitcoin, $65M for Ether – Who Says Money Doesn’t Grow on Digital Trees?

Ah, the magical world of crypto ETFs—where numbers hop and skip like a caffeinated kangaroo. Today’s spectacle: Bitcoin ETFs snatched up an astonishing $329 million, marking their fifth day of relentless ascent. Ether ETFs, not to be outdone in this daring dance, sneaked in a tidy $65 million, their third consecutive day basking in green glory. Who knew, perhaps caffeine is a mandatory ingredient in crypto trading? ☕️💸

Bitcoin and Ether ETFs Keep the Party Going—Inflows Like There’s No Tomorrow

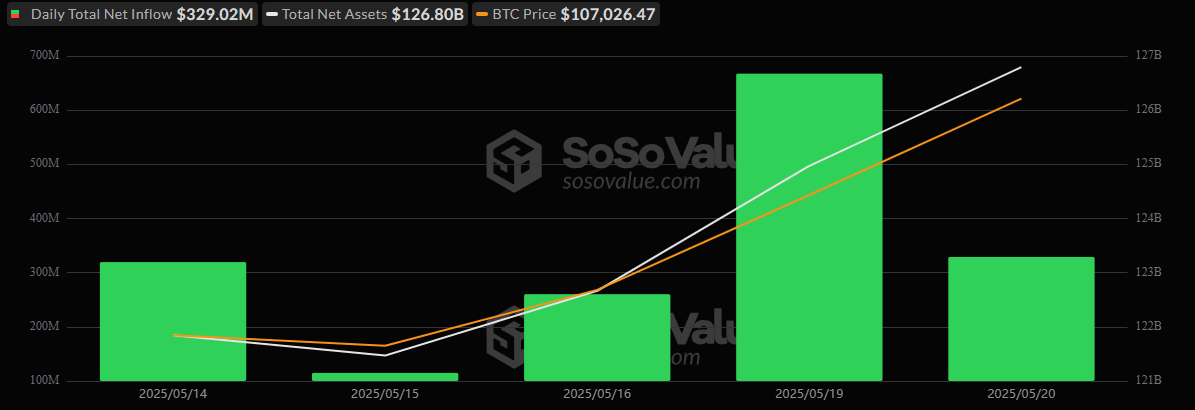

On the illustrious Tuesday, May 20, investor enthusiasm for crypto exchange-traded funds (ETFs) refused to dim. Bitcoin ETFs, those digital treasure chests, amassed $329.02 million in fresh inflows, stretching their streak to five flawless days. It’s almost as if investors are convinced this is the new gold rush—minus dirt and pickaxes. Looks like Blackrock’s IBIT was the star of the show, taking in nearly 90% of the total, or a cool $287.45 million. Fidelity’s FBTC chipped in with a modest $23.26 million, perhaps mystified by the rising magic. Meanwhile, ARK’s ARKB, Grayscale’s mini trust, and Bitwise’s BITB joined the fray with a few million each—because why not spread the love? 🎭💰

Spectacularly, not a single outflow was seen across all 12 bitcoin ETFs, signaling that the bullish mood is contagious. Total trading skyrocketed past $3.59 billion, with total net assets swelling to $126.80 billion—a figure that could make even the steeliest of skeptics blink twice. 🚀

Meanwhile, Ether ETFs kept pace with their own streak, garnering $64.89 million—day three of inflows, because apparently, they’re just as eager to join the party. Blackrock’s ETHA led with $45.04 million, and Fidelity’s FETH chipped in with $19.85 million, because who needs sleep or stability in the wild world of crypto? No ether ETFs reported outflows either—like a mutually supportive family reunion where everyone’s in the green. Daily trading volume hit a staggering $303.03 million, and net assets closed at $8.70 billion—perhaps a small fortune, or just enough to keep traders awake at night. 😉

With consecutive days of green, institutional bigwigs piling in, and the market humming a tune of unwavering confidence—who needs traditional stocks anyway? The crypto ETF world marches on, fueled by caffeine, comedy, and dreams of digital riches long after the coffee wears off. ☕️✨

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Top 8 UFC 5 Perks Every Fighter Should Use

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

2025-05-21 16:11