Ah, dear XRP holders, perched upon the precipice of financial fate, you find yourselves in a most exquisite state of anticipation, as the SEC prepares to unveil its next act in this grand legal theatre. The decisions regarding ETFs, those tantalizing harbingers of market transformation, loom like a specter over the Ripple realm.

Brad Garlinghouse: The Maestro of Institutional Momentum for Ripple XRP

In a recent episode of Ripple’s “Crypto in One Minute,” our illustrious CEO, Brad Garlinghouse, waxed lyrical about the transformative power of crypto ETFs, likening them to “the gateway to financial power.” One must wonder, is it a gateway or merely a gilded cage? 🏦

“This was really the first time you had institutions be able to go on Wall Street and trade directly in crypto,” he proclaimed, as if announcing the arrival of a new messiah, referring to the debut of XRP futures ETFs on Nasdaq and the Chicago Mercantile Exchange (CME). How quaint!

The launch of Volatility Shares’ XRP Futures ETF ($XRPI), alongside Teucrium’s earlier leveraged 2x XRP ETF, signals a burgeoning institutional appetite for Ripple’s digital delicacies. These ETFs, dear reader, invest primarily in XRP-linked futures contracts, deftly sidestepping the traditional custody conundrums. How clever! 🎩

Garlinghouse, ever the optimist, believes this shift heralds a broader acceptance of digital assets. “Crypto ETFs are institutionalizing this industry,” he declared, as if they were the very elixir of legitimacy, akin to gold ETFs in their halcyon days.

XRP Spot ETF Decisions: A Cloudy Horizon

Yet, as institutional tools expand, regulatory clarity remains as elusive as a well-mannered cat at a dog show. Several XRP spot ETF applications—filed by Bitwise, Grayscale, Franklin Templeton, and 21Shares—are currently under the watchful eye of the SEC. The first key decision deadline is June 17, 2025, for Franklin Templeton’s application. But alas, Bloomberg’s own oracle, James Seyffart, predicts that formal approvals may not grace us until Q4 2025. Patience, dear friends, is a virtue! ⏳

Despite the delays, optimism is rising like a soufflé in a well-timed oven. According to Polymarket, the odds of the SEC approving a Ripple XRP spot ETF by the end of 2025 now stand at a staggering 83%. Analysts posit that such approval could propel XRP prices to dizzying heights, reminiscent of Bitcoin’s 131% rally post-BTC-spot ETF launches. Oh, the drama!

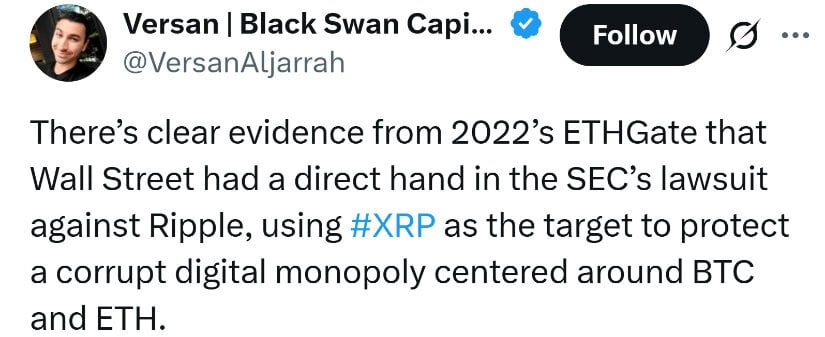

However, progress may hinge on the resolution of the Ripple lawsuit. The SEC’s request to lift the injunction on institutional XRP sales and reduce the $125 million penalty was recently denied by Judge Analisa Torres. Former SEC attorney Marc Fagel, with a twinkle of sarcasm, clarified that no official settlement has been approved yet, despite the whispers of rumor. “The court indicated it would not simply do what the parties asked without further briefing,” he quipped. How very judicial of them!

Legal Uncertainty: The Sword of Damocles Over XRP Traders

XRP has danced a volatile waltz, tied to the whims of the Ripple lawsuit and SEC developments. The token rebounded 1.44% on May 24, following a dramatic 5.57% drop the day before. Traders, ever the cautious optimists, find themselves in a state of perpetual suspense, as legal delays continue to cast a long shadow over sentiment.

Pro-crypto lawyer Bill Morgan, with a sage nod, noted that the path to revising penalties and dissolving the injunction will be a high bar indeed. “It is not just that the parties tried to avoid the correct rule,” he mused, “but the very high bar to satisfy under the correct rule—showing exceptional circumstances.” A delightful conundrum!

Garlinghouse, however, remains steadfast, positioning Ripple as a compliant institutional partner. The launch of Ripple’s new stablecoin, RLUSD, aims to support regulated enterprise finance. Designed to maintain a 1:1 peg with the U.S. dollar, RLUSD is set to become a cornerstone of Ripple’s strategy in stable assets. How very practical! 💼

Ripple’s Vision: A Bridge Over Troubled Waters

Garlinghouse believes that RLUSD and ETFs are part of a grander strategy to usher digital assets into the hallowed halls of traditional finance. “Regulatory alignment will be a core driver of institutional adoption,” he emphasized, as if reciting a mantra. By launching tools like RLUSD and supporting the XRP ETF wave, Ripple is moving beyond legal skirmishes to build long-term trust with banks and financial institutions. A noble pursuit!

RippleNet already serves over 300 global partners, and the company is leveraging its network to push forward the adoption of Ripple currency price solutions. The broader Ripple exchange ecosystem is also expected to benefit from increasing institutional flow, especially as ETFs channel fresh capital into digital assets. How delightful!

Ripple’s efforts have not gone unnoticed. Attorney John Deaton recently suggested that Garlinghouse could be a strong candidate for a hypothetical crypto Mount Rushmore, citing his leadership and innovation in launching RLUSD and acquiring institutional-grade platforms like Hidden Road. A true titan of industry!

XRP Price Prediction: The Crystal Ball Gazes

Market analysts, with bated breath, are watching closely for two major catalysts: the SEC’s ETF decisions and the final outcome of the Ripple lawsuit. A positive resolution on both fronts could trigger a rally that sends XRP soaring toward its all-time high of $3.55—and perhaps even higher. The suspense is palpable!

With institutional interest rising, the launch of ETFs, and Ripple’s expanding product suite, the XRP price prediction landscape is beginning to resemble a bullish utopia. Should the legal hurdles clear and ETF approvals follow, XRP could set its sights on the $4–$5 range in the medium term. How thrilling!

For now, XRP traders remain cautiously optimistic, awaiting clearer signals from regulators and the courts. But if Ripple’s vision unfolds as Garlinghouse anticipates, 2025 may very well be the year when Ripple XRP news reigns supreme in both crypto and traditional finance. A most splendid prospect!

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Delta Force: K437 Guide (Best Build & How to Unlock)

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Invincible’s Strongest Female Characters

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-25 21:32