Hold On Tight: XRP ETF Approval Is Almost Here… Well, Maybe? 😅

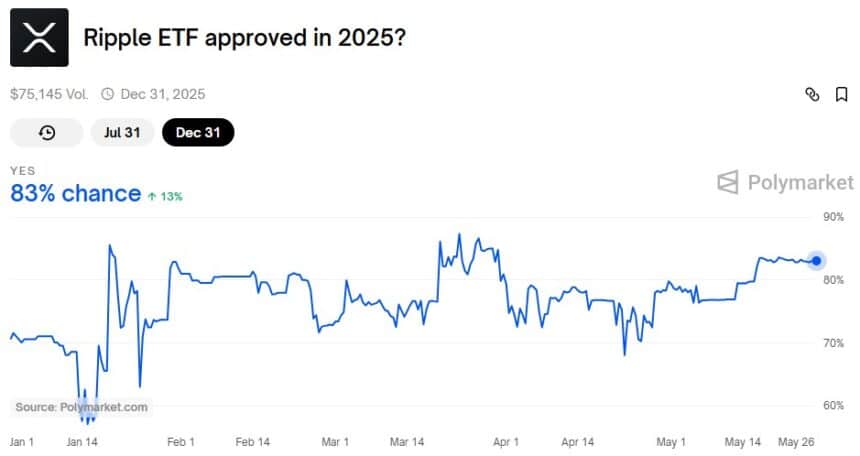

The heavens have opened and—voila! The chances of an XRP spot ETF being approved have leapt to 83% this week, a shocking rise from a mere 70% just a few days ago. Polymarket, the ever-reliable crystal ball for prediction, has been waving its magic wand to make this happen. Yes, you heard right! An 83% chance! Now, if only we had that kind of luck at the lottery.

But don’t let your hopes soar too high yet. Despite the SEC dragging its feet (as usual) and delaying decisions on multiple XRP ETF filings, the big players are still hanging on. Bitwise, CoinShares, Franklin Templeton, Grayscale—these are the financial titans waiting for the green light. Experts, however, in their infinite wisdom, assure us that delays are the usual dull hum in the background of the SEC’s slow-motion circus. Expect final decisions, they say, by October. Oh, what a delightful date for uncertainty!

In the meantime, Ripple’s CEO, Brad Garlinghouse, is sitting pretty, smiling like a cat who just knocked over a vase and is pretending it wasn’t him. He’s confident that the XRP ETF will grow like a weed in an institutional investor’s backyard. On Ripple’s podcast “Crypto in One Minute,” he was quick to point out that ETFs provide a neat, tidy, and regulated path for institutional investors to step into crypto without having to actually, you know, deal with crypto exchanges or self-custody. Ah yes, Wall Street’s eternal struggle—accessing crypto without getting their hands dirty.

Garlinghouse even dropped a nugget of wisdom, marveling at how Bitcoin ETFs exploded to $1 billion faster than any ETF in history. And guess what? He expects XRP ETFs to follow this glorious trajectory. Well, we’ve got to give him credit—confidence is half the battle, right?

And speaking of momentum, the first-ever XRP futures ETF has made its debut on Nasdaq, courtesy of Volatility Shares. With the ticker “XRPI,” it’s like the financial world’s way of saying, “Yes, we’re serious about this.” And just to keep the good vibes rolling, CME Group launched XRP futures earlier this month. It’s a ripple (pun intended) effect, and no one is complaining.

Meanwhile, Tectrium has stepped into the ring with a 2x Long Daily XRP ETF. Because why settle for regular volatility when you can double it? Institutions are clearly eyeing this with interest, which only makes it more likely that the elusive XRP ETF will be given the final stamp of approval. Because nothing says “legitimacy” quite like doubling down on a volatile asset.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nine Sols: 6 Best Jin Farming Methods

- Delta Force: K437 Guide (Best Build & How to Unlock)

- USD ILS PREDICTION

- Rick and Morty S8 Ep1 Release Date SHOCK! You Won’t Believe When!

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-26 07:00