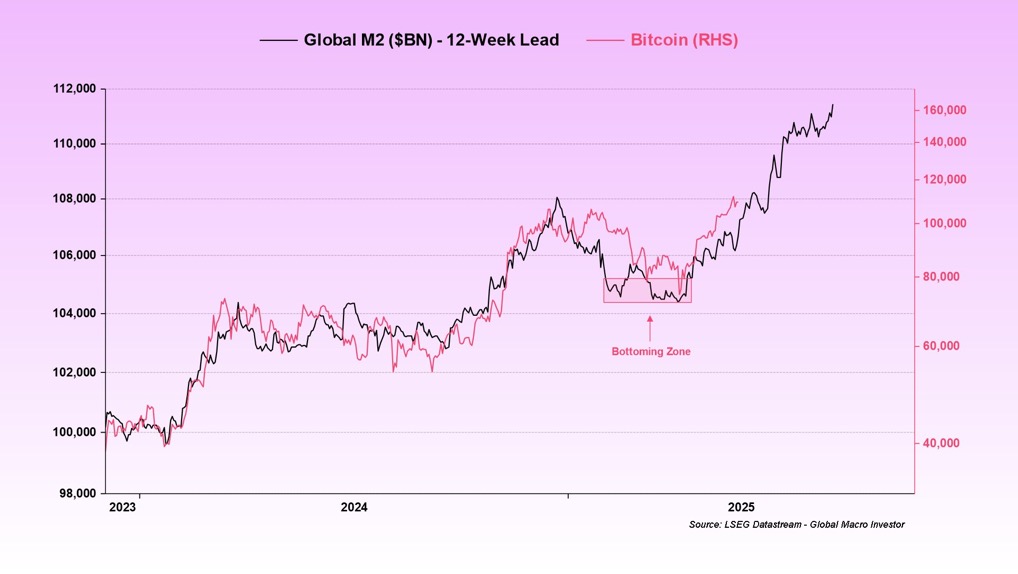

Ah, dear readers! Gather ‘round as we embark on a journey into the world of crypto, where logic is optional and fortune favors the brave (or the foolish). Bill Barhydt, the mysterious master behind Abra, decided to stir the crypto pot this weekend. How, you ask? By reposting a delightful collage of M2 vs. Bitcoin charts that sent Crypto-X into a frenzy. These charts, originally popularized by the renowned macro investor Raoul Pal and researcher Julien Bittel, seemed to suggest that Bitcoin’s price could skyrocket to a glorious $130,000 in the coming months—if, of course, the liquidity flood didn’t drown us first. But Barhydt, ever the cynic, was quick to toss in a little skepticism, saying, “It could be all horseshit. Whatever.” Ah, the humility of a crypto king!

“I’ve seen over a dozen posts with different versions of the global liquidity M2 vs Bitcoin price chart,” he said, generously crediting @RaoulGMI and @BittelJulien for this “discovery” of the century. I bet they’re thrilled! 🎉

Will Bitcoin Follow M2? Or Is It Just A Fantasy?

But wait, the plot thickens! Barhydt continued his discourse on the macroeconomic landscape, offering a nugget of wisdom: “Global liquidity needs to rise significantly in the coming months.” Naturally, Bitcoin, that great vacuum cleaner of all things liquid, will dutifully absorb this excess like a sponge. Ah yes, the classic ‘debasement’ story. But don’t get too comfortable, dear traders, for Barhydt has some advice: “Watch your leverage, touch grass, and please, for the love of crypto, be civil.” It seems like he’s been hanging out with too many sober-minded folks, doesn’t it? Just imagine, a crypto world where civility reigns! 🌱

Now, for those who are worried that this chart thing is getting crowded, Barhydt has a very sophisticated take: “We’re talking trillions of dollars, billions of people, not thousands of crypto enthusiasts in their basements. Retail’s not even looking at crypto right now.” Well, that’s a relief—right?

But the plot thickens once more! A second critic, less impressed by the liquidity data, argued that it wasn’t useful for predicting daily price moves. Barhydt, being the thoughtful man he is, agreed, “I completely agree. Hence the ‘whatever’ reference. It’s macro directional on a weekly scale at best.” Ah, yes, the ‘whatever’—a phrase that sums up the crypto market perfectly, don’t you think? 😉

But fear not! Liquidity-first is still the reigning theory, backed by the mighty Raoul Pal. According to Pal, “liquidity is the single most important driver of all asset prices.” So, if global money supply is up, Bitcoin’s price is bound to follow like a loyal dog. Bittel, not to be outdone, claims that M2 is nearing a record $111 trillion. And, of course, Bitcoin is just getting started. 🤑

But will these mighty forces propel Bitcoin to the exalted $130,000? Or will they prove to be “horseshit,” as Barhydt so delicately put it? We shall see, dear friends, we shall see. It all depends on how quickly central banks unleash their balance sheets and how much leverage traders decide to play with. In any case, Barhydt’s call serves as a roadmap, a reality check, and perhaps a slap in the face: the next move could be explosive, but it’s only as good as the liquidity it tracks. Enjoy the ride, if you dare!

At press time, BTC is sitting pretty at $104,625, but we all know that’s subject to change faster than you can say “blockchain.” ⏳

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-02 20:49