Oh, look who’s feeling optimistic again! Tom Lee, the oracle of all things cryptic, confidently announces that Bitcoin might skyrocket to a daring $250,000 by the end of 2025. Because, you know, dips are just a brief intermission in the grand Bitcoin ballet. Recently, it nosedived from a jaw-dropping $111,970 to a more modest $104,000—talk about a tantrum—yet Lee insists the market’s holding steady, like a toddler clutching their favorite toy.

Lee’s Short-Term Outlook: Hype or Hope?

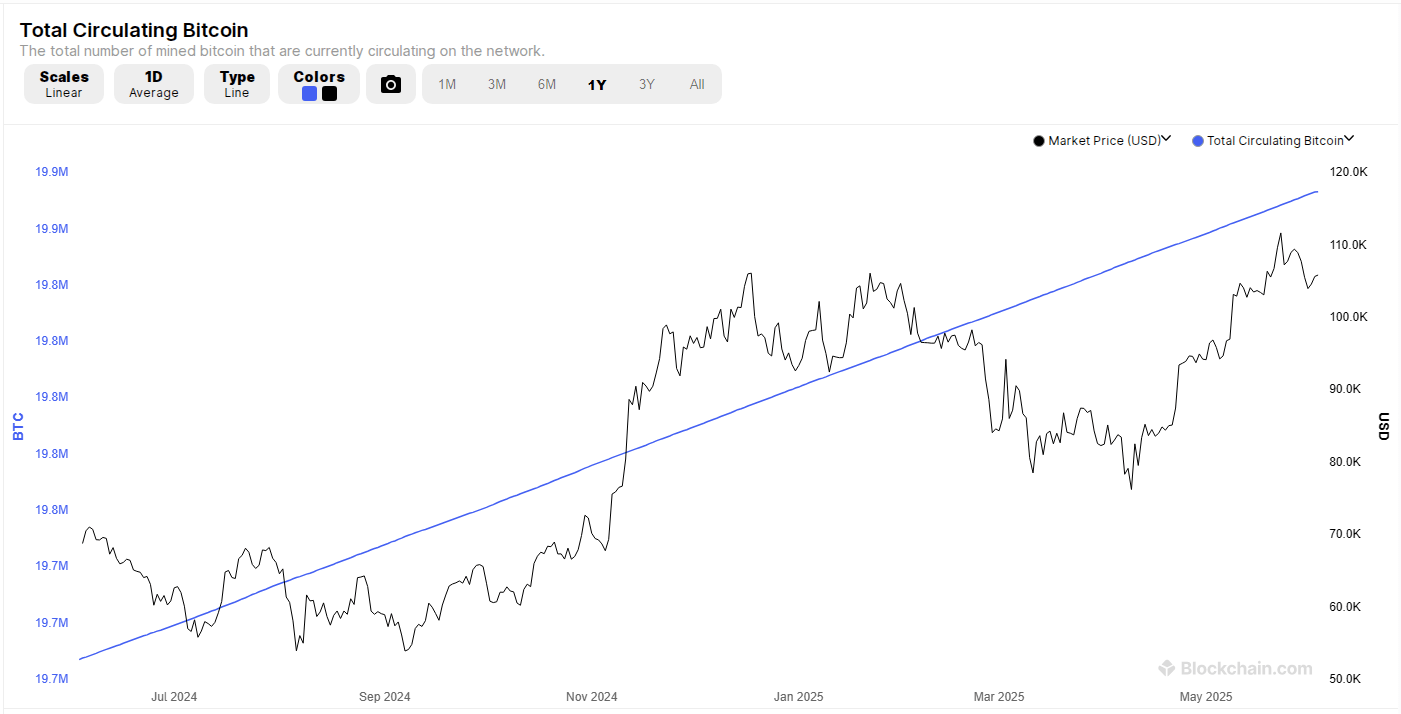

During an interview on CNBC’s Squawk Box—because who doesn’t love a good financial rollercoaster—Lee dropped the bombshell that about 95% of all Bitcoin has already been mined. That’s nearly 20 million coins, with just 1.13 million left before the supply runs out faster than your patience at airport security. And apparently, this “tight supply” is what’s going to drive prices higher, possibly making your piggy bank cry tears of joy.

Meanwhile, he pointed out that almost everyone on the planet remains clueless about Bitcoin—no surprise there. Sadly, 95% of the population doesn’t own a single coin. So, basically, there’s a vast ocean of potential buyers waiting to be swept up in the crypto craze, and Lee seems to think that’s a recipe for even more upward momentum. Because what’s a market without a little speculation and a lot of FOMO?

To take Bitcoin from the current $104,000 to the staggering $250,000, it would need a 140% jump—a feat only a brave or reckless investor would celebrate. Lee believes hitting $150,000 by December is plausible, and if demand continues to heat up, we could see a thrilling ride to $200,000 or even $250,000. Talk about a moon mission you didn’t see coming. 🚀

The Supply-Demand Tango: Who’s Winning?

Lee emphasizes the global poker game of Bitcoin ownership—most people haven’t bought in yet, creating a sort of ‘supply squeeze’ that could push prices into the stratosphere. With less than 5% of coins left to mine and millions of potential new buyers lurking in the shadows, all it takes is a tiny spark of interest for the price to erupt. Yes, even your grandma with her sock drawer might soon be tempted to buy Bitcoin.

He also mentions the ‘im)balance’ — limited supply versus an emerging army of new investors. So, if just a fraction of the world’s population decides to hop on the Bitcoin bandwagon, we’re all going to need a bigger wallet.

Supply is slowing, demand’s heating up, and Lee figures this mismatch could lead to a Bitcoin boom bigger than Elon Musk’s Twitter account. Keep your eyes peeled, folks.

Dreaming Big: Bitcoin’s Golden Future

When asked about Bitcoin’s grand finale—its ‘terminal value,’ if you will—Lee expects it to someday match gold’s hefty $23 trillion market cap. That’s a cool $1.15 million per Bitcoin if we assume 20 million coins are floating around in the crypto cosmos. Because, of course, some coins will be lost—people forget passwords or accidentally swallow their private keys, poor souls.

He even dares to dream bigger—$2 million or $3 million per coin. With a bullish case of $2.5 million, that’s a 2,300% rise from today’s prices! Sounds like gambling? Perhaps. But hey, who doesn’t love a good fairy tale?

Other Crystal Ball Gazers

Oh, and Matthew Sigel from VanEck isn’t about to be left out. He envisions Bitcoin hitting a mind-boggling $3 million by 2050. Because, apparently, the future of crypto is as bright as a glow stick at a rave—full of promise, chaos, and questionable financial decisions. Both predictions hinge on demand continuing to grow and big money pouring in from hedge funds and pension plans—sounds about as stable as a Jenga tower in an earthquake.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-03 21:42