The Bitcoin Open Interest has reached an unprecedented peak, according to the data, coinciding with the cryptocurrency’s price soaring beyond $72,000.

Bitcoin Open Interest Has Shot Up Recently

Maartunn, the community manager for CryptoQuant in the Netherlands, recently shared on platform X that the current number of open Bitcoin derivative contracts across all exchanges has reached a new record high – a concept referred to as “Open Interest.”

If the level of this metric goes up, it typically means that investors are buying more derivative contracts related to the asset at present. In turn, the overall financial leverage in the market grows. Consequently, there’s a higher chance for the asset to exhibit heightened volatility due to the increased Open Interest.

Alternatively, when the indicator declines, it means investors are either choosing to sell their holdings or being forced to do so against their will by the trading platform. This results in a decrease in leverage and potentially brings more price stability.

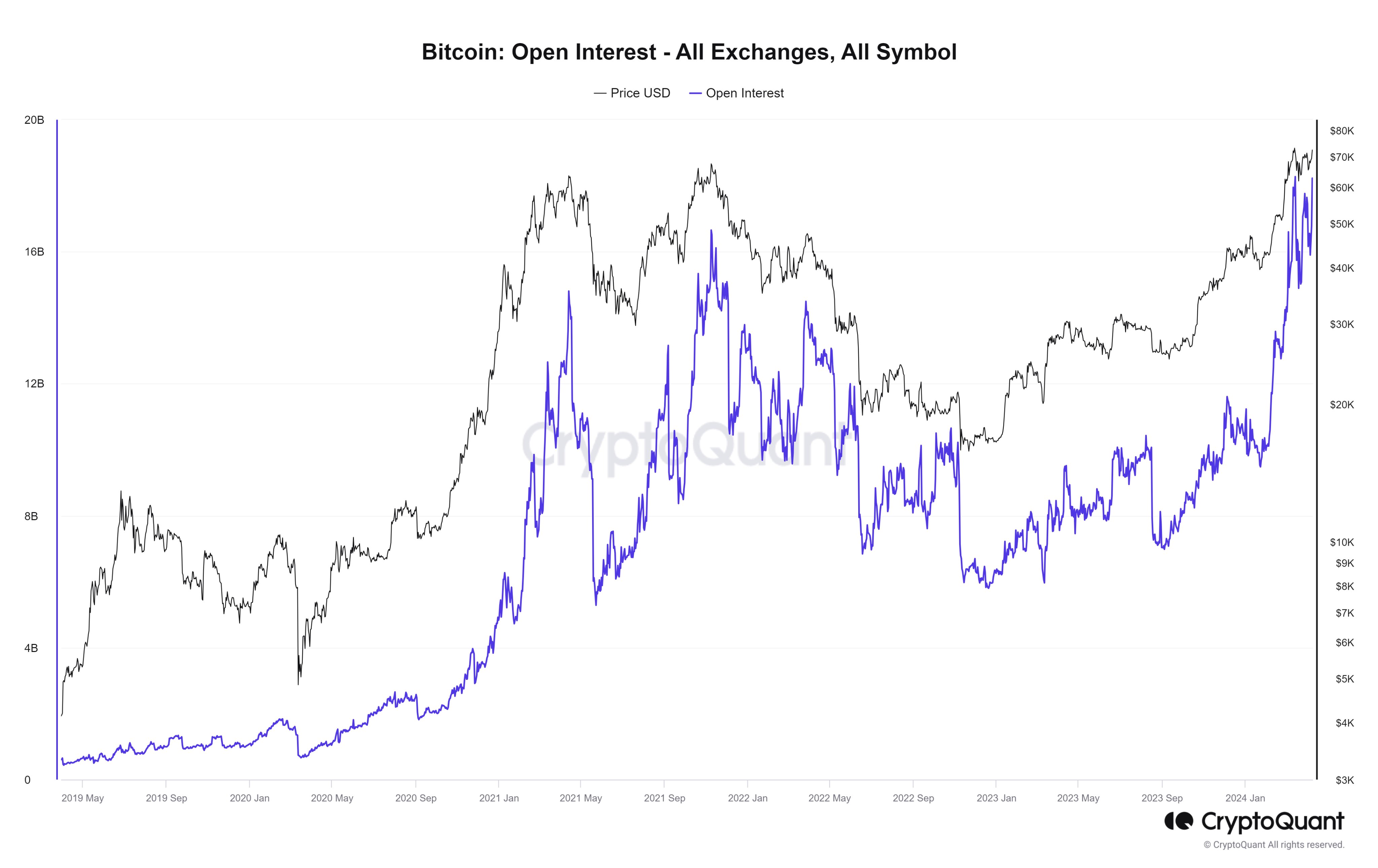

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the past few years:

The Bitcoin Open Interest shown in the graph above has seen a significant spike lately, reaching a new all-time high of approximately $18.2 billion. This rise corresponds with an uptick in Bitcoin’s own price.

The surge in price for cryptocurrencies is nothing out of the ordinary. Such price increases tend to draw significant interest, leading to a fresh wave of speculation concerning derivatives.

Last month, Bitcoin reached an all-time high (ATH) for the indicator with a price exceeding $73,000. However, it’s important to note that hitting new heights with the rising indicator may increase price instability.

Based on current trends, the volatility of this metric could increase or decrease. However, historical data indicates that past peak levels of this metric have often been followed by local highs in the asset’s price. Additionally, as shown in the chart, the previous all-time high for Open Interest for this asset saw a swift decrease afterwards.

The future of Bitcoin (BTC) remains uncertain, and it’s debatable whether it will experience another price crash like before. However, one thing is clear: With such high Open Interest levels, BTC could potentially become even more unpredictable in its price movements.

Mentioned before, Bitcoin experienced a significant drop in price following its all-time high Open Interest. It’s common during these price fluctuations for a substantial number of liquidation orders to be executed.

Liquidations fuel the price trend they aim to halt, extending its duration. Consequently, more liquidations follow suit, creating a persistent cycle.

In simpler terms, this chain reaction of liquidations is referred to as a “squeeze.” The recent surge in prices has caused a large number of losses for short sellers in the cryptocurrency market, totaling over $108 million.

BTC Price

At the time of writing, Bitcoin is trading at around $71,500, up 5% over the last week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- REF PREDICTION. REF cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

- MDT PREDICTION. MDT cryptocurrency

2024-04-09 07:11