In a rather unexpected twist that signals the universe’s rekindled sense of humor,

the behemoth Vanguard, that mighty titan of investment wisdom, finds itself meandering

toward the cryptocurrency abyss via the whims of Gamestop’s ill-fated BTC reserve plan.

For ages, it has clutched to its age-old dogma, denouncing digital currencies as mere

figments of speculative imagination, akin to the fleeting dreams of a drunken man in a

Petersburg tavern.

The Unfathomable Gambit of Vanguard: A Bitcoin Reverie Through Gamestop’s Wizened Eyes

Lo and behold, the formidable Vanguard Group, accompanied by a sense of

trepidation bordering on farce, faces the jarring prospect of indirect exposure to Bitcoin

through its significant stake in Gamestop—yes, the very same Gamestop that has played

the merry jester in the court of stocks, where rationality seems to have taken a permanent

leave of absence.

With a caste of characters heightened by absurdity, Vanguard suddenly finds itself

entangled in the glittering web of cryptocurrency, much to the delight of those who thrive

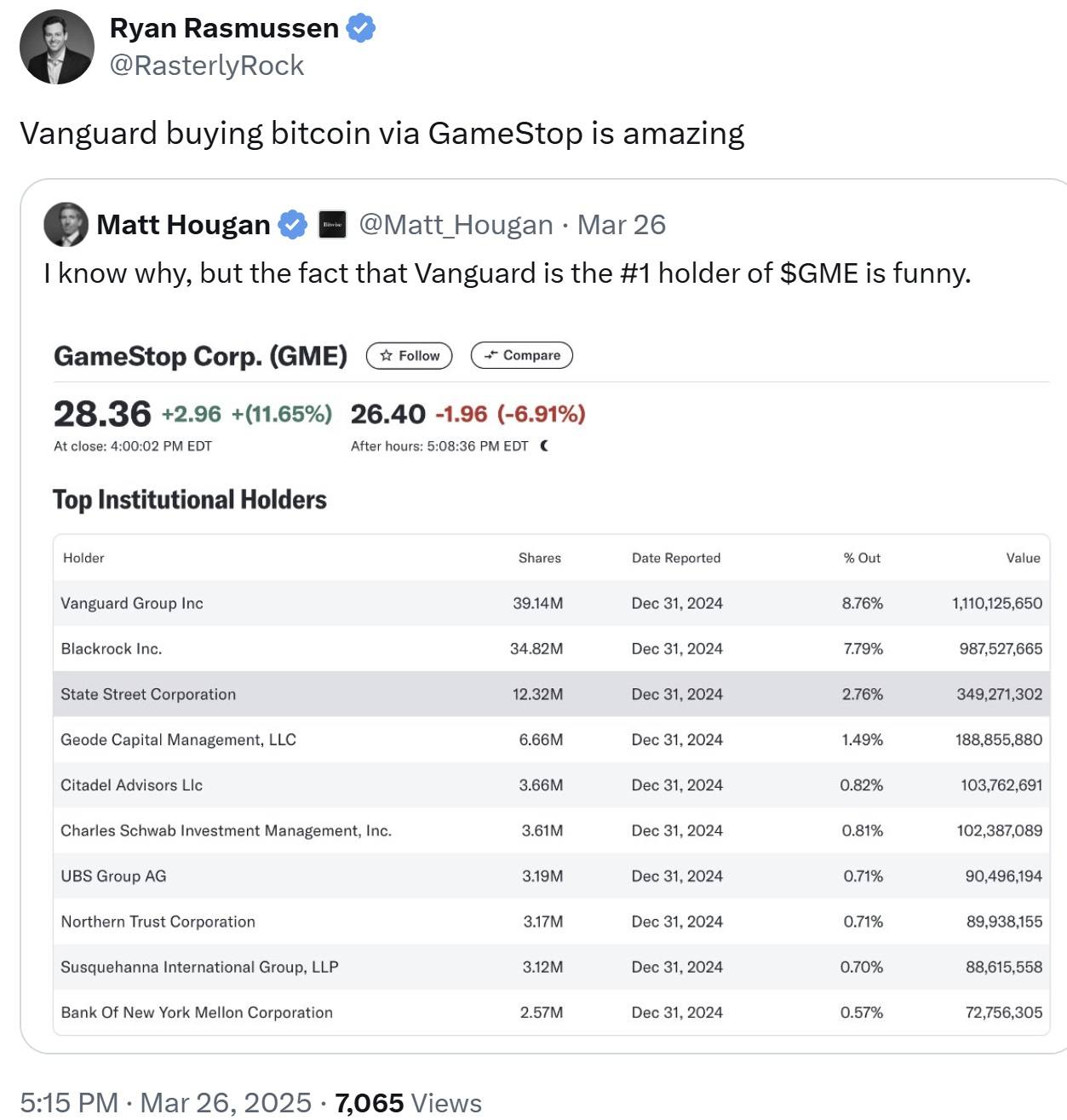

on paradoxes. The whispers of Ryan Rasmussen, Head of Research at Bitwise, fluttering

through the treetops of social media, echo: “Vanguard buying Bitcoin via Gamestop is

nothing short of miraculous!” Such praise, mind you, is as if one were to commend

Raskolnikov for his moral philosophy while still clutching a blood-stained axe.

Just last week, Gamestop unveiled a strategic bitcoin reserve plan—yes,

friends, “strategic” and “Gamestop” in the same sentence—isn’t that simply delicious?

Plans are afoot to harness the chaotic winds of fortune through a convertible bond offering,

shrouded in mystery as the company refuses to divulge the grand sums of Bitcoin it yearns

to acquire. Perhaps it wishes for nothing less than to ascend the throne of digital asset

dominion, akin to a beggar wishing to wear royal robes.

What makes Vanguard’s gambit all the more amusing is the stark contrast it presents

to its previously rigid stance on digital assets. While its contemporaries, those pragmatic

architects of asset management like Blackrock and Fidelity, have embraced cryptocurrencies

with open arms and bright-eyed optimism, our dear Vanguard clung painfully to its

dichotomous morals. Just last December, Duncan Burns—a name that sounds like a

villain out of Dostoevsky’s imagination—denounced Bitcoin, proclaiming it a frivolous

endeavor devoid of value. Meanwhile, the ever-cautious CEO Salim Ramji, despite a past

steeped in crypto knowledge, reiterated a resolute “no” to the prospect of crypto ETFs,

preferring the warm embrace of traditional strategies, which are much less scandalous,

after all.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- Slormancer Huntress: God-Tier Builds REVEALED!

- Top 8 UFC 5 Perks Every Fighter Should Use

- REPO’s Cart Cannon: Prepare for Mayhem!

- USD ILS PREDICTION

- Invincible’s Strongest Female Characters

- AI16Z PREDICTION. AI16Z cryptocurrency

2025-03-31 04:03