As a seasoned researcher with a knack for deciphering market trends and a penchant for Cardano (ADA), I find myself intrigued by the recent events unfolding in the perpetual futures market. The significant liquidation gap between long and short positions, with an overwhelming 85.7% of shorts getting liquidated, is a sight to behold.

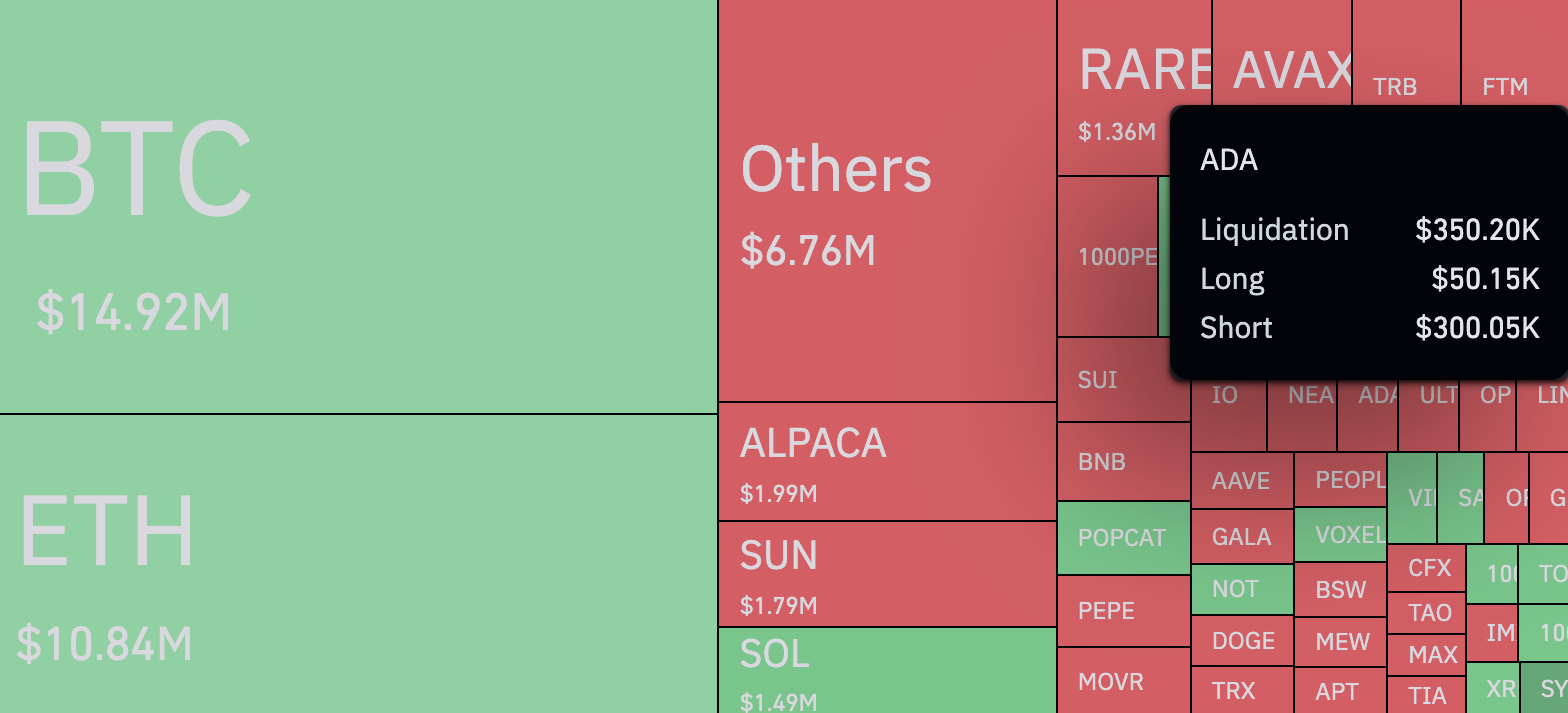

Over the past 24 hours, there’s been a substantial difference between long and short positions involving Cardano (ADA) in the perpetual futures market. As per CoinGlass data, the total liquidations associated with ADA derivatives surpassed $350,000 during this time frame.

As someone who has been actively trading cryptocurrencies for several years now, I have noticed that a significant portion of the transactions often involve liquidations of short positions. In this case, about $300,000 or 85.7% of the total amount, was due to short positions on the Cardano token. These are positions taken with the expectation that the price will drop, and they can be risky, especially when market conditions shift unexpectedly. From my personal experience, it’s crucial to closely monitor these types of trades to avoid potential losses.

The sudden drop in long positions might be explained as an aggressive strategy by sellers (bears) aiming to profit from the decline in the value of the Cardano token, which reached a significant resistance level near $0.38 per ADA on yesterday’s market.

Contrary to expectations, there was a strong breakout instead of resistance, leading to a massive sixfold increase in losses for bear traders compared to gains made by bulls during the same period. Simultaneously, the Cardano token experienced a 3.36% rise.

Whose side does one take now?

Following the outbreak, it’s common to see a decline in Cardano’s price, which is exactly what happened. Interestingly, bears had been anticipating this drop at a crucial resistance level. However, the bulls managed to orchestrate it eventually, adding more profit margins to their holdings by strategically securing their positions.

As a crypto investor, I noticed that during the sell-off, the price action was quite contained, with the token’s value hovering around $0.38. Interestingly, it seemed like some savvy investors were taking advantage of this dip and began buying back the token, opening long positions to capitalize on any potential price recovery.

Therefore, we can confirm that this price level has become a significant anchor for ADA. In other words, as long as the price of Cardano stays above this mark, a positive trend is likely to continue for it.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD PHP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- CAKE PREDICTION. CAKE cryptocurrency

2024-08-23 17:08