In the shadowed corridors of Wall Street, where the air is thick with ambition and the clinking of coins echoes like a funeral march, VanEck’s ChainCheck report emerges-a modern-day parable of hubris. “Behold!” it proclaims, as if penned by a mad prophet, “Bitcoin shall ascend to $180,000! All hail the alchemy of money printing and futures flows!” One might ask: Is this a prophecy or a fever dream? The answer, dear reader, lies in the trembling hands of those who dare to speculate.

Ode to the Absurd: M2 and Bitcoin’s Love Affair

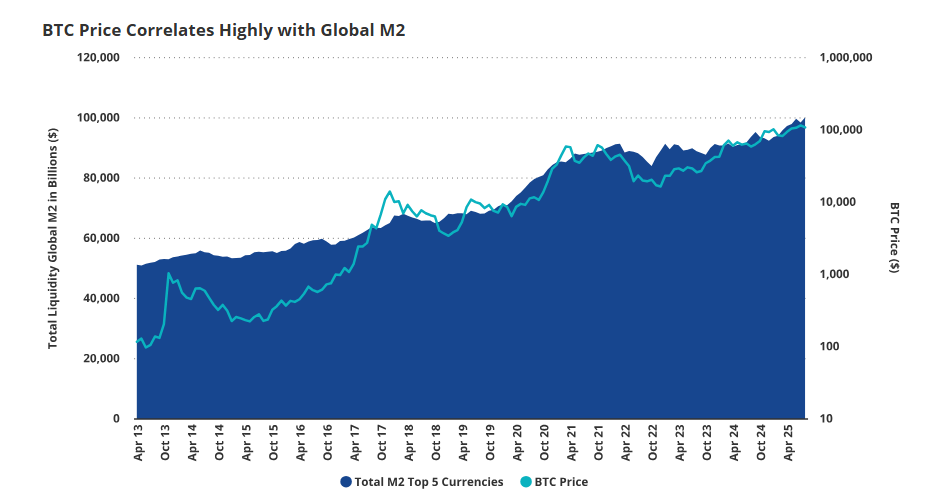

Since 2014, the global M2 supply has swelled from $50 trillion to $100 trillion-a veritable flood of liquidity, as if humanity collectively decided to drown in its own wealth. Bitcoin, that sly trickster, rose 700x in kind, now claiming 2% of this deluge. VanEck, with the solemnity of a priest interpreting scripture, declares: “To hold less than this share is to bet against fate itself!” A bold claim, indeed, for an asset whose value is as stable as a drunkard’s heartbeat.

What is this correlation, if not a marriage of madness and mathematics? It does not promise perfection, but rather whispers, “Trust the system!”-a mantra for our age of algorithmic folly.

The Tragedy of Futures: A Crowd’s Last Laugh 🎭

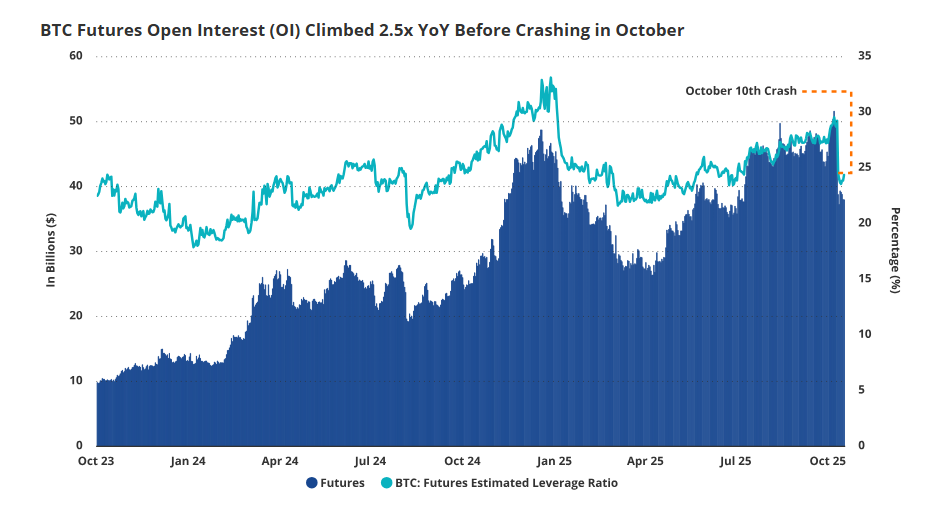

Futures markets, that grand theater of greed and despair, have become Bitcoin’s puppeteers. VanEck, with the precision of a hangman measuring rope, notes that 73% of BTC’s price swings since 2020 stem from futures open interest. Cash collateral? A mere $145 billion-enough to buy a small country, or feed the world for a week. Yet when BTC plunged 20% in eight hours, open interest crumbled from $52B to $39B, as if the crowd had collectively forgotten how to breathe.

Borrowed positions, now flirting with the 95th percentile, teeter on the edge of a cliff. For 75 days, they dance with ruin, a masquerade of confidence. When the music stops, the unwinding will be… entertaining.

Rotation Between Safe Havens and Risk Assets: A Tale of Two Greed

Gold, once the golden calf of investors, now suffers a $2.5 trillion correction. Is this a “cooling off,” as analysts whisper, or merely the prelude to a fiery rebirth? In this eternal dance between the miser and the spendthrift, macro prints dictate the steps. A soft CPI, a truce in trade wars-such morsels could redirect capital into Bitcoin’s embrace, pushing it toward $130K by Q1 2026. Or perhaps not. The future is a riddle wrapped in a joke.

VanEck’s shorter-term targets-$129,200 and $141,000-sound like lottery numbers chosen by a poet. And if BTC cracks $125K? “Renewed buying strength!” they cry, as if the market were a melodrama and every dip a heroic sacrifice.

Between $108K and $125K, BTC flirts with destiny. VanEck identifies a “Whale Buy Zone” at $108,600-a term so absurd it could only be invented by someone who’s never met a whale. Holding above $108K, they insist, “tilts the odds to the upside.” A poetic lie, perhaps, for those who still believe in “odds” in a world ruled by chaos.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- INR RUB PREDICTION

2025-10-26 01:38