In a world teetering on the brink of technological tyranny, Arthur Hayes, that erstwhile prince of the cryptocurrency exchange BitMEX, has deigned to share his latest prophecy. With a gravitas befitting a man who has weathered the storms of both financial markets and regulatory ire, Hayes declares a growing schism between his cherished Bitcoin and the tech-laden Nasdaq 100. This, he insists, is no mere blip but a harbinger of credit calamity lurking beneath the surface, as insidious as a cocktail party bore.

Hayes, ever the wordsmith, dubs Bitcoin a “fiat liquidity fire alarm”-a phrase so apt one wonders why it wasn’t coined sooner. This digital sentinel, he claims, is the first to sound the alarm when credit conditions shift, much like a debutante fainting at the sight of a poorly tied cravat.

A Market Divergence to Make One’s Brow Furrow

When assets once joined at the hip begin to part ways, the trading classes prick up their ears. Hayes, with the air of a man who has solved the crossword before breakfast, suggests this divergence warrants scrutiny. Might it, he posits, signal distress in the hallowed halls of banking or a tightening of the lending spigot? Perish the thought, but one must consider it, however unpalatable.

This, he assures us, is no mere squabble over a single stock or trade. It is, rather, a matter of the financial plumbing-a system so delicate that liquidity can evaporate faster than a gin and tonic at a society wedding.

AI’s March of Progress: A Double-Edged Sword

Reports abound of AI wielding its axe with gusto, claiming thousands of jobs in its march toward efficiency. An outplacement firm, no doubt with a spreadsheet at the ready, counts some 55,000 layoffs in 2025 attributed to this silicon übermensch. The tech sector, once the darling of the economy, finds itself particularly in the firing line.

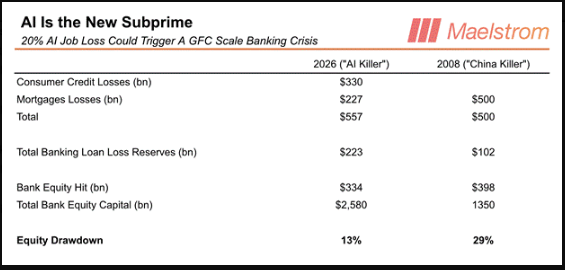

Hayes, ever the Cassandra, sketches a scenario as bleak as a winter’s day in a Brontë novel. A precipitous decline in knowledge-worker employment, he warns, could weaken mortgage and consumer credit repayment. This, in turn, might nibble away at bank equity and tighten lending, like a belt after a particularly indulgent dinner party.

His figures, he admits, are more impressionist than precise, but they serve to illustrate the potential cascade of woe. A shock to white-collar paychecks, it seems, could send ripples through the credit system, much like a dropped teacup at a garden party.

Central Banks to the Rescue? One Can Only Hope.

Should banks begin to falter and credit freeze, Hayes anticipates a cavalry charge from the Federal Reserve. Fresh liquidity, he predicts, will be injected with all the urgency of a doctor administering a tonic. This, he assures us, would be manna from heaven for Bitcoin’s price outlook, a narrative he has trotted out with the regularity of a seasonal fashion trend.

Past essays and posts, it seems, have linked such Fed interventions to crypto rallies with the inevitability of a society scandal. One can almost hear the chorus of “I told you so” echoing through the marble halls of finance.

Maelstrom’s Maneuvers: A Tactical Affair

Hayes’ fund, the evocatively named Maelstrom, stands ready to deploy stakes and stablecoins into privacy-focused and exchange-native plays. Zcash and Hyperliquid are name-checked as potential beneficiaries, should the liquidity spigots be turned on. This, one gathers, is a strategy as tactical as a well-played game of bridge, designed to profit from the short-term surge in risk assets that follows a policy pivot.

A Measured View, or So We’re Told

The chain of events Hayes proposes is as dramatic as a grand opera: AI job losses lead to credit losses, which cause bank stress, which forces the central bank to expand the money supply, which lifts Bitcoin. Each link, he concedes, is plausible but far from certain. His figures, one suspects, are more illustrative than predictive, like a caricature at a society ball-amusing but not to be taken too seriously.

History, that fickle mistress, shows that central banks do occasionally ride to the rescue, and that policy moves can indeed power asset rallies. Yet outcomes, as always, depend on timing, scale, and public confidence-factors as unpredictable as the British weather.

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2026-02-18 18:04