December 10, 2025 11:30:46 UTC

The FOMC Rate Cut: A Most Exciting Drama, Dear Reader

My dear sirs and madams, gather ’round as we contemplate the grand spectacle at 2:00 p.m. ET today-an event most anticipated, where the FOMC is expected to graciously reduce interest rates by a trifling 25 basis points, with a probability of 90% that this wish will be granted. The illustrious Fed Chair Jerome Powell shall then give his discourse at 2:30 p.m., where any mention of QE or liquidity support could persuade the markets to dance with joy-or despair. Should he hint at further cuts, risk assets might join in a merry rally; a neutral tone, however, could cause a brief symphony of volatility. Heaven forefend, if inflationary fears take hold, beware the market’s melancholy descent-oh, the drama! 🎭

December 10, 2025 11:16:55 UTC

Japan’s Quiet Storm: BOJ Meeting Prepares to Shake the World (or at Least the Yen)

All eyes are now fixed upon Japan, dear reader, as the humble nation prepares for the impending 19 December meeting of the Bank of Japan. With yields soaring to ascendancy, multitudes of carry trades flourish like imported roses in January. Any unforeseen policy shifts could ignite a whirlwind of volatility across cross-asset markets, leaving traders grasping at straws amidst the calm exterior. Bitcoin and its ilk remain perched on the precipice, yearning for some movement-may the odds be ever in their favor! 🌸

December 10, 2025 11:13:33 UTC

Tonight’s FOMC: Powell’s Speech, The Market’s Morality Play

Oh, how eagerly the market gazes upon tonight’s occasion-an event most pivotal! While a predictable rate cut is expected, all eyes are fixed upon Jerome Powell, whose words may serve as a master’s stroke or a discordant note in the symphony of finance. His discourse will nudge the risk appetite, with the future of policies hanging delicately in the balance. A cautious utterance might keep the markets in a sluggish state-if only they knew what each phrase truly signified! 🧐

December 10, 2025 11:13:33 UTC

Bitcoin’s Steady Fort: Around $92K & Still Waiting for a Sign

Our dear Bitcoin remains affixed around the noble sum of $92,000, maintaining an air of stoic composure amid the chaos. The recent outflows have slightly eased, and ETF flows have intertwined with cautious traders-ever so cautious, indeed. Despite a semblance of relief, the sentiment remains restrained, as though waiting for the next grand event. Wait and watch, for Bitcoin is not one to be hurried-patience, darlings! 💰

December 10, 2025 11:08:01 UTC

$8 Billion in Shorts: The Elephant in the Room Ready to Stampede?

Imagine, if you will, a twenty percent-no, wait-a ten percent surge in Bitcoin, which could effortlessly eradicate $8 billion in short positions overnight! Today’s FOMC meeting looms like a thundercloud, and traders are watching feverishly for any whisper of liquidity support from Mr. Powell. Should such signals emerge, risk assets like Bitcoin might leap joyfully-perhaps even causing some unfortunate shorts to suffer a swift demise. Hold on tight, dear friends, for volatility shall reign supreme! ⚡

December 10, 2025 11:06:03 UTC

Hints of Easing & Powell’s Future: Will the Market Dance or Frown?

The market whispers of potential purchases of MBS or T-bills-an act most gentle, yet full of consequence. The horizon of Q1-Q2 2026 glimmers, suggesting stability unless Mr. Powell should suddenly resign, and Mr. Hasset takes the stage-oh, what a spectacle that would be! Meanwhile, any surprise lack of rate cuts or hawkish remarks might cause a swift market swoon, prompting traders to very aggressively favor Ethereum-’tis a curious time for speculation, indeed! 🔮

December 10, 2025 11:06:03 UTC

The Dot Plot: A Map to Future Rate Cuts or a Red Herring?

All manner of minds are scrutinizing the FOMC dot plot, desperately seeking hints of future cuts-are they many, or few? Even with today’s modest 25 basis points, the subtlety of signals-like a whispered secret-could sway the markets immensely. Ah, the suspense of anticipation! The wise traders watch closely, waiting for a sign from Powell-will it be a gentle easing or a stern pause? Only time shall reveal! 🕵️♂️

December 10, 2025 11:04:21 UTC

Markets at a Crossroads: The Statement & The Waiting Game

Market sentiment hinges on this very moment-will the statement be ‘dull as dishwater’ or ‘a thunderclap’? The 25 bps seems practically baked into the cake, yet the tone is what truly matters. A bold declaration such as “employment outshines inflation” could electrify the crowd, or perhaps leave them yawning. Regardless, traders will pore over every word, ready to jump into action or retreat-such is the life of a modern speculator. ⚖️

December 10, 2025 11:00:23 UTC

Oh Dear! The Hype and Reality of the FOMC Rate Cut & Bitcoin’s Caution

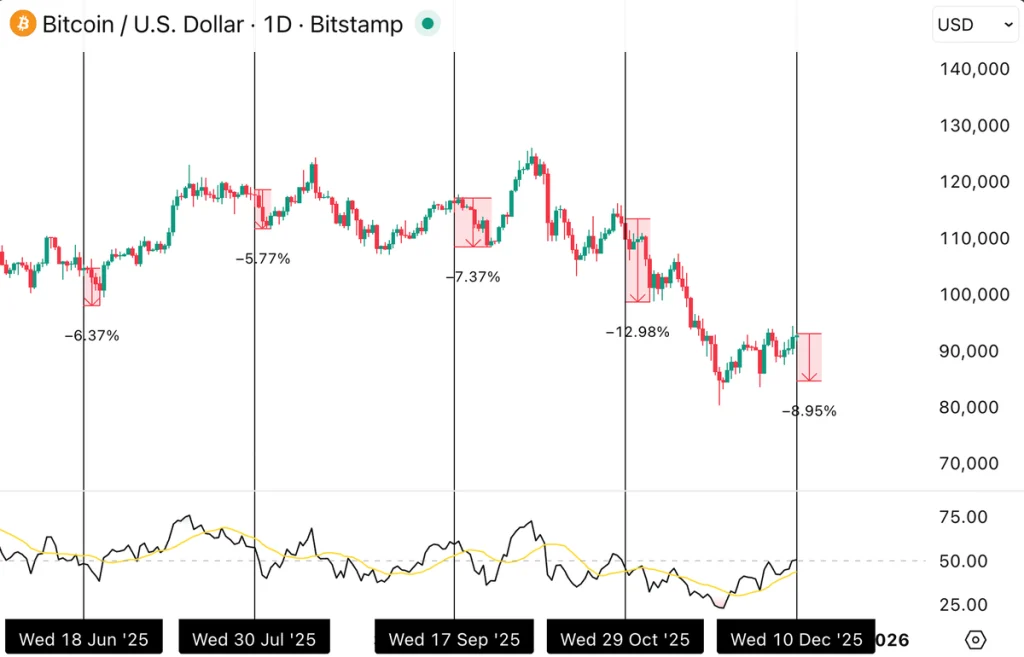

Far be it from me to dampen spirits, but a rate cut is anticipated, and the world’s Crypto Twitter is aflutter with predictions of a grand pump. Yet, history whispers otherwise: in the last four FOMC meetings, Bitcoin suffered sagging prices-oh, how the mighty stumble! With a 99% chance of a cut already baked into the cake, perhaps patience shall be our guiding star. If the past serves as any guide, Bitcoin may revisit the $88K neighborhood-unless, of course, an unexpected turn of fate intervenes. 📉

December 10, 2025 10:55:51 UTC

Bitcoin’s Bullish Fort: Ready for Tomorrow’s Storm?

According to my humble analysis, Bitcoin’s structure remains resilient-an ode to bullish perseverance. A support level of $91.5K would be most agreeable, yet even a dip to $91K would scarcely perturb the grander design. FOMC days often deceive the untrained eye-price swings just enough to entrap both the eager bulls and the cautious bears. Patience, dear reader, patience; the great journey continues! 🚀

December 10, 2025 10:54:47 UTC

The FOMC Hook: When & How to Watch?

Mark this splendid moment-December 9-10-as the date of decision! The policy statement shall be unveiled at 2:00 p.m. ET, with Mr. Powell’s eloquent speech to follow. For our friends in India, that’s 12:30 a.m. IST on December 11-an hour for deep contemplation and perhaps caffeination. Stay alert, dear friends; the market’s future hangs on this! ☕

December 10, 2025 10:51:59 UTC

The Dilemma: Hawkish or Dovish Fed?

All fingers point to a ‘hawkish’ rate cut-think 25 basis points, bringing rates to about 3.50%-3.75%. Yet, divergence within the Fed might produce dissent-a sort of internal squabble among the financial clergy. The dot plot may reveal resistance to further easing, much like a stubborn mule. Powell will likely adhere to a ‘data-dependent’ script, avoiding clear promises of future cuts. Oh, the suspense! 🦅

December 10, 2025 10:51:59 UTC

Bitcoin’s Marathon: Stability Before the Storm

Bitcoin’s price stands confident around $91,000, showing strength in numbers-like a hero awaiting the next great challenge. The market’s structure hints at a bullish breakout, but beware the choppy waters of FOMC days-they tend to mislead even the most seasoned sailors. A dip to $91K? Mere illusion-true direction shall soon be revealed! 🚢

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-12-10 15:16