Comrades, the whispers of a brewing storm are growing louder. Arbitrum, the oft-overlooked token, is stirring once more. The price action is coiling, like a spring ready to unleash its fury, around the key resistance zone. The market seers are abuzz, prophesizing a major breakout that could catapult ARB toward the dizzying heights of $1 in the short term, and perhaps even higher in the long run 🤯.

A Textbook Double Bottom: The Calm Before the Storm?

Behold, the chartists are pointing to a clean double bottom formation, a harbinger of a trend reversal. The neckline, situated in the $0.48 to $0.50 region, is the Rubicon that must be crossed. If the price manages a sustained break above this zone, the technical target of $1.00 beckons. This pattern, a classic sign of a trend shift, suggests that buyers are gathering momentum, like a mighty river about to burst its banks 🌟.

The structure is well-defined, with strength gathering near the right shoulder, lending credence to the move. The resistance block remains the final hurdle. If the bulls can flip this area into support, it would confirm a larger breakout and unleash a fresh leg higher, like a mighty bear awakened from its slumber 🐻.

ARB: The Unsung Hero of the Rally

While the market was fixated on the big names, ARB has been quietly outperforming the pack. A recent comparison chart shared by Lynch shows ARB leaving HYPE and Fart in the dust, and even giving ETH a run for its money, before it has properly broken out on the ETH pair. This kind of early strength, especially against benchmarks, is often the market’s first clue of a stronger underlying shift in trend 📈.

This performance comes before ARB has fully activated its bullish pattern breakout. If the breakout above resistance plays out as expected, ARB’s lead could stretch even further, like a champion sprinter crossing the finish line 🏃♂️.

Breaking Free from the 8-Month Downtrend

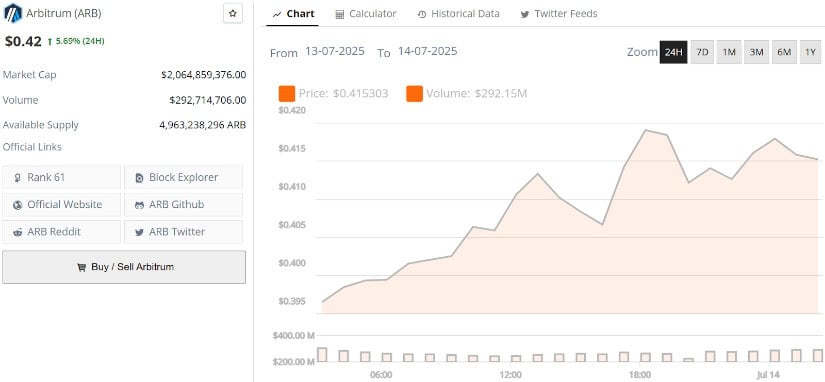

After nearly eight months of a persistent downtrend, Arbitrum is now pressing up against a long-term descending trendline. As shared by Ty Digital, the chart shows ARB testing this major diagonal resistance while forming a potential reversal base below it. The price is approaching the point of decision, where a confirmed breakout could mark the start of a new trend altogether, like a phoenix rising from the ashes 🔥.

A close above the $0.40 level would be the first technical confirmation of this breakout. From there, the path opens up toward $0.55, an intermediate resistance from earlier consolidation, followed by $0.70. If momentum holds, the previously discussed double bottom target at $1.00 becomes a realistic next leg, like a mighty wave crashing on the shore 🌟.

Stablecoin Growth: The Fuel for the Rally

While ARB’s chart setups continue to look constructive, there’s now solid on-chain data backing the move. Arbitrum has just hit a new all-time high of $7.1 billion in stablecoin supply, marking a 70% increase over the past year, according to data shared by growthpie_eth. That kind of growth signals increasing user activity, capital inflow, and stronger liquidity across the network, like a mighty river flowing into the sea 🌟.

This stablecoin surge comes at a key moment. ARB is already attempting to break out from an 8-month downtrend, with clear upside targets lining up at $0.55, $0.70, and eventually $1.00 if momentum holds. With more capital sitting on the sidelines within the ecosystem, the potential for a clean breakout and follow-through increases, like a snowball rolling down a hill, gathering speed and size 🌨️.

ARB Price Prediction: A Leveraged ETH Proxy?

As price action tightens around key breakout zones, there is a growing longer-term interest among the ARB community. One view gaining traction is that Arbitrum doesn’t just follow Ethereum‘s trajectory; it amplifies it. Analyst 0xXunoYou summed it up clearly: if ETH heads to $10K, ARB could be knocking on the door of $20. That framing is gaining attention, and it shifts ARB from a mid-cap Layer 2 token to a high-beta macro play on Ethereum’s long-term growth, like a rocket ship blasting off into the stratosphere 🚀.

The idea isn’t far-fetched when you consider the fundamentals lining up behind the chart. ARB has already shown leadership in this recent rally, outpacing ETH on its own pair while riding a wave of on-chain momentum. With $7.1 billion in stablecoin liquidity, a clean reversal setup forming the case for ARB as a leveraged ETH proxy is starting to move beyond just sentiment. It’s starting to look technical, like a perfectly crafted timepiece ⏰.

Final Thoughts: ARB to $20 in 2025?

ARB is shaping up to be more than just a sidekick to Ethereum. The fundamentals are getting stronger, the stablecoin liquidity is rising fast, and technically, it’s ticking the right boxes. If ETH does make its way toward $10K, it wouldn’t be surprising to see ARB stretch toward $20, like a champion athlete crossing the finish line 🏆.

It’s shown relative strength throughout this recent rally, and the way it’s behaving against ETH gives a clear message. If the ETH narrative kicks into full gear, ARB could ride that wave harder than most expect, like a surfer riding a tsunami 🌟.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Sony Shuts Down PlayStation Stars Loyalty Program

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-07-14 02:32