As a seasoned researcher and analyst with over two decades of experience in the financial markets, I’ve witnessed countless trends and shifts – from the Dot-com bubble to the Global Financial Crisis, and now the rise of cryptocurrencies. The recent move by Japanese investment firm Metaplanet to increase its Bitcoin holdings is a testament to the growing acceptance and adoption of digital assets as a legitimate investment option.

The Japanese financial company Metaplanet has increased its Bitcoin (BTC) portfolio by acquiring an additional 108.78 Bitcoins, raising its total Bitcoin reserves to more than 639 Bitcoins.

Metaplanet Unfazed By Bitcoin Price Movement

On October 7, 2024, the company Metaplanet, based in Tokyo, announced that they had bought more Bitcoin. Specifically, they acquired a sum equivalent to $6.7 million, which added 108.78 Bitcoins to their existing holdings.

The new development occurs amidst an increase in global political conflicts, challenging Bitcoin’s claim as a global currency. Nevertheless, some analysts see this period as a chance to buy Bitcoin (BTC), and Metaplanet’s move seems to align with this viewpoint.

It’s important to mention that traditionally, Bitcoin prices have tended to rise in October. However, this year, October didn’t get off to a great start. Despite this, those who believe in Bitcoin (bulls) remain optimistic, anticipating price increases as we move deeper into the month.

As a researcher, I’ve observed that these recent advancements seem to hold minimal influence on Metaplanet’s Bitcoin hypothesis. Interestingly, the company’s stock price experienced a significant jump after its latest Bitcoin acquisition, concluding the trading day with a 7.86% increase, equivalent to approximately 72 JPY or $0.49 USD.

This month, Metaplanet has been aggressively purchasing Bitcoins, with over 107 Bitcoin acquired on October 1 alone. On October 3, it was revealed that the company had made approximately 23.9 Bitcoins – equivalent to nearly $1.5 million at the time – by selling Bitcoin put options and receiving premiums.

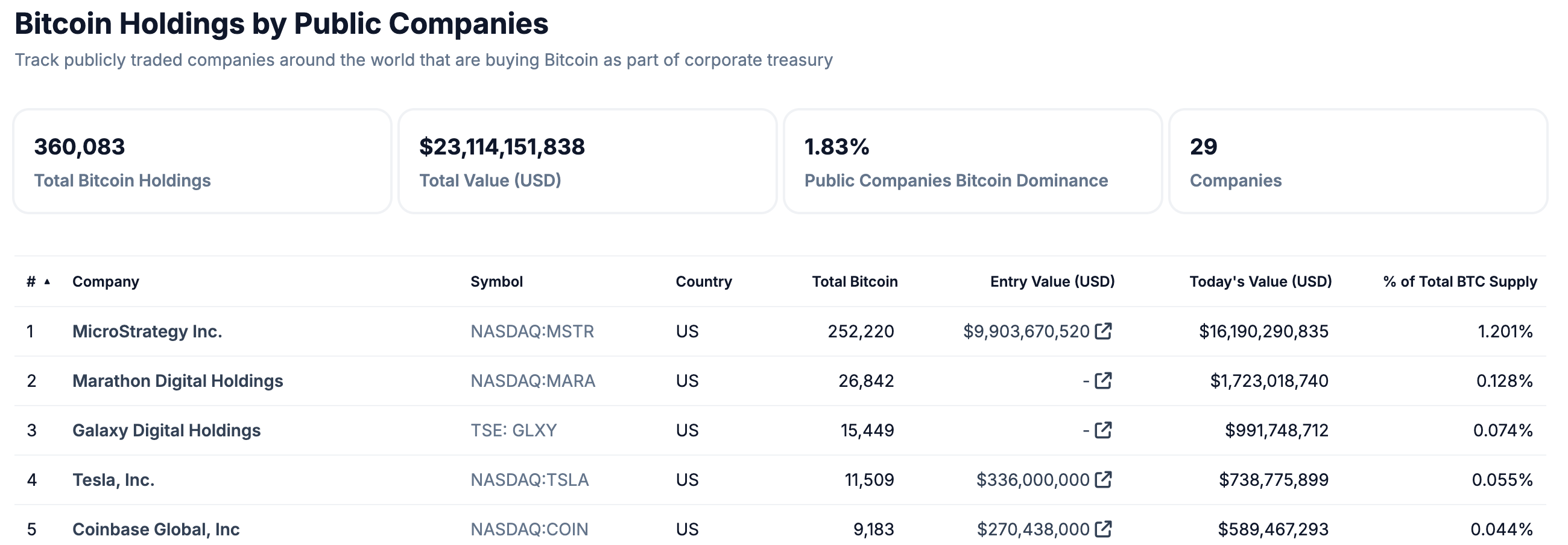

Currently, Metaplanet’s total Bitcoin holdings amount to approximately 640 Bitcoins, which equates to more than $40 million at the current market price of around $63,720 per Bitcoin. This recent acquisition has also moved Metaplanet up to the 17th spot on the list of publicly-traded companies that hold Bitcoin.

As per the given list, these five entities – MicroStrategy, Marathon Digital Holdings, Galaxy Digital Holdings, Tesla, and Coinbase – hold the most significant Bitcoin (BTC) reserves.

Japan Wants To Attract Crypto Capital By Easing Regulations

Japan, recognized for its openness to innovative and burgeoning technologies, has faced some setbacks when it comes to digital assets, particularly after the high-profile Mt. Gox hack in 2014.

In a shift that comes as little surprise, Japan is looking to revamp its tough cryptocurrency regulations. This move is driven by the findings of a recent poll showing that most institutional investors in Japan are contemplating their entry into the cryptocurrency market within the next three years.

This month, Japan’s Financial Services Agency (FSA) announced intentions to revise the nation’s crypto gaming regulations in order to foster expansion within the blockchain gaming industry.

On October 2nd, an insider from the Financial Services Authority revealed that they might reevaluate their current rules regarding digital assets. This could signal a path towards approving a Crypto Exchange-Traded Fund (ETF) and reducing taxes on cryptocurrency earnings. Currently, Bitcoin is being traded at $63,720, marking an increase of 1.9% over the past 24 hours.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR AUD PREDICTION

- USD PHP PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- USD GEL PREDICTION

- DUSK PREDICTION. DUSK cryptocurrency

- POL PREDICTION. POL cryptocurrency

2024-10-08 07:12