- ATOM crypto decided to take a 6% leap in a single day, casually breaking a descending trendline like it was a piñata at a birthday party.

- Its flirtation with the $5 zone could either be the start of a beautiful relationship or a tragic breakup.

Cosmos [ATOM] managed to pull off a 6% increase in a day, which is roughly the equivalent of a sloth suddenly deciding to sprint. It successfully breached the declining trendline on its daily chart, leaving everyone wondering if it’s finally found its groove.

If the bullish momentum keeps up, ATOM might just continue its upward trend, much like a determined squirrel hoarding acorns for the winter.

ATOM came perilously close to the $5 resistance, a level so crucial that breaking it could be the difference between a triumphant rally and a humiliating retreat.

If ATOM manages to exceed $5 and stay there, it could potentially rally to new resistance barriers, much like a determined marathon runner who’s just spotted the finish line.

However, if it fails to break and hold above $5, the bullish setup could become as pointless as a screen door on a submarine, leading to a price rejection that could trigger a market decline.

A price movement to the $4.30 level might signal ATOM’s weakness, potentially triggering lower support areas near $4, which is about as comforting as finding out your parachute was packed by a toddler.

The MACD indicator displayed a weak bullish orientation, which is about as convincing as a politician’s promise during election season.

The proximity of MACD to its signal lines suggested a possibility of market stabilization before emerging with a distinct trend pattern, much like a cat deciding whether to jump off the couch or just take a nap.

When ATOM exceeded the descending trendline, it showed an evolving market momentum, which is about as surprising as finding out that water is wet.

Price movement after the current juncture could probably depend on the behavior of Cosmos, as it trades between significant levels at $4.30 and $5, much like a tightrope walker deciding whether to take another step or just call it a day.

ATOM’s Liquidation Levels

More analysis showed the heatmap from Binance revealed a high concentration at the $4.87 level, accompanied by a liquidation leverage of $233.23K, which is about as comforting as finding out your life savings are tied to a meme coin.

These zones of high concentration of liquidation activities signified an important area of interest, much like a black hole is an important area of interest for astrophysicists.

The daily gains created larger liquidations in the regions around $4.87 and $5, thus suggesting price resistance possibilities, which is about as reassuring as a weather forecast predicting a 50% chance of rain.

Subsequently, long liquidation zones formed at $4.68 and $4.57, prompting key support levels, which is about as stable as a Jenga tower in an earthquake.

Long liquidations would likely occur if ATOM failed to maintain positions above these resistance levels, which could result in heightened market fluctuations, much like a rollercoaster ride that you didn’t sign up for.

//ambcrypto.com/wp-content/uploads/2025/04/Screenshot-33.png”/>

ATOM needs to establish itself at $4.87 and $5 to determine whether it could have an uptrend, which is about as uncertain as a coin toss.

A price rejection near $5 could produce a correction, yet a successful break through this level could signal further upward price movement, much like a phoenix rising from the ashes.

Volume and Netflow of Spot Trades

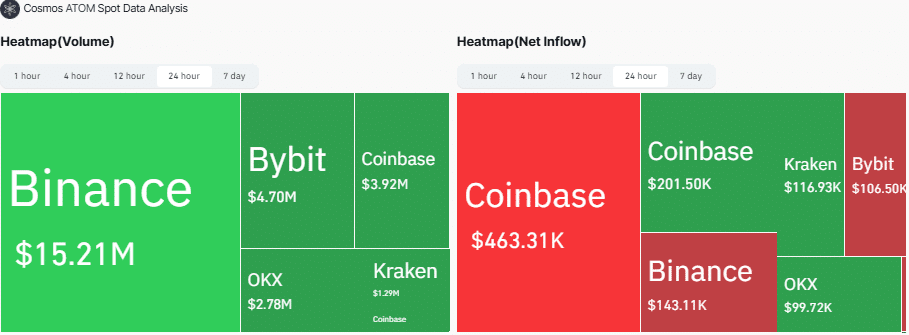

Meanwhile, Binance maintained the highest ATOM spot volume position at $15.21M, Bybit at $4.70M while Coinbase obtained $3.92M. The exchange pairs of OKX and Kraken yielded $2.78M and $1.29M respectively, which is about as impressive as a group of toddlers playing a game of Monopoly.

Coinbase’s first account saw a $463.31K outflow while Coinbase, Kraken, and OKX maintained positive inflows totaling $201.50K, $116.93K, and $99.72K correspondingly, which is about as balanced as a seesaw with a sumo wrestler on one end.

Binance and Bybit saw withdrawals worth $143.11K and $106.50K into their platforms respectively, which is about as surprising as finding out that your cat has been secretly running a side hustle.

The withdrawals could indicate investors taking profits or redistributing funds, while the inflows suggested the exchanges still remained in a position of gaining additional funds, which is about as predictable as a soap opera plot twist.

The surge in some of the exchange’s asset intake showed signs that ATOM could continue increasing in value. If the platforms kept draining assets, it could trigger momentary downward pressure on ATOM and other tokens, which is about as comforting as finding out your parachute was packed by a toddler.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- AI16Z PREDICTION. AI16Z cryptocurrency

- Invincible’s Strongest Female Characters

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- REPO’s Cart Cannon: Prepare for Mayhem!

2025-04-04 19:10