🧙♂️ The AVAX token, that most capricious of digital phantoms, once more presses against the gilded gates of a critical resistance zone, its trajectory a dance of hope and hubris. Market sages whisper that this may be the moment the bulls, those perennial optimists, finally breach the $27 threshold, unlocking a 40% rally that would make even the most jaded investor weep with joy. 🎉

AVAX Community Shows Signs of Renewed Unity

The Avalanche AVAX community, that fickle assembly of investors and builders, once more congeals into a cohesive mass, evoking memories of past surges. 🐦 While recent months saw debates as chaotic as a Shakespearean play, the current mood is one of unity, a rare phenomenon akin to a well-timed pun. Steven9000, that arbiter of crypto fate, claims this alignment mirrors the days of yore, when the community’s collective energy propelled Avalanche into the stratosphere. 🌌

Last time the community realigned, Steven9000 believes, Avalanche experienced a powerful ecosystem-wide rally, and the mood today feels similar. Beyond just price action, this renewed spirit suggests that builders, investors, and users are beginning to move in sync again. With fresh catalysts developing across DeFi and real-world adoption, AVAX could be laying the groundwork for its next strong push. 🚀

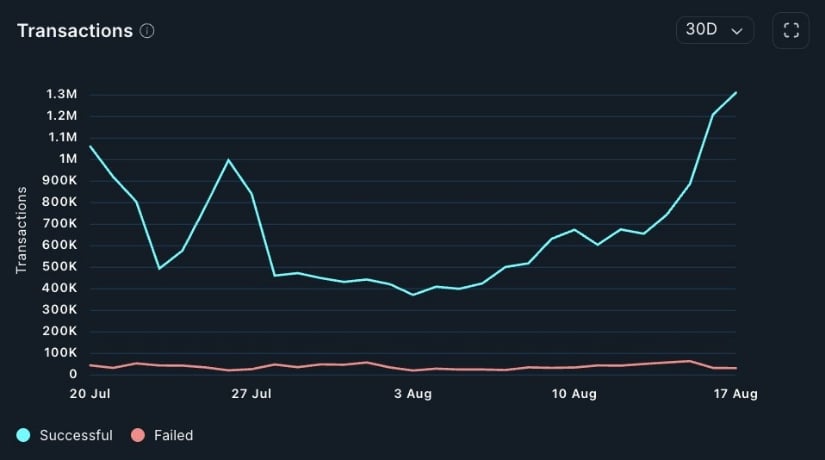

Avalanche Transactions Surge to Fresh Highs

The Avalanche network, that once-dormant titan, now thunders with renewed vigor, its daily transactions doubling in weeks. 🚀 Data from Nansen, that modern-day oracle, reveals AVAX climbing from 500,000 to 1.3 million transactions per day, a spike that would make even the most stoic analyst raise an eyebrow. 🤨

The rise in on-chain activity aligns with the recent signs of community cohesion, giving Avalanche both on-chain and social momentum. When network usage climbs at this pace, it often strengthens liquidity pools, improves efficiency for developers, and signals a healthier environment for adoption. 🧠

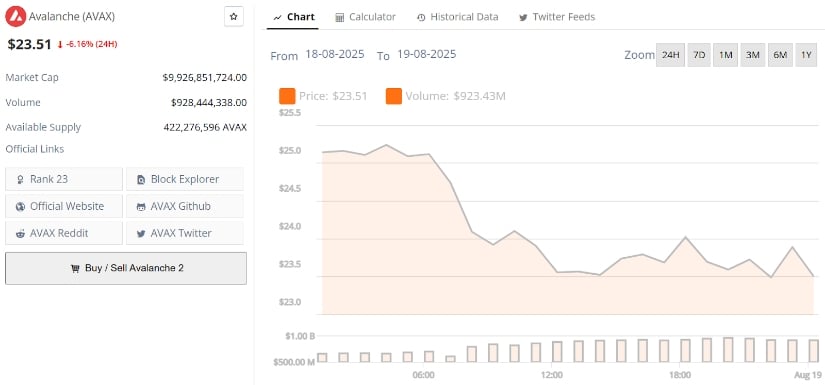

Avalanche Price Pressures Key Resistance

Following strong other parameters, AVAX technicals are once again testing a stubborn resistance level, with the chart showing this as the eighth attempt to break through the same zone. Multiple rejections at this level highlight its importance, as sellers continue to defend it aggressively. However, the repeated retests also signal that momentum is gradually building. 🧮

Looking at the chart structure, ItzStr8Luck says, AVAX is pressing against the $25 to $26 region while maintaining a series of higher lows beneath it. This type of compression typically creates an explosive setup, where any successful breakout could trigger rapid expansion into the $35 to $38 range. With volume profiles showing strong liquidity backing the lower supports, the pressure is mounting. 🔥

AVAX Price Prediction: Breakout Toward $44 in Focus

Avalanche is displaying a constructive setup on the daily chart, with price climbing off an ascending support base and now pressing into the mid-range resistance near $27. This zone has historically acted as a pivot level, and its retest carries weight as the next inflection point for momentum. A sustained close above $27 could clear the path toward the upper trendline, with the major breakout target highlighted around $44. The confluence between rising stoch RSI strength and a price underpins the case for a continued push higher. 📈

From a broader perspective, AVAX price is still working within a longer-term compression pattern that began after the March 2024 high near $68. The recent sequence of higher lows signals strengthening buyer conviction, and the breakout trajectory suggests the market is gradually preparing for an attempt at trend reversal. 🌀

Final Thoughts: What Next for AVAX Price?

AVAX Avalanche price has built a strong foundation of higher lows, rising network activity, and a community that seems more aligned than it has in months. All of these factors strengthen the argument that AVAX is nearing a decisive moment. A clean breakout above $27 could set off a wave of momentum towards $35 to $44, where bulls would finally have confirmation that a trend reversal is underway. 🧠

That said, the $25to $27 range has proven tough to crack in the past, and failure here could invite another round of pullbacks. Even so, the broader structure looks constructive, with liquidity and adoption both trending higher. 📊

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-08-18 23:09