Behold, the venerable Bank of America, that paragon of financial wisdom, has deigned to advise its clients to allocate a mere 1-4% of their portfolios to the whims of cryptocurrency-a gesture as fleeting as a snowflake in a Siberian wind 🐍. The month of November, that most tumultuous of seasons, saw Bitcoin swing from a lofty $126,000 to a humbling $82,000, only to settle, like a weary traveler, near $90,000 on December 2. A dance of volatility, indeed!

“For those with a penchant for chaos and a heart full of hope, a modest 1-4% in digital assets may yet prove a worthy endeavor,” mused Chris Hyzy, a man whose words are as enigmatic as a Tolstoyan epilogue. 🎭

The firm, ever the trendsetter, has resolved to cover four Bitcoin ETFs in 2026, a move as audacious as a Cossack charging into a storm. Their Q3 2025 report, a testament to their global reach, boasts 70 million clients, 3,600 retail outposts, and 15,000 ATMs-though one wonders if these machines still accept rubles. 🏦

Notably, corporate interest in crypto surged in November’s final week, a curious turn of events. The CoinShares report, a document as dense as a Russian novel, reveals that crypto ETPs absorbed $1.07 billion, fueled by whispers of a US rate cut and the eloquent musings of FOMC member John Williams. A spectacle of economic theater! 🎭

The US, that insatiable consumer, accounted for nearly $1 billion of the total, while Thanksgiving-week volumes slumbered like a contented bear. Bitcoin, Ethereum, and XRP-each a character in this grand narrative-saw inflows of $464 million, $309 million, and a record $289 million, respectively. A tale of triumph, if not entirely coherent. 🚀

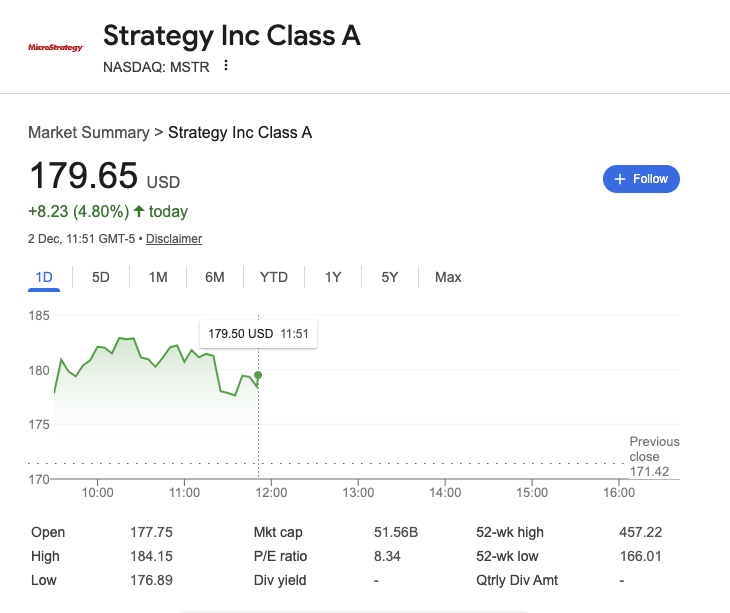

Strategy (MSRT) share price rebounded 4.7% on Dec. 2 as Bitcoin price retakes $90,000 | Source: Nasdaq

Yet, even as macro flows improved, Strategy’s shares danced like a drunkard at a wedding, rebounding 5% after a 12% plunge. Michael Saylor, that intrepid capitalist, confirmed the purchase of another 130 BTC, elevating his holdings to 650,000-a number as large as a Siberian winter. 🐺

He also unveiled a $1.44 billion reserve, a financial marvel funded by recent ATM stock issuance, to sustain dividends and interest payments. A feat of modern alchemy! 💰

JPMorgan Flags Bitcoin-Gold Divergence as Risk Signal

JPMorgan’s Jack Caffrey, that astute observer of market tides, declared Bitcoin a key indicator of risk. The recent divergence between Bitcoin’s November woes and Gold’s ascent above $4,000, he mused, is as perplexing as a Shakespearean sonnet penned in a foreign tongue. 🧠

Caffrey, speaking to CNBC, suggested this divergence might signal investors’ anticipation of a steeper yield curve-a phenomenon as elusive as a mirage in the desert. He cited the resilience of big tech and pharmaceutical giants, a testament to the economy’s stubborn vitality. 🌍

Yet, the Bitcoin-Gold rift, he argued, betrays a cautious outlook, as investors brace for the year-end macro maelstrom. A tale of uncertainty, indeed. 🌪️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-12-03 01:33