Despite a circus of regulatory slapfights and listing headaches, a fresh report from TokenInsight shows that Binance is, as usual, in the driver’s seat of the CEX market. Sure, competition from MEXC and Bitget knocked a smidge off Binance’s towering throne, but let’s face it, it still holds the crown, grabbing more than a third of all CEX trades.

The firm’s like the high school quarterback at prom—leading in every category, from market share to public buzz. When it comes to spot and derivatives trading volume, Binance is holding court with no competition in sight. Stability? They’ve got that too, better than most kids in the class. 🏆

Binance is Winning the CEX Race By a Mile (Again)

Yes, Binance stumbled a bit this quarter, but let’s not kid ourselves, they’re still running laps around the competition. Some of its token listings have flopped, sparking the usual cries from the community (because who doesn’t love a good drama?) and the whispers about potential ties to the Trump family, but who’s keeping track of that noise? 🧐

All that aside, Binance had a rock-solid Q1 in 2025, clinging to its title as the CEX market overlord, with trading volumes eating up a full third of the market pie. 🍰

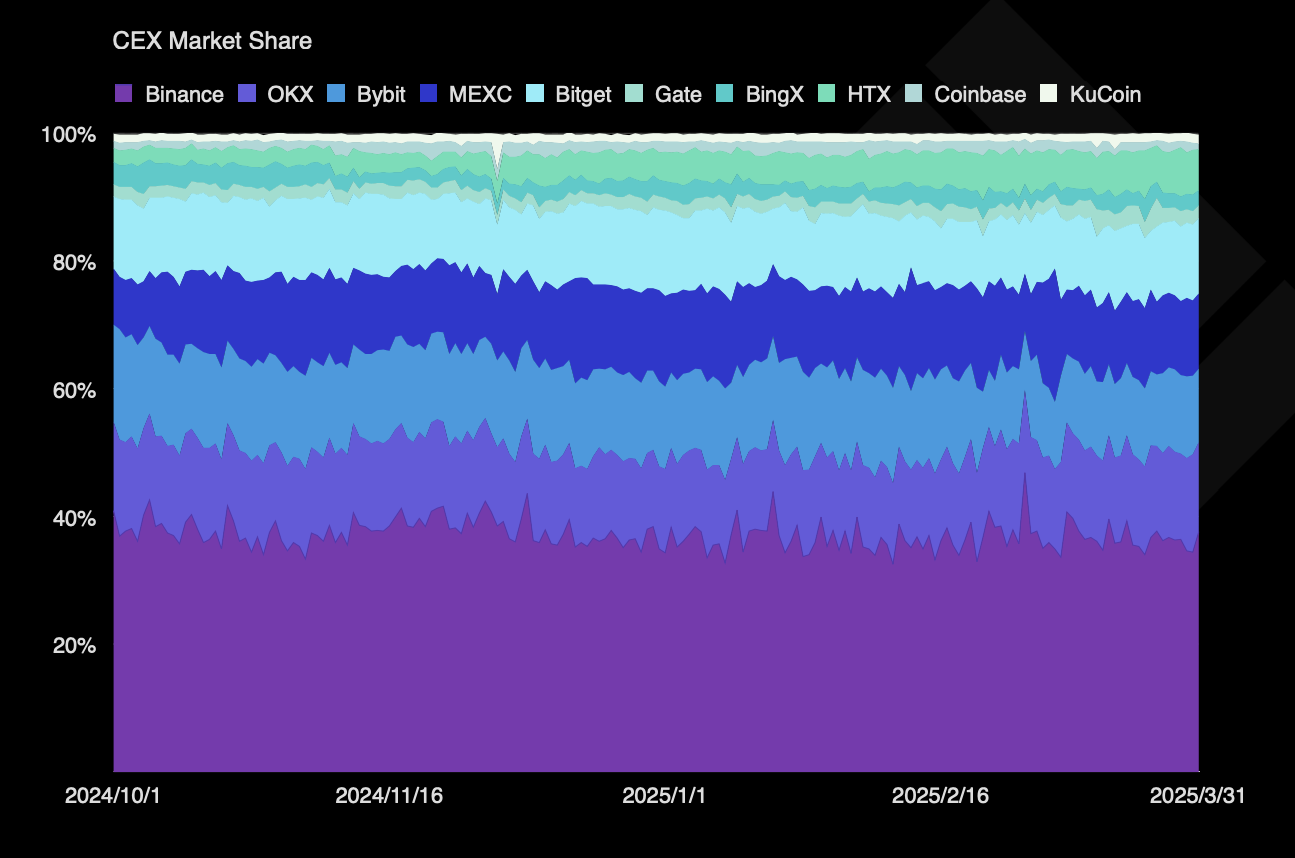

“Binance maintained its market-leading position in both quarters, with a trading volume of $9.95 trillion in Q4 2024. Due to market volatility, its trading volume in Q1 2025 was approximately $8.39 trillion. Binance continued to lead in market share, holding 36.5% in Q1 2025,” the report claimed.

Now, don’t get too comfy just yet. Binance didn’t conquer the whole CEX world. Its total market share dropped by a teensy 1.38%, which, when you think about it, isn’t much. In fact, no other exchange had a worse quarter—Bybit only lost 0.89%, and they’re still licking their wounds from the hack. Meanwhile, every other CEX is feeling a slight decline too, but none can keep up with Binance’s head start.

Binance may control nearly 36% of the CEX market, but that’s just the beginning. In the spot trading race, they’re eating everyone’s dust with a solid 45% market share. And in derivatives? 17% ahead of the nearest competitor. Like, seriously, who’s even competing at this point? 💸

TokenInsight also pointed out that Binance keeps the most stable platform structure, maintaining a balance between spot and derivatives trading like a Zen master. 🧘♂️

And let’s not forget, Binance took the top spot in open interest market share. It wasn’t exactly a “comfortably ahead” situation, but a lead’s a lead. TokenInsight also threw in a few soft touches, noting how some ‘unseen’ factors are keeping Binance firmly at the top of the CEX game. 🏅

When it came to Q1 2025’s big moments, Binance was practically the star of the show. Forbes even tossed it a bone, naming it one of the world’s most trusted crypto exchanges. Who could’ve seen that coming? 🤷♂️

All things considered, even with regulatory noses being twisted and poked in various regions, Binance’s grip on the market doesn’t seem like it’s loosening anytime soon. You know, unless they trip over something really dumb (but we doubt it). 🤞

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-18 02:04