As a seasoned researcher with extensive experience in studying Bitcoin market trends, I have closely monitored the recent surge in whale accumulation of Bitcoin (BTC). This trend has been particularly noteworthy since the beginning of the year, with these large investors consistently adding to their holdings despite market corrections.

Since the start of the year, significant Bitcoin investors, referred to as “whales,” have been actively purchasing large quantities of Bitcoin. This persistent buying trend is driven by their optimistic view of the crypto market’s future growth. The increased holdings of these whales signify investor confidence, which in turn has fueled a robust six-month surge for Bitcoin’s price.

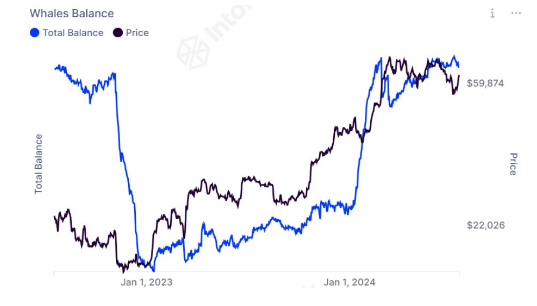

In spite of recent price adjustments, evidence from the blockchain shows that large investors, referred to as whales, have increased their Bitcoin purchases significantly. Consequently, their Bitcoin holdings have reached quantities not seen since 2022. Specifically, the amount of Bitcoin stored in wallets containing 1,000 BTC or more has attained a two-year peak.

What’s Behind The Surge In Whale Bitcoin Accumulation?

According to IntoTheBlock’s latest findings, Bitcoin addresses possessing 1,000 BTC or more have recently achieved a significant annual achievement in amassing Bitcoin. This data pertains to the group of whale addresses. Reaching this milestone implies that these addresses now hold their greatest quantity of Bitcoin since over two years ago.

The significant increase in whale holdings is just one aspect of the larger crypto narrative. Based on IntoTheBlock’s chart analysis, this amassing of Bitcoin increased dramatically in January 2024, marking the initiation of a robust bullish market trend. The US crypto markets witnessed a game-changing event with the introduction of Spot Bitcoin ETFs, which opened up new investment avenues for institutional investors. Consequently, a wave of affluent investors eagerly capitalized on this opportunity and amassed substantial quantities of Bitcoin.

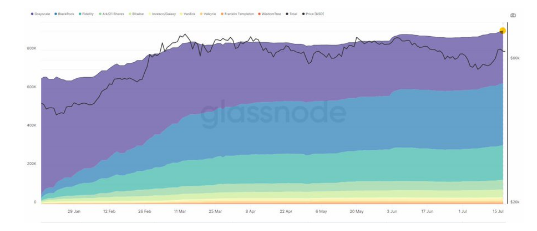

Based on information from Glassnode, the acquisition of Bitcoin through Spot ETFs can be confirmed. According to Glassnode’s chat, US spot ETFs have amassed over 900,000 Bitcoin in a mere seven-month period. Despite market corrections, these funds continue to purchase Bitcoin.

Bitcoin miners were responsible for acquiring an additional 4,500 BTCs in July, equivalent to approximately $300 million. Currently, there are around 7.9 million Bitcoin addresses holding over 1,000 BTC, which represents nearly 40% of the total circulating supply of approximately 19.7 million BTC.

What Does This Mean For Bitcoin?

The buying behavior of large Bitcoin investors, or whales, has predominantly driven up Bitcoin’s price and sparked price surges. When whales decide to invest, their actions often catch the attention of other market participants. This can set off a chain reaction, as smaller investors may follow suit, increasing demand for Bitcoin. The recent accumulation milestone could further fuel bullish sentiments, with Bitcoin hovering near the $70,000 price mark once more.

Current Bitcoin price stands at $66,715 during this composition. Bulls have been attempting but failing so far to surpass and sustain a position above $67,000.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD CLP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

2024-07-21 14:41