As an experienced financial analyst, I have closely monitored the Bitcoin market for years. The recent data indicating a decline in new addresses to multi-year lows is of significant concern. This trend could be a potential warning sign that the asset may be losing appeal among new investors.

The latest on-chain statistics indicate a deceleration in Bitcoin‘s adoption rate, reaching its lowest point since the summer of 2018. Several possible factors might be contributing to this trend.

Bitcoin New Addresses Count Has Plunged To Multi-Year Lows

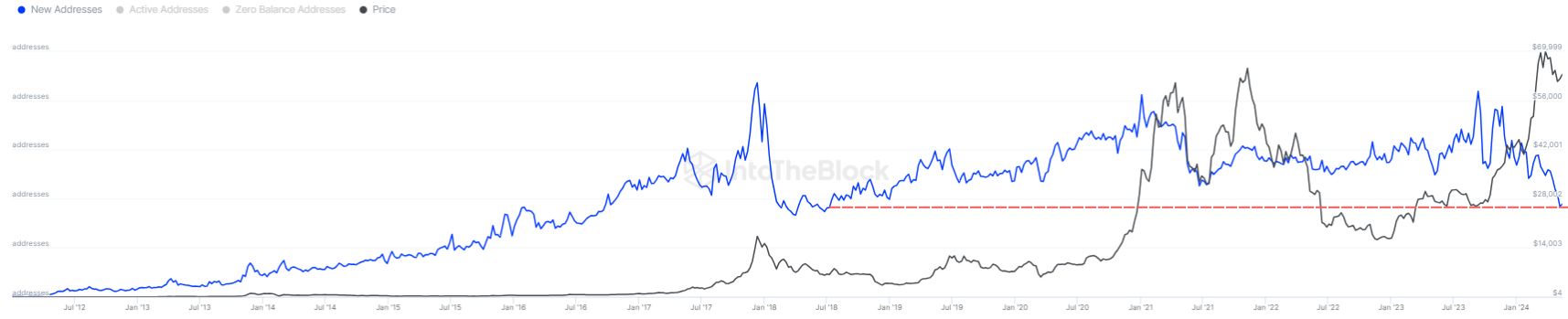

Based on information from market intelligence tool IntoTheBlock, an intriguing development emerges in the Bitcoin New Addresses statistic. This metric monitors the daily total count of newly created Bitcoin addresses.

A high value for this metric signifies an increase in the number of new addresses being added to the blockchain. This surge could be a symptom of new investors entering the cryptocurrency market.

Yet, there’s more than just this explanation for the metric’s rise. Former investors re-entering the market and old investors coming back after exiting earlier could both impact the indicator’s value. Additionally, holders creating multiple wallets for confidentiality reasons would also affect the metric naturally.

In simpler terms, the simultaneous occurrence of these events implies some level of adoption for the asset on the internet. As a result, an increased number of new addresses could indicate a positive trend for the asset’s price in the future.

An alternative interpretation is that a low value of the indicator might indicate that new investors are not showing interest in the cryptocurrency at the moment. This could potentially lead to a bearish forecast for the asset.

Here’s a chart illustrating the historical development of the weekly average new Bitcoin addresses.

Based on the graph presented, the average number of new Bitcoin addresses formed each day over the past year has decreased. This implies that there may be fewer newcomers joining the Bitcoin market.

After the recent decline, the metric’s value now stands at approximately 276,000 – its lowest point since July 2018. The graph indicates that a significant drop in new addresses has historically followed the conclusion of bull markets.

Based on the current trend, my analysis suggests that the recent rally may have reached its peak. However, it’s essential to consider other possible explanations for this pattern besides investor apathy.

At the beginning of the year, a significant development occurred for Bitcoin with the SEC’s green light for the trading of spot Bitcoin ETFs in the United States.

Investment tools called Spot ETFs offer traditional investors an easier way to access the crypto market by providing exposure to cryptocurrencies in a more conventional format.

It’s possible that the new users these days simply prefer to buy into spot ETFs instead. Since this adoption is happening off-chain, it makes sense why an on-chain metric wouldn’t be able to detect it.

BTC Price

At the time of writing, Bitcoin is trading at around $66,100, up more than 5% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- EUR CLP PREDICTION

- USD COP PREDICTION

2024-05-17 22:11