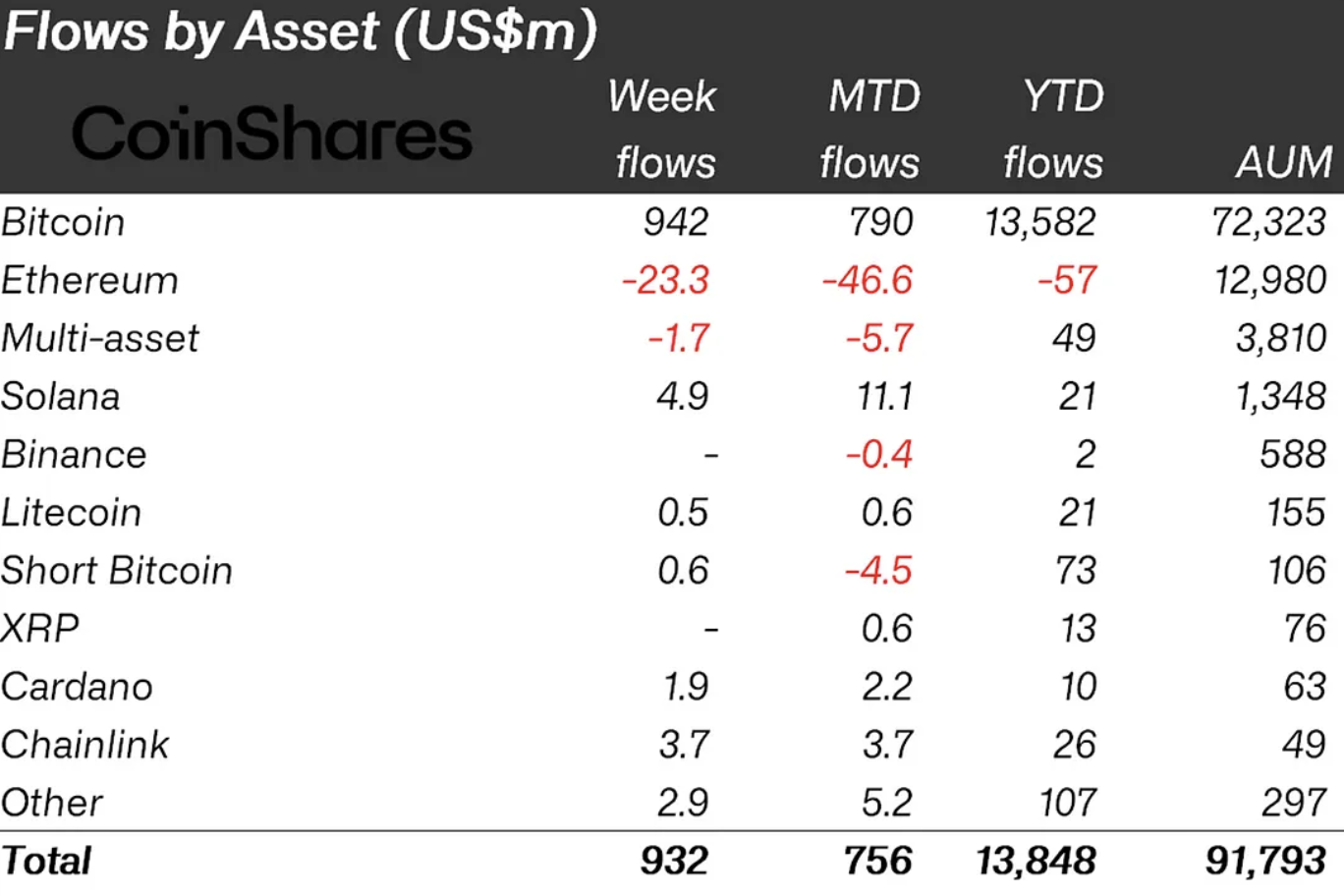

As a researcher with extensive experience in the crypto market, I find the latest weekly report by CoinShares on digital asset investment products intriguing. The significant increase in inflows, amounting to $932 million, represents a massive 716% rise from the previous week’s $130 million. This surge was primarily driven by the lower-than-expected CPI report and the last three trading days of the week, which contributed 89% of total inflows.

Last week, CoinShares reported a substantial surge in investments into digital asset products, with a total inflow of approximately $932 million. This is over seven times the $130 million recorded in the preceding week.

As a crypto investor, I’ve noticed an impressive price surge in recent days. This uptick can be attributed to the unexpectedly low Consumer Price Index (CPI) report released on Wednesday. The last three trading days of the week accounted for a staggering 89% of total inflows into the crypto market. These developments suggest that crypto prices are once again closely tied to interest rate expectations.

Over the past week, Bitcoin (BTC) received a significant portion of the inflows into cryptocurrency markets, further solidifying its status as the dominant digital currency. The inflow into Bitcoin Exchange-Traded Funds (ETFs) totaled approximately $942 million.

As an analyst, I’ve observed that the lack of substantial demand for short positions on Bitcoin indicates a favorable perspective among investors. So far this year, Bitcoin-related investment instruments have attracted approximately $13.85 billion in total inflows.

Cardano soars into spotlight

As a researcher studying the market trends of various digital assets, I’ve observed some significant inflows among altcoins. Specifically, Solana, Chainlink, and Cardano (ADA) have caught my attention with inflows amounting to $4.9 million, $3.7 million, and $1.9 million respectively.

As an analyst, I’ve noticed that Cardano experienced a notable surge in inflows this week, with approximately $2 million entering the market. This is particularly noteworthy given the absence of any inflows last week. With these latest additions, the total investment in Cardano Exchange-Traded Products (ETPs) has reached $10 million for the year. This trend signifies growing investor interest in this asset.

Instead of Ethereum dealing with outflows amounting to $23 million, there’s been a more pessimistic viewpoint due to uncertainties regarding the SEC’s decision on a spot ETF. Consequently, investors have adopted a cautious stance.

Last week saw significant investments pouring into Bitcoin and Cardano, indicating a growing sense of trust among investors in these digital currencies.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-20 18:16