As a seasoned crypto investor with a decade of experience in this volatile market, I can confidently say that this week is shaping up to be a pivotal moment for Bitcoin, Ethereum, and other digital assets. I’ve weathered numerous market fluctuations and have learned to keep a keen eye on significant events that could impact the crypto landscape.

Having closely followed the cryptocurrency market for several years now, I firmly believe that this week is poised to leave a significant mark on Bitcoin, Ethereum, and other digital assets. With a number of high-stakes events unfolding, the potential repercussions could reshape the market dynamics in profound ways.

#1 Bitcoin 2024 Conference

The Bitcoin 2024 conference taking place from July 25-27 in Nashville is generating significant buzz this year. Notable for its impressive roster of speakers, the event has drawn particular interest due to the confirmation of Donald Trump as a keynote speaker on its last day (Saturday). As the leading contender in the US presidential election, Trump’s participation adds an extraordinary dimension to the conference.

As a researcher delving into the Bitcoin community, I’ve come across numerous whispers and conjecture regarding potential plans from Donald Trump, should he be re-elected in November, to establish a United States Bitcoin strategic reserve. The latest buzz was ignited last week by Dennis Porter, the founder of Satoshi Act Fund, who asserted that such an announcement would be made in Nashville based on information from confidential sources.

As an analyst, I’ve noticed that Elon Musk recently updated his X profile picture with a “laser-eyes” meme. This symbol is commonly used among Bitcoin enthusiasts to express a bullish market outlook. Consequently, there has been much conjecture regarding Musk’s potential attendance and backing of the upcoming Bitcoin conference. The buzz generated by this speculation has added fuel to the growing excitement surrounding the event.

#2 US Spot Ethereum ETF Launch

On Friday, it was announced by the Chicago Board Options Exchange (Cboe) that trading for several Ethereum spot Exchange-Traded Funds (ETFs) will begin on July 23 (Tuesday). This decision comes after the US Securities and Exchange Commission (SEC) granted approval for the required regulatory paperwork in May.

Five new Ethereum-focused Exchange Traded Funds (ETFs) are set to debut: 21Shares Core Ethereum ETF (CETH), Fidelity Ethereum Fund (FETH), Franklin Ethereum ETF (EZET), Invesco Galaxy Ethereum ETF (QETH), and VanEck Ethereum ETF (ETHV). According to the announcement, these ETPs are scheduled to start trading on Cboe from July 23, 2024, subject to regulatory approval.

#3 Ripple Vs. SEC: Settlement Or Ruling?

Based on rumors within the XRP community, there are reports suggesting that the US Securities and Exchange Commission (SEC) has postponed last week’s canceled private meeting with Ripple Labs to July 25, 2024. This anticipated encounter could hold significant weight as it might pave the way for a resolution in the ongoing legal battle between Ripple and the SEC. The announcement of this new date has stirred excitement in the financial markets, resulting in an uptick in XRP’s value.

Significantly, in an interview with Fortune, Ripple CEO Garlinghouse indicated optimism for a swift conclusion to the ongoing lawsuit. According to Bitcoinist’s report, he mentioned that there are some key issues before the judge which could be decided upon within a month or even less. However, he admitted that he couldn’t be certain about the exact timeline but was eagerly anticipating a complete resolution.

Additionally, attorney Fred Rispoli who supports Ripple, anticipates that a decision regarding remedies and penalties will be made public by the end of July.

#4 US Inflation Data

As a crypto investor, I can’t stress enough the significance of the upcoming US inflation data release, particularly the core PCE price index, scheduled for July 26 (Friday). Economists predict that this data will indicate a persistent trend of moderate inflation rates. These expectations could potentially shape the Federal Reserve’s monetary policy decisions, impacting financial markets, including Bitcoin and crypto.

“This week brings significant economic data releases. According to Bloomberg’s economist consensus, the monthly increase in the core PCE price index for June is predicted to be just 0.1%. If accurate, this would mark a second consecutive month of such growth and result in the slowest three-month annualized rate for the year. This figure would also fall below the Federal Reserve’s target of 2%.” (Gordon spoke about this via X)

Just like Bank of America expects, the upcoming economic reports are believed to depict a strong economic environment with stable inflation rates. Specifically, personal income and consumption are forecasted to grow by 0.4% and 0.1%, respectively, on a monthly basis in June. Likewise, headline and core PCE (Personal Consumption Expenditures) indices are projected to rise by 0.1% and 0.2%, suggesting a steady increase in spending and controlled inflation. In essence, the data is anticipated to reveal vibrant economic activity and an inflation trend moving in the desired direction.

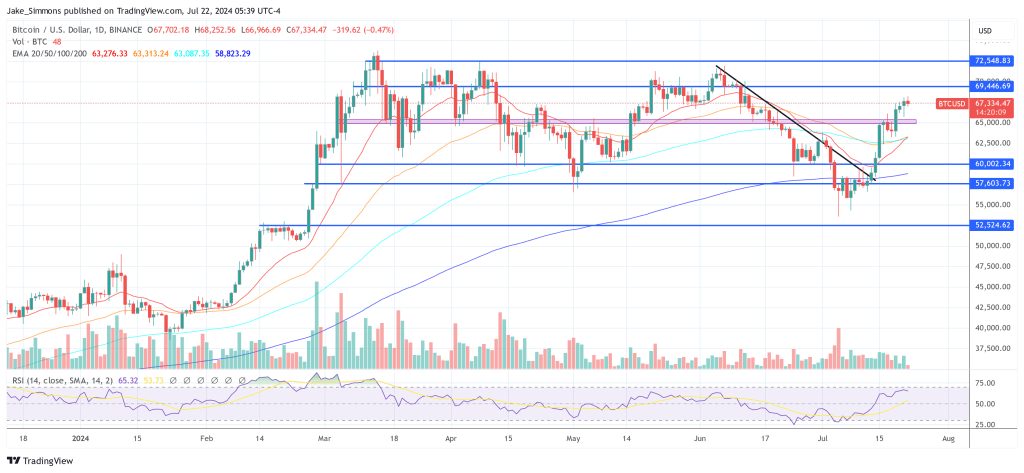

At press time, BTC traded at $67,334.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD CLP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

2024-07-22 14:12