The ledger-house, that odd cathedral of numbers, shudders as if a ghostly clerk misplaced the keys to fate. Bitcoin, the stray dog of the digital bazaar, lumbers forward with a swagger that belies the panic behind every ticker. Short-term holders clutch their wallets like fools clutch rosaries, while the grand question of where prices may finally settle becomes a rumor whispered in back rooms and cyber cafés. Markets tremble; those who bought at noon discover their pockets turned inside out, and the rest rush to the exits as if a fire drill conducted by fate itself. The on-chain numbers, ever the press gang, march forward in a cold parade of losses.

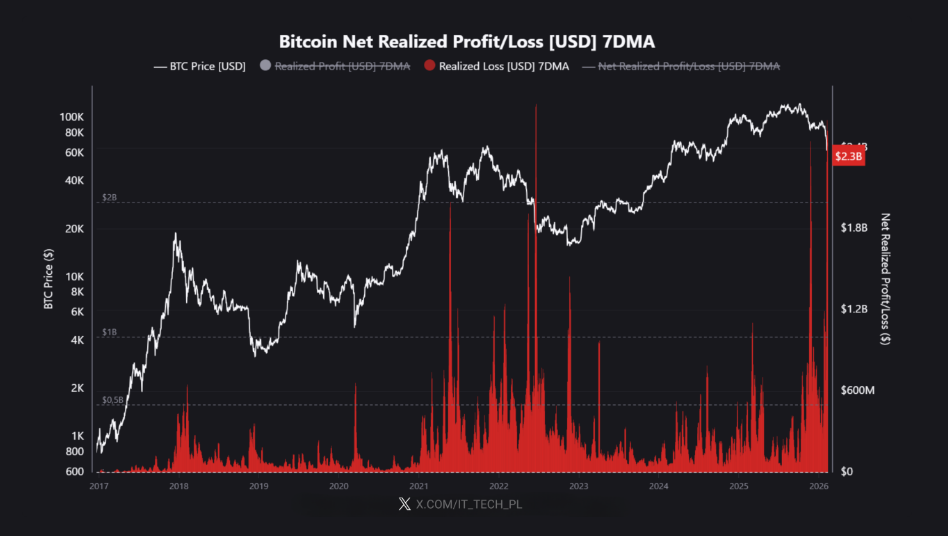

Realized Losses Hit Historical Levels

According to CryptoQuant and an analyst signing his name in the smoke as IT Tech, Bitcoin’s seven-day average of realized net losses rose to about $2.3 billion-a number that could make even a banker nod and then laugh with the sigh of a tired sphinx. It places this sell-off among the most storied losses in the annals, a chapter that future economists will flip to like a cruel page-turner.

“This is one of the largest capitulation events in BTC history, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction,” IT Tech proclaimed, as if delivering a verdict from a tribunal of spreadsheets.

This spike means many traders sold at a loss over a week, not merely in a single breathless afternoon-the kind of thing that makes even the calendar look guilty.

Price Action And Market Context

Reports tell of a dramatic fall from a lofty peak, with the price dancing between support lines like a wary cat in a room full of rocking chairs. After flirting with $126,000, the token slipped to a shade around $60,000 earlier in the month and has hovered near $66,600 on recent checks. The gap is vast enough to make a grown man sigh and a crowd of speculators pretend not to have noticed. Panic selling has pushed realized losses to the sky, as if the abyss itself opened its jaws for a bite.

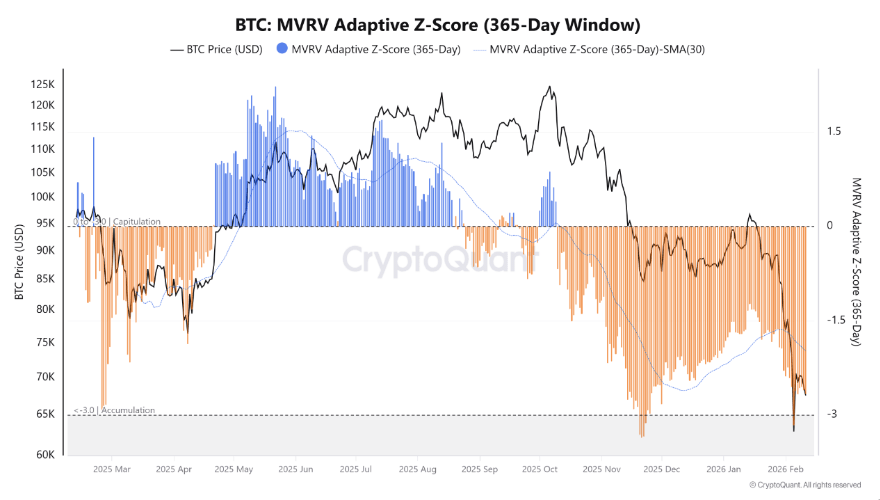

Signs Pointing To Capitulation

On-chain indicators tied to profit and loss show losses rising faster than gains. A CryptoQuant contributor, GugaOnChain, flagged a Z-Score reading he describes as consistent with deep capitulation-a moment when more holders concede defeat than buy. When that happens, markets behave like a crowded theater in a storm: chaotic at first, then perhaps, mercifully, orderly in the intermission.

What Analysts Are Saying Now

Analysts foretell continued pressure for a spell. Nic Puckrin, an investment analyst, spoke of the market in “full capitulation mode,” warning that selling could persist for months before a clearer footing appears. Others suggest that heavy losses might clear the stage for patient buyers later, as if the audience merely needed a longer intermission and quieter clapping.

Where Bottoms Have Lived Before

CryptoQuant’s measure of the “realized price” sits near $55,000-a figure historically linked to the end of sizable sell-offs and the birth of sideways lullaby. It is not a floor; it is a place where past buyers, on average, stopped losing money. Markets have wandered far below similar marks before they steadied, so history offers patterns, not guarantees, like a weathercock that points the way but does not command the wind.

That does not mean a floor has formed this time; it merely marks a region where earlier buyers stopped bleeding. If history is a guide, it suggests only that patterns exist, not that fate will obey them.

What This Means For Traders And Investors

In the short term, expect wild swings and the kind of dramatic reversals that keep editors awake at night. Some days will offer sharp rallies that vanish like smoke; others will drag on, and realized losses may continue to climb as more players retreat to their corners. In the longer view, if institutional demand returns or if big holders pause the slow dance of sales, price stability could return to the stage. For now, the market is shedding positions and testing whether support lines will hold when the orchestra begins to play again.

Read More

- EUR USD PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2026-02-13 19:16