As a seasoned crypto investor with over a decade of experience navigating the volatile waters of digital currencies, I find myself standing at a crossroads between cautious optimism and pragmatic skepticism. The steady state of Bitcoin at press time is reminiscent of a calm before the storm, with the liquidation of August 27 casting a long shadow over our current position.

At the moment, Bitcoin appears stable, but it’s facing significant selling pressure following the liquidations on August 27. From a technical perspective, there are signs of potential vulnerability.

Conversely, if Bitcoin bulls manage to drive prices beyond the current resistance at $66,000, this preview could change. The level we’re referring to here is the peak from August 23, and a subsequent rise would signal the continuation of the uptrend that began on August 8.

Binance Traders Are Net Bearish

Previously, traders held a guarded sense of hope regarding Bitcoin, recognizing its delicate structure and past market instability. However, even with prices maintaining their current levels, an analyst from platform X highlights that most traders on Binance, the exchange with the highest number of clients, generally have a bearish outlook.

According to the analyst’s evaluation, fewer traders are choosing to short the world’s most valuable coin, which could be a sign of growing bullish sentiment. If more retail investors continue to make bearish wagers, this could potentially reinforce the downward trend, mirroring the losses from August 24.

When the majority of traders show no strong bias towards buying or selling a cryptocurrency, it often leads to a shift in sentiment that benefits sellers. As per the CMC Crypto Fear and Greed Index, on August 28, most traders took a cautious stance, leaning more towards neutrality rather than expressing any significant bullish or bearish sentiments.

Since Bitcoin’s prices dropped significantly in early August, there has been a widespread feeling of apprehension among traders, with many choosing to exit their positions, leading us into the most “cautious” or “fearful” state since early September 2023. Examining the sentiment graph, it appears that the only time traders exhibited extreme greed over the past year was when Bitcoin reached its peak and soared to $73,800.

If prices are low and feelings are neutral, this could encourage optimistic investors in the near future. A rise above $63,000, reversing the losses from August 27, might stimulate interest. This growth could serve as a foundation for potential increases surpassing the August 2024 highs.

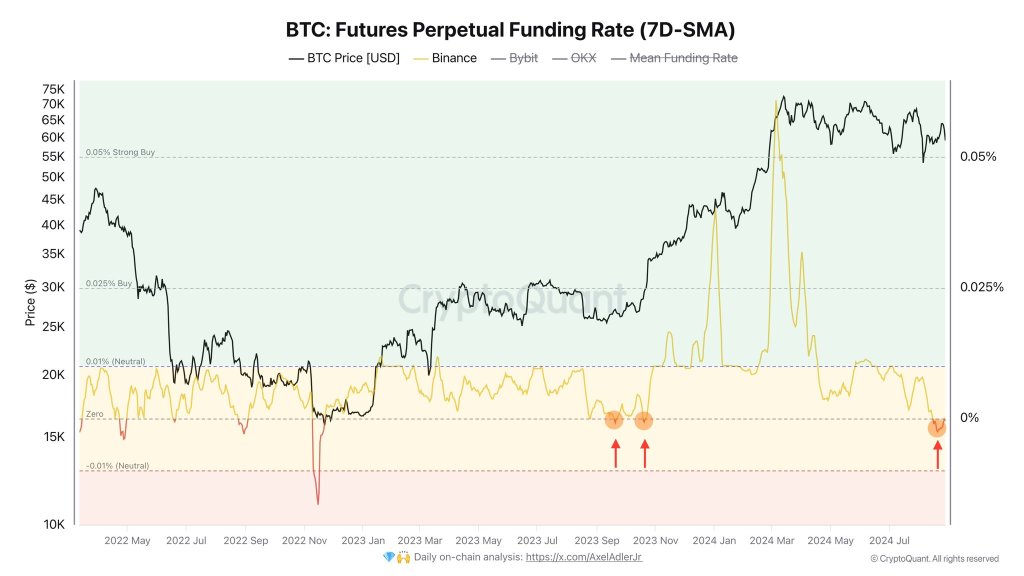

Why Is Funding Rate Positive Amid Falling BTC Prices?

It appears that the typical interest rate for trades on platforms like Binance, Bybit, and OKX is currently around 0.002%, a figure that indicates a positive return for those engaging in short-leverage trading, as they receive payment for maintaining their positions.

Generally speaking, this indicates that the cost of perpetual contracts is higher than the current market price, which might encourage additional sellers and potentially deepen the price decline.

As a researcher, I often observe that funding rates tend to be favorable during market rallies, signifying optimistic investor attitudes. Conversely, when the market takes a dive, these rates become unfavorable, indicating that short sellers who borrowed funds to bet on price declines must now repay those who wagered on price increases.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- USD ZAR PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

2024-08-29 04:11