In May, everyone suddenly remembered that cryptocurrencies exist — especially institutions. Bitcoin and Ethereum ETFs became the new shiny toys, thanks to some overly optimistic regulatory whispers. 🎉

As if that wasn’t enough excitement, Bitcoin soared to a new all-time high in May, reaching a jaw-dropping $111,970 on the 22nd. Meanwhile, traders panicked and liquidated nearly a billion dollars — because what’s life without a little drama? The U.S. and U.K. trade talk sparked this chaos, but sure, let’s blame it on the markets. 💥

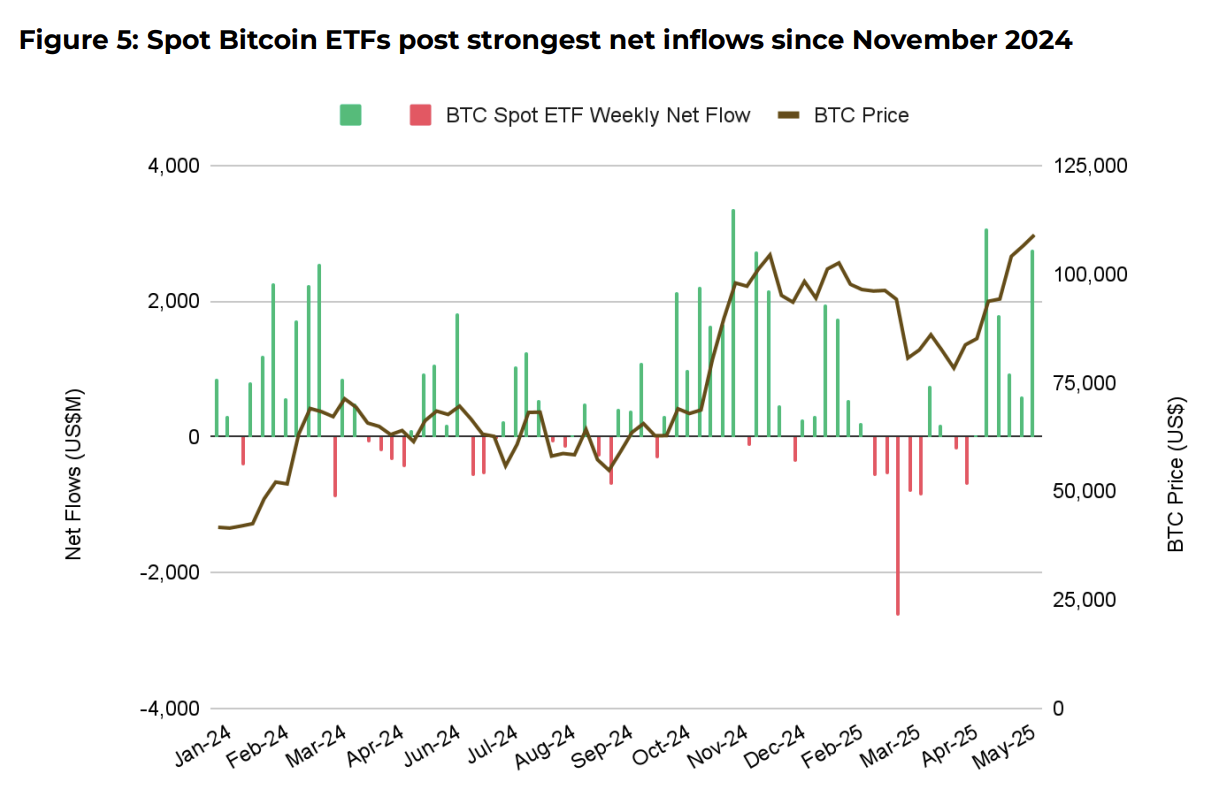

Curiously, despite these rollercoaster rides, interest in Bitcoin ETFs remained remarkably strong—pulling in a whopping $5.2 billion, the most since late 2024. Just in time for Bitcoin’s record-breaking spree! Coincidence? Nope, just good ol’ market magic. ✨

The biggest cheerleader? Regulatory momentum, naturally. The U.S. Senate was busy proposing the GENIUS Act — because nothing says “serious business” like stablecoin regulation. Meanwhile, Hong Kong rolled out the red carpet for stablecoins, as if to say, “Come on in, the water’s fine!”

DeFi Turns Out to Be the Real Rock Star

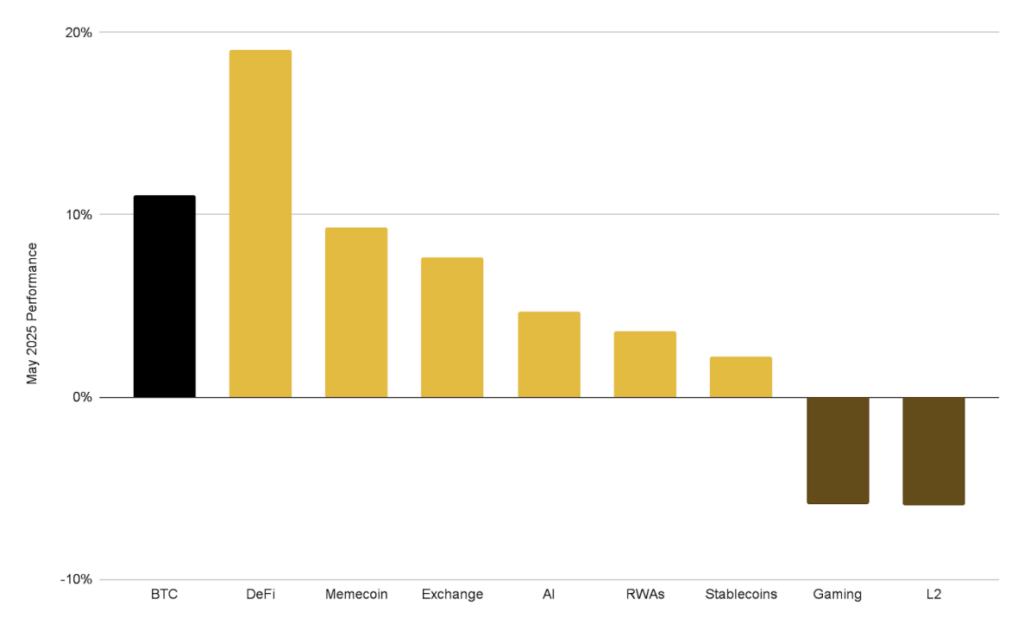

While Bitcoin pravils around, DeFi had its own party and outperformed the king of cryptocurrencies with a 19% growth — barely less enthusiastic than a cat showing interest in a laser pointer. In contrast, Bitcoin nudged up 11.1%, probably reflecting that everyone suddenly remembered it’s more than a complicated joke. Plus, DeFi’s total value locked hit its highest since February—because why not? 🚀

Corporate treasuries also joined the fun, holding over 809,100 BTC across 116 companies. That’s right, billionaires are throwing billions into Bitcoin — maybe to impress investors, or perhaps in hopes of someday buying their own island. Trump Media reportedly went all-in, proving once again that in crypto, the sky’s the limit (and so are the risks!).

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-05 17:50