As a seasoned crypto investor with more than a decade of experience navigating the tumultuous seas of digital currencies, I can’t help but feel both exhilarated and cautiously optimistic about the latest Bitcoin (BTC) developments. The all-time high hashrate and the predicted record-breaking mining difficulty adjustment are undeniably impressive feats that underscore the resilience and robustness of this revolutionary technology.

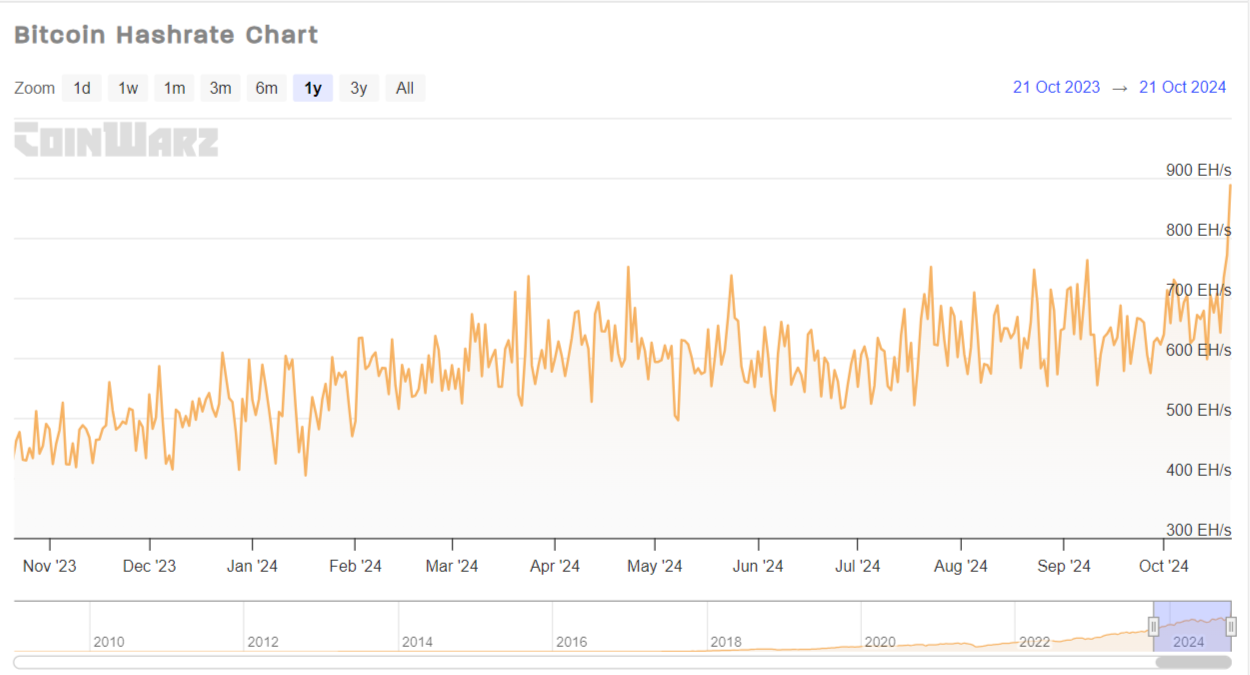

The combined computing power used by all devices mining Bitcoin (BTC), known as the hashrate, has reached a new peak. It’s anticipated that the difficulty of mining Bitcoin (BTC) could reach an all-time high tomorrow, following a projected increase.

Bitcoin (BTC) hashrate hits new all-time high

In simple terms, the largest digital currency network, Bitcoin (BTC), has set a new record for its computing power, known as hashrate. This impressive increase was approximately 25.3% overnight and now stands at an astonishing 925 quintillion hashes per second (Eh/s). This is the highest level ever recorded for this specific metric in Bitcoin’s entire history.

The level of complexity involved in discovering the next Bitcoin (BTC) block hash, known as Bitcoin (BTC) mining difficulty, is approaching an all-time high.

Tomorrow, we anticipate a rise of approximately 4.17%, potentially exceeding 95.88 trillion. Our highest recorded value so far was reached in mid-September, which stood at around 92.76 trillion.

At present, the Bitcoin (BTC) network is handling blocks approximately 40 seconds quicker than anticipated. This rapid pace reflects the increasing activity within the Bitcoin (BTC) network, which in turn suggests the enthusiasm of miners.

When miners seek potential profits, they tend to expand their operations by incorporating additional mining equipment into the network. This expansion leads to an increase in the overall computational power (hashrate) and a subsequent adjustment in the mining complexity.

Bitcoin (BTC) bull run finally starting?

In recent times, the value of Bitcoin (BTC) has bounced back. This morning on October 21, 2024, it peaked at a high of $69,500 – a level not seen since mid-June.

Consequently, Bitcoin (BTC) investors found themselves gripped by a wave of greed: the Fear and Greed Index climbed to 72 out of 100, signifying high levels of greed.

In the last 24 hours, short positions have covered over 70% of liquidations on derivative markets.

Previously reported by U.Today, Bitcoin (BTC) has just five more days to initiate an uptrend. If it fails to do so, the market could record the longest period of bearish decline on record.

Based on Ki Young Ju, the CEO of CryptoQuant, it appears that this could potentially be the longest period of sideways movement in Bitcoin’s history during a halving year.

Read More

- XRP PREDICTION. XRP cryptocurrency

- POWR PREDICTION. POWR cryptocurrency

- EUR ARS PREDICTION

- FIS PREDICTION. FIS cryptocurrency

- EUR VND PREDICTION

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- EUR CAD PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Predicting Monter Hunter Wilds’ Meta Weapons

- Marvel Rivals Shines in its Dialogue

2024-10-21 17:30