As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of bull and bear cycles, and the current state of Bitcoin is one that intrigues me. The recent decline in active addresses on the BTC network might be interpreted as a bearish sign, but it’s essential to consider the context.

The latest on-chain analysis indicates that the number of active Bitcoin addresses has been experiencing a significant drop, which might be an indication suggesting potential bearish trends for Bitcoin.

Bitcoin Active Addresses Have Recently Seen Their Biggest Drop Since 2021

According to an analyst’s analysis in a CryptoQuant Quicktake post, there has been a decrease in the number of active Bitcoin addresses since March this year. An address is considered “active” if it takes part in any transactional activity within the network, either as a sender or receiver.

The Active Addresses marker monitors the distinct daily count of addresses involved in transactions within the Bitcoin network. Essentially, these unique active addresses can be likened to the individual users navigating the system, providing insights into the daily activity or traffic on the Bitcoin blockchain.

As an analyst, I’d like to draw your attention to this graph that illustrates the evolution of the 100-day Simple Moving Average (SMA) of active Bitcoin addresses over the past couple of years. This data provides insights into the trend and activity levels within the Bitcoin network.

In the graph provided, we can see that the 100-day Simple Moving Average (SMA) of Bitcoin Active Addresses was on an upward trend throughout most of 2023 and into early this year. However, since March, there’s been a significant change – instead of continuing to rise, the SMA is now falling rapidly. This turnaround coincides with Bitcoin reaching its latest all-time high (ATH), suggesting that the decrease in the indicator may be linked to the consolidation period Bitcoin has experienced since then.

It’s not unusual for Active Addresses to decrease during periods like this, as investors often find steady price action less thrilling compared to rallies. However, the significant drop in the 100-day Simple Moving Average (SMA) of this metric might be worth paying attention to. At present, its value is lower than the lowest point seen during the 2022 bear market and could potentially dip below the 2021 low as well.

It’s important to remember that Bitcoin’s momentum is largely driven by its active userbase, so the recent decrease in the indicator’s value might suggest a bearish outlook. The analyst suggests that we may soon see Bitcoin’s price mirroring the trend of address activity.

Despite a downward trend in Active Addresses, CryptoQuant CEO Ki Young Ju recently expressed in a post that we’re right in the heart of Bitcoin’s ongoing bull market cycle.

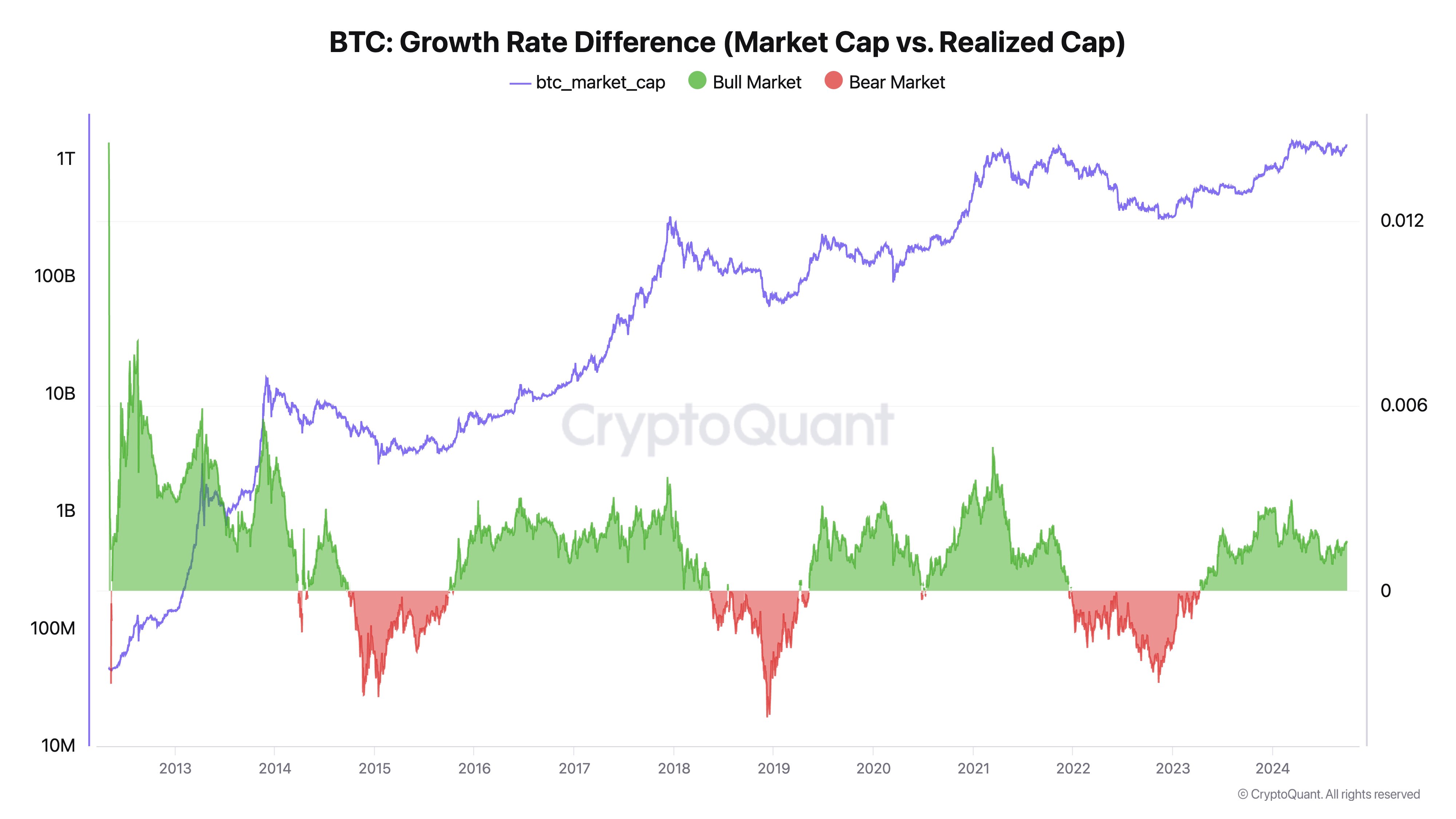

The chart provided by Young Ju illustrates a pattern in the disparity between the growth rates of Bitcoin’s market capitalization and its realized capitalization, which is a tool used to compare their respective expansion.

As a crypto investor, I’d like to share some insights about a metric known as Realized Cap. This on-chain model offers a glimpse into the collective investment made by all investors in a particular cryptocurrency.

Currently, the market cap is expanding at a rate that surpasses the realized cap, which might suggest a bullish trend in the market. Conversely, if the realized cap expands faster than the market cap, it could be indicative of a bearish trend. This observation was made by the CEO of CryptoQuant.

BTC Price

Over the past day, Bitcoin has experienced an extension of its recent drop, with its value currently dipping to approximately $62,700.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- FLOKI PREDICTION. FLOKI cryptocurrency

2024-10-02 14:42