As a seasoned crypto investor who’s been through the bull runs of 2017 and the bear markets of 2018-2020, the latest surge in liquidity has me both excited and cautiously optimistic. The record high stablecoin market cap is reminiscent of the pre-bull run conditions we saw back then, but I’ve learned that past performance isn’t always a reliable predictor of future results.

Based on current blockchain information, the liquidity within the cryptocurrency sector has attained a record peak. This development could potentially impact the value of Bitcoin and predict future trends.

Stablecoin Market Cap Hits New Highs — Impact On Bitcoin Price

Recently, CryptoQuant’s latest findings indicate that the cryptocurrency market experienced an unprecedented level of liquidity towards the end of September, igniting discussions about the possible return of the Bitcoin bull market. As per the insights provided by the on-chain analytics company, the measure of crypto market liquidity is determined by the value of stablecoins and total market capitalization, currently estimated to be approximately $169 billion.

2024 has seen a substantial surge in the combined market value of leading USD-pegged stablecoins, according to CryptoQuant data. This rise amounts to approximately 31% or $40 billion on a year-to-date basis. The primary drivers behind this growth have been Tether’s USDT and Circle’s USDC, the two largest players in the market.

It’s no wonder that USDT and USDC remain the leading players in the stablecoin sector, accounting for a combined 92% of the market share, with USDT holding 71% and USDC taking 21%. As per CryptoQuant’s latest data, USDT has seen a significant growth in its market cap this year, increasing by around $28 billion or 30%, while USDC’s market value has risen by 44% (or approximately $11 billion) between January and now.

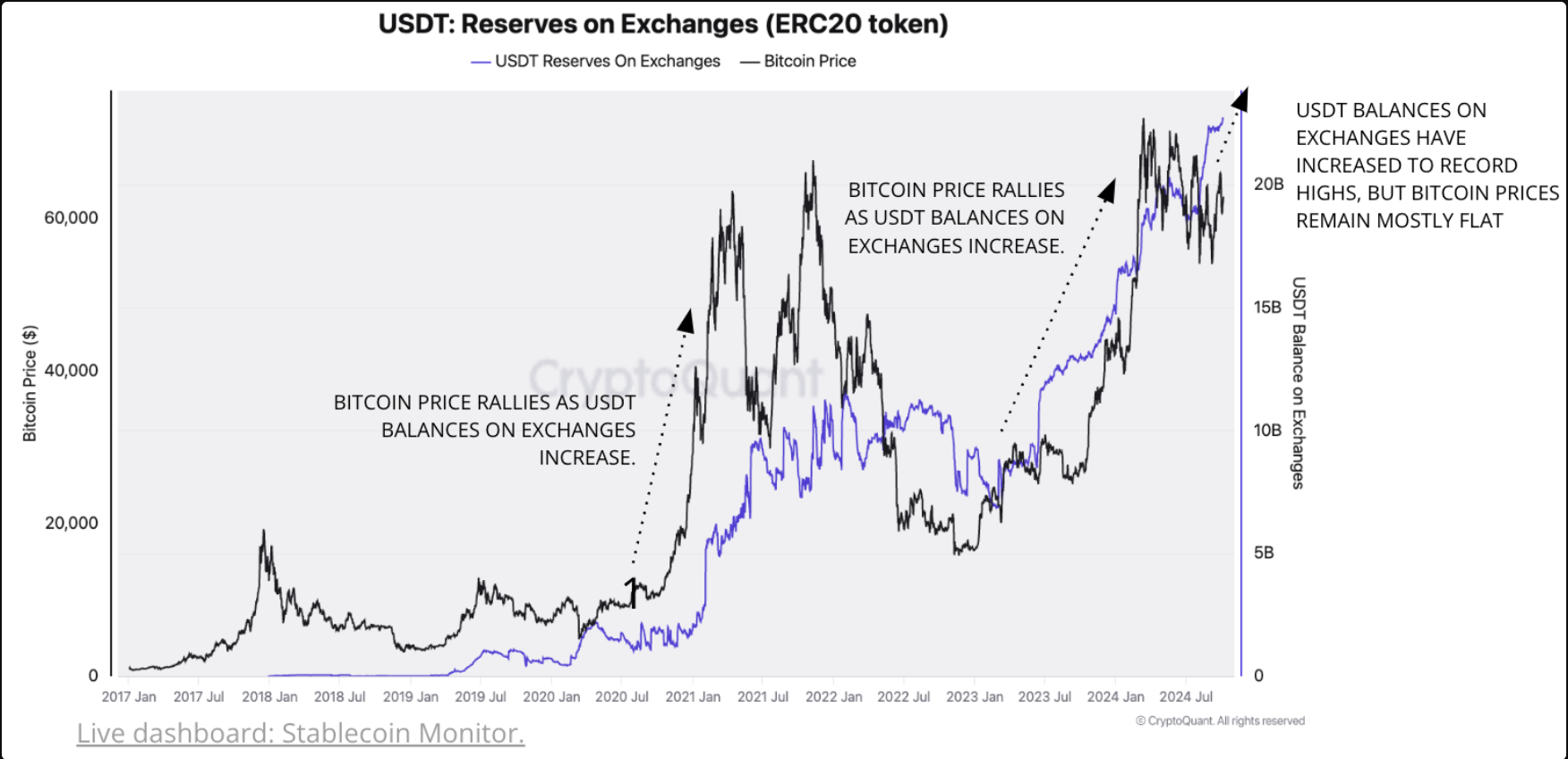

A notable indicator of expanding market fluidity is the unprecedented amount of stablecoins stored on centralized trading platforms, particularly USDT (ERC20 on Ethereum). Remarkably, these stablecoin balances reached a peak of 22.7 billion in October, representing a 54% rise or approximately $8 billion since the start of 2024. This surge suggests an increasing trend.

Historically, an increase in the amount of stablecoins stored on exchanges tends to correlate with higher prices in the crypto market, particularly Bitcoin. This is due to the fact that a larger quantity of stablecoins can indicate greater purchasing power for investors, as they can swiftly convert these stablecoins into other cryptocurrencies using exchange platforms that facilitate such trades.

Having substantial amounts of stablecoins stored in exchanges might indicate a preparedness among investors to buy cryptocurrencies. This potential increase in demand could drive the value of assets higher, particularly when investors typically make purchases anticipating a rise in prices.

As market liquidity increases, investors find themselves pondering if another Bitcoin bull run might be imminent. It’s important to mention that the total amount of USDT (ERC20) held on exchanges has significantly increased by 146%, from $9.2 billion to $22.7 billion, since January 2023 – the beginning of the current market cycle.

On the other hand, it’s worth noting that investors may need to adjust their expectations slightly. This is because the USDT holdings have grown by approximately 20% from August 2024, whereas the price of Bitcoin has stayed fairly stable during the same period.

Bitcoin Price At A Glance

Currently, the value of Bitcoin stands approximately at $62,750, marking a nearly 3% rise within the last 24 hours.

Read More

- ZIG PREDICTION. ZIG cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

- NTRN PREDICTION. NTRN cryptocurrency

- USD MXN PREDICTION

- DF PREDICTION. DF cryptocurrency

2024-10-13 07:11