As a researcher with a background in blockchain analysis and on-chain data, I find the recent surge in Bitcoin’s Coin Days Destroyed (CDD) to be an intriguing development. The spike in CDD, which has now surpassed the previous ATH observed during the November 2018 market crash, suggests that a significant number of long-term bitcoins have been moved on the network.

The latest data from the Bitcoin blockchain indicates that the Coins Days Destroyed (CDD) metric has hit a record peak. This development might be attributed to several potential reasons.

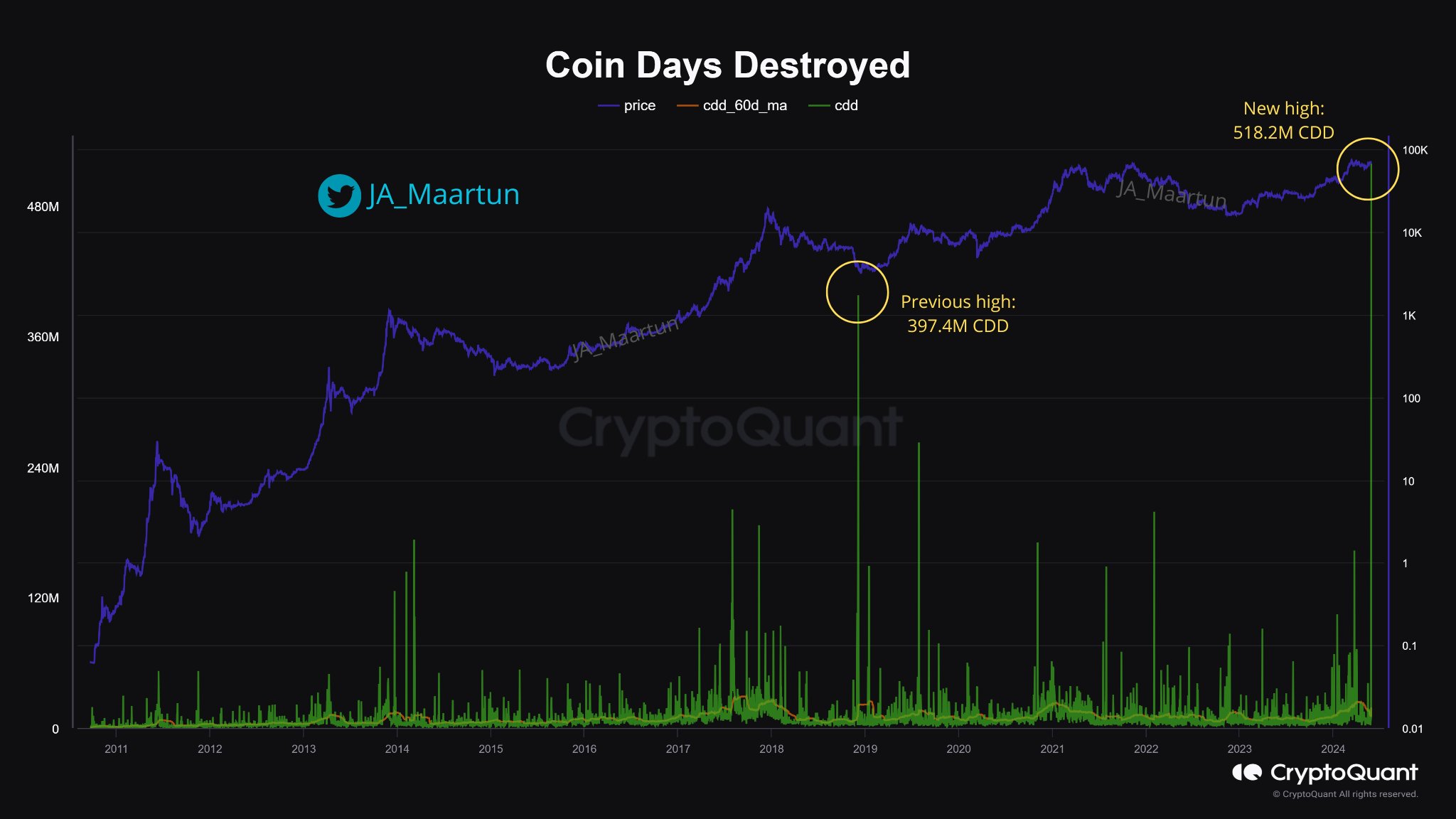

Bitcoin CDD Has Just Observed A Spike Larger Than November 2018

According to Maartunn, the community manager at CryptoQuant, there has been a significant increase in the Bitcoin Cumulative Depth of Distribution (CDD) as indicated on X. The CDD metric is calculated using the concept of “coin days,” which refers to the total amount of time that Bitcoin addresses have held their coins for a certain period.

As a researcher studying the intricacies of Bitcoin transactions, I would describe a coin day as follows: Every 24 hours that a single bitcoin (1 BTC) sits unspent on the blockchain adds a coin day to its record. Consequently, if a coin resides in the same digital wallet for a specific number of days, it will accrue an equivalent number of coin days.

When a dormant cryptocurrency coin is transacted within a blockchain network for the first time, its coin age or dormancy counter returns to zero. Previously accumulated coin ages are considered annulled and referred to as “lost” or “consumed.” The Coin Days Destroyed (CDD) metric monitors and tallies the total amount of such lost coin ages across the network daily.

Here’s a chart illustrating the historical development of Bitcoin’s Cash Difficulty Disscount (CDD).

Based on the presented graph, I’ve noticed a significant surge in the Bitcoin CDD (Coin Days Destroyed). This spike indicates that an substantial number of old bitcoins, which had been in circulation for extended periods, have recently been involved in transactions, resulting in their coin age being reset.

Typically, significant increases in the indicator can be linked back to actions taken by long-term investors (LTIs). These investors are known for holding onto their assets for extended durations. As a result, they accumulate a substantial amount of “coin age” or “holding duration.”

As an analyst, I’ve observed that once these steadfast hands execute transactions, the amassed coin days get cleared out, leading to a significant increase in the relevant metric’s value. Typically, long-term holders (LTHs) tend to remain quiet until they decide to sell. Consequently, spikes in this indicator might be an indication that these diamond-handed investors are contributing to a selloff event.

As a crypto investor, I’ve noticed that during the recent surge in CDD (Coin Days Destroyed), approximately 518.2 million coin days have been eliminated. This is significantly higher than the previous all-time high of 397.4 million coin days that were destroyed back in November 2018.

At first glance, it seems that the least active Large Traders (LTHs) may have executed their largest transaction ever. But upon closer inspection, the cause of this significant Cumulative Depth of Market (CDD) increase can be attributed to the Mt. Gox transactions.

The insolvent cryptocurrency platform previously announced its intention to repay its debtors. Consequently, the recent transactions are most likely connected to this endeavor.

As a crypto investor, I’ve noticed that my Bitcoins held in the platform’s custody hadn’t been moved for some time. Consequently, these coins accumulated what we call “coin days.” The recent activity in the market caused a surge in the number of coin days destroyed within a short period. In simpler terms, many bitcoins like mine that had been dormant for an extended period were moved and thus eliminated from the count of coin days.

BTC Price

At the time of writing, Bitcoin is trading at around $67,500, down 4% over the past week.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- PYTH PREDICTION. PYTH cryptocurrency

2024-05-30 07:11