Lately, Bitcoin has faced difficulties and momentarily dipped under the $60,000 mark. Amidst the market turmoil, here’s what the large investors, referred to as “whales,” have been up to.

How The Bitcoin Whales Are Behaving At The Moment

On X’s latest update, IntoTheBlock’s new post unveils the recent activities of significant Bitcoin investors, or “whales,” in response to the ongoing price instability for the cryptocurrency.

Investors holding a minimum of 1,000 Bitcoins (BTC) in their wallets are commonly referred to as “whales” in the cryptocurrency community. At present exchange rates, this quantity is equivalent to approximately $63.5 million. Given the substantial size of their holdings, these whales possess significant power to impact the Bitcoin network.

In simpler terms, their actions are definitely worth observing. The analytics company has identified significant players in the Bitcoin market, referring to them as “Large Holders.” According to IntoTheBlock, Large Holders are individuals who possess 0.1% or more of the total circulating Bitcoin supply.

At present, approximately 19.7 million units of this cryptocurrency exist, making significant holders those who possess roughly 19,700 BTC. The value of this amount equates to an impressive $1.25 billion.

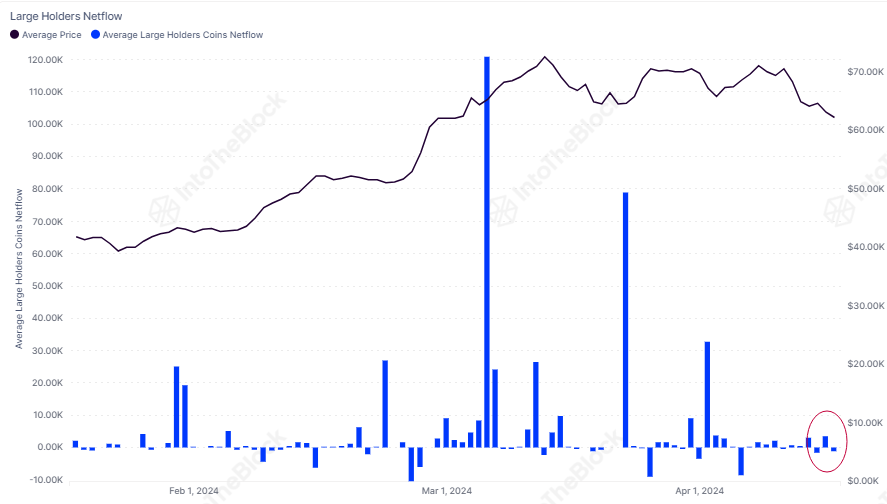

The analytics company monitors the actions of major Bitcoin holders by examining its “Large Holder Netflow” indicator. This metric is derived from on-chain data and measures the net amount of Bitcoin flowing into or out of these significant entities’ wallets.

Below is the chart for the indicator that shows how its value has changed over the last few months.

Based on the graph, significant upward trends in Bitcoin Large Holders Netflow emerged in March, indicating that major investors likely contributed to the increase in holdings.

Recently, the metric’s value has hovered around the neutral mark, indicating no clear trend towards either distribution or accumulation. Consequently, the most recent price decrease has not presented an attractive buy-the-dip chance for this group.

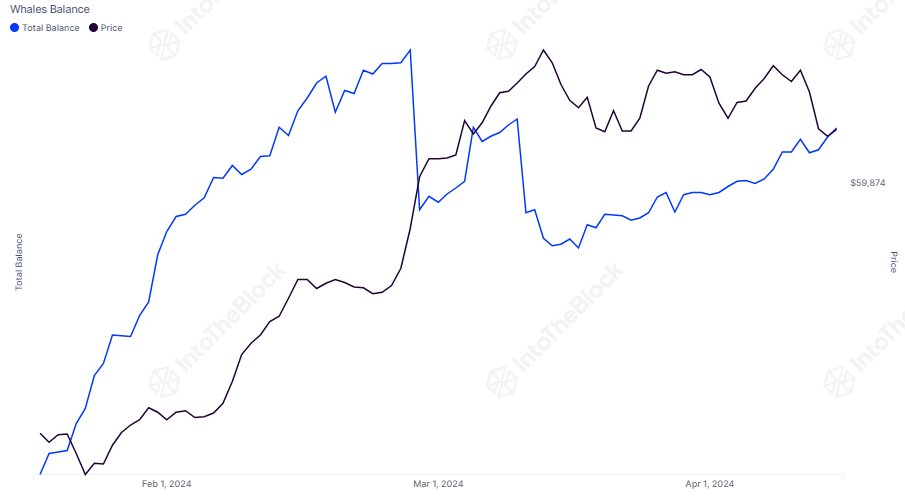

Whales, on the other hand, have taken advantage of current low prices to make purchases. The following chart illustrates their accumulated holdings.

Last month, Bitcoin’s price reached a new record high, and large Bitcoin holders, referred to as whales, made significant sales according to the graph.

After Bitcoin’s price decline from its all-time high, large investors, or “whales,” have resumed purchasing. With prices decreasing in recent days, these buyers have increased their acquisition pace significantly. According to IntoTheBlock, they have bought approximately 16,300 Bitcoins (worth around $1.04 billion) over the last week.

In simpler terms, the absence of significant selling by large Bitcoin holders while smaller investors continue to buy could indicate a stable or even optimistic outlook for Bitcoin’s price.

BTC Price

At the time of writing, Bitcoin is trading at around $63,400, down 10% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- LPT PREDICTION. LPT cryptocurrency

- ZGD PREDICTION. ZGD cryptocurrency

- LYX PREDICTION. LYX cryptocurrency

- CHOW PREDICTION. CHOW cryptocurrency

2024-04-19 10:20