As a seasoned crypto investor with a decade of market experience under my belt, I can confidently say that the recent surge in Bitcoin’s price and the growing correlation between its performance and the US stock market, specifically the S&P 500, has certainly piqued my interest. The fact that Bitcoin managed to register a surprisingly positive performance in a historically bearish month like September is nothing short of remarkable.

Over the past week, Bitcoin‘s price has shown another impressive improvement, aiming to close out September and kick off October with even more strength. Following a series of upward trends in recent weeks, Bitcoin reached a peak of approximately $66,000 on Friday, September 27th.

A current trend indicates a potential strengthening link between the U.S. stock market’s performance and the worth of the most valuable global cryptocurrency. This raises the question: in what ways might this impact the strategies of investors?

How Did Bitcoin And S&P 500 Perform In September?

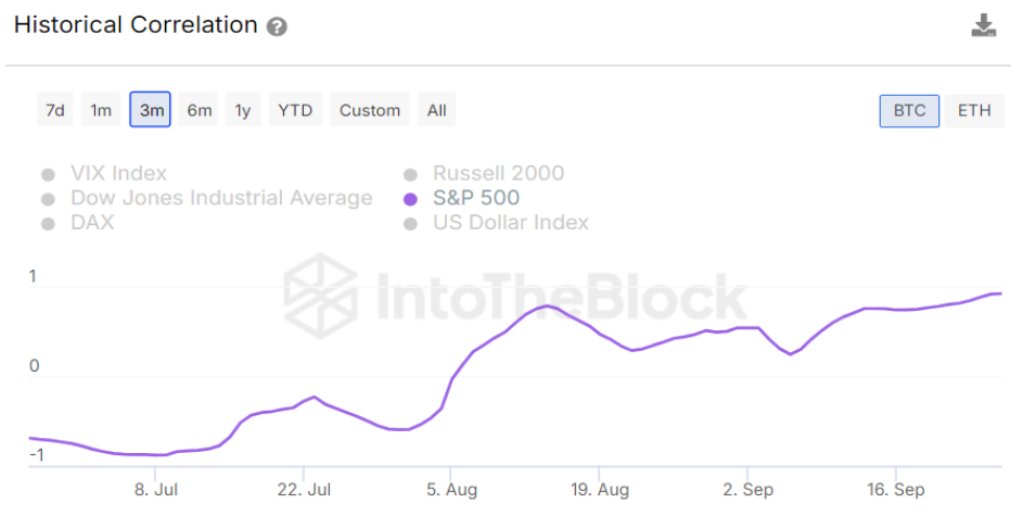

In a recent update on platform X, cryptocurrency analysis firm IntoTheBlock highlighted that the link between Bitcoin’s price and the S&P 500, a well-known stock market indicator, has reached its strongest point in over two years. To provide some context, the S&P 500 index measures the overall performance of approximately 500 major publicly traded companies based in the United States.

As an analyst, I’ve noticed an unexpectedly bullish trend in the price of Bitcoin over the course of September – a month notoriously bearish for this digital currency. According to my findings from CoinGecko, the value of Bitcoin has surged by over 11% within the past month.

Currently, the S&P 500 index is experiencing a swift and robust comeback. It has reached a record peak once more, despite an early-month dip. Data from TradingView indicates that the index has climbed nearly 4% this September.

As a researcher examining financial markets, I’ve consistently found the interplay between traditional stock markets and the cryptocurrency realm fascinating. It’s clear that many investors are drawn to seize opportunities in either arena. However, the perceived strong link between these asset classes could potentially limit the diversification benefits they can provide for investors, as investments in one may not fully shield against fluctuations in the other.

Currently, Bitcoin’s price is approximately $66,024, showing a minor 1.1% growth over the last 24 hours. On the other hand, the S&P 500 Index remains stable near 5,800, experiencing a 0.4% increase during the same period.

Global Liquidity Surges By $1.426 Trillion In A Week

As a researcher, I recently observed an intriguing increase in the flow of capital across global financial markets. The data I’ve gathered from my analysis indicates a significant rise in global liquidity, amounting to approximately $1.426 trillion within the last week, as shared by crypto analyst Ali Martinez on the X platform.

This week witnessed a significant increase of approximately $1.426 trillion in global liquidity, bringing the total to about $131.6 trillion. This growth has positively impacted #Bitcoin and other risk assets, with these assets seeing gains. However, it’s important to note that this surge in liquidity could potentially extend into October.

— Ali (@ali_charts) September 27, 2024

In simple terms, Bitcoin and other high-risk investments have profited from the surge in global funds availability, as their worth has escalated because of the increased money flow. Furthermore, Martinez pointed out that this influx of liquidity might persist until October.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- WELL PREDICTION. WELL cryptocurrency

- REF PREDICTION. REF cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

2024-09-28 21:41