As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous bull and bear cycles, but none quite like the one we are currently experiencing with Bitcoin. The recent dip in Bitcoin’s price has reminded me of the rollercoaster ride that is cryptocurrency investing – a wild, exhilarating, and unpredictable journey.

Currently, Bitcoin‘s price is significant as it has dropped by approximately 5% from its recent peak of around $66,500. Despite the turbulence in the overall crypto market, investors continue to harbor hope for the coming months. The Federal Reserve’s move to lower interest rates has noticeably enhanced market confidence, sparking anticipation for a robust rebound.

According to information from CryptoQuant, the typical Bitcoin investor has experienced substantial profits so far this year, reinforcing optimistic forecasts. Although there’s been a temporary dip lately, many investors are convinced that Bitcoin’s overall trajectory is upward, with some predicting a possible price spike in the near future.

In light of recent economic shifts, and as we anticipate what’s next, Bitcoin’s price fluctuations could significantly influence the overall market trend over the next few days.

Attentive investors keep a keen watch on Bitcoin’s movements, eagerly anticipating a clear spike indicating an upcoming bull run. The focus is squarely on Bitcoin as it challenges crucial support thresholds, with everyone hopeful for another strong upswing.

Bitcoin Investors Pocket Significant Gains

Bitcoin appears poised to validate a significant uptrend reaching new peaks, as it surpassed the crucial $62,000 mark and benefited from the Federal Reserve’s lowered interest rates. Analysts and investors are growing more hopeful that the recent decline was a beneficial correction, paving the way for an even more powerful increase in the upcoming period.

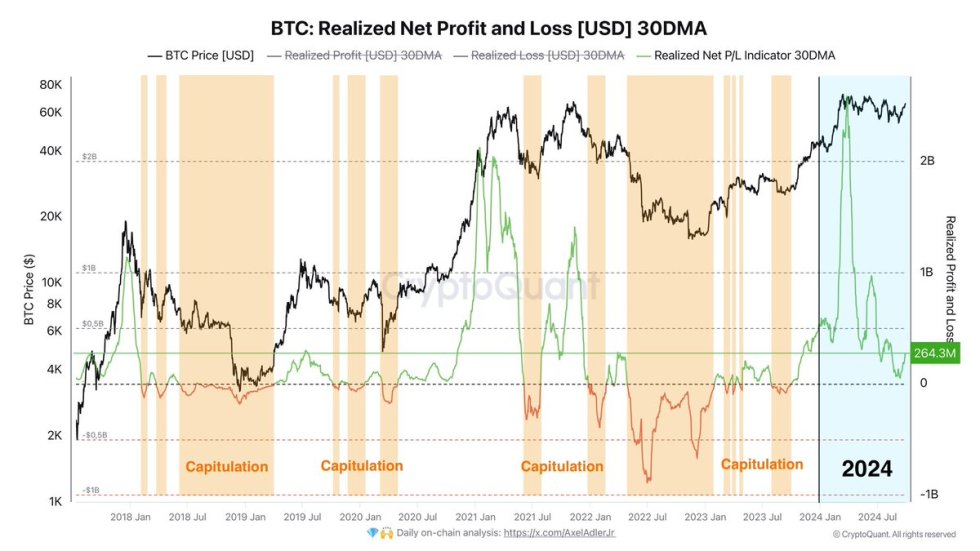

Prominent CryptoQuant analyst Axel Adler shared an insightful report on X, revealing a chart highlighting Bitcoin’s impressive performance this year. Despite facing numerous challenges, including global economic uncertainty, BTC has consistently delivered significant returns to investors.

Based on Adler’s assessment, the market hasn’t fully reached a state of surrender or mass selling, as large-scale profit-taking isn’t prevalent yet. On a daily basis, the average net realized profit is approximately $264 million, which strengthens the optimistic outlook for Bitcoin.

As we near the end of the year, many people think Bitcoin still has great promise to bring significant returns for patient investors. Historically, the fourth quarter is a strong period for the cryptocurrency market, leading some to speculate that Bitcoin’s current growth might push it toward new record-breaking highs. For those seeking long-term profits, the present consolidation could provide a chance to take advantage of the upcoming price surge.

BTC Testing Crucial Liquidity Level

Currently, Bitcoin’s price stands at approximately $63,900, slightly dipping from its recent peak but close to the daily 200 moving average ($63,690). This specific level has been important in the past, signaling a robust market when acting as both strong support and resistance during market fluctuations.

To keep moving upward and strengthen the ongoing upward trend, Bitcoin should stay above its 200 Moving Average (MA) over the next few days. If it manages to finish above this marker, it will suggest a robust market and could pave the way for a possible increase in price, potentially leading to higher values.

If Bitcoin doesn’t manage to surpass its current level, there’s a possibility of a more significant correction. In that case, Bitcoin might retreat to areas with less demand, and the next significant support could be around $60,500. This level is being closely monitored, as it could signal either a path towards new highs or an extended period of price consolidation in the Bitcoin market.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- JST PREDICTION. JST cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

- EUR CAD PREDICTION

- OKB PREDICTION. OKB cryptocurrency

2024-10-02 07:11