As a long-term Bitcoin investor with several years of experience in the market, I find the current trend in Bitcoin’s long-term holder distribution quite intriguing. The data suggesting a similar trend to that seen before the 2021 bull run top is certainly worth paying attention to.

As a crypto investor closely monitoring the market trends, I’ve noticed some intriguing on-chain data suggesting parallels between the current Bitcoin indicator behavior and the one that preceded the peak of the 2021 bull run.

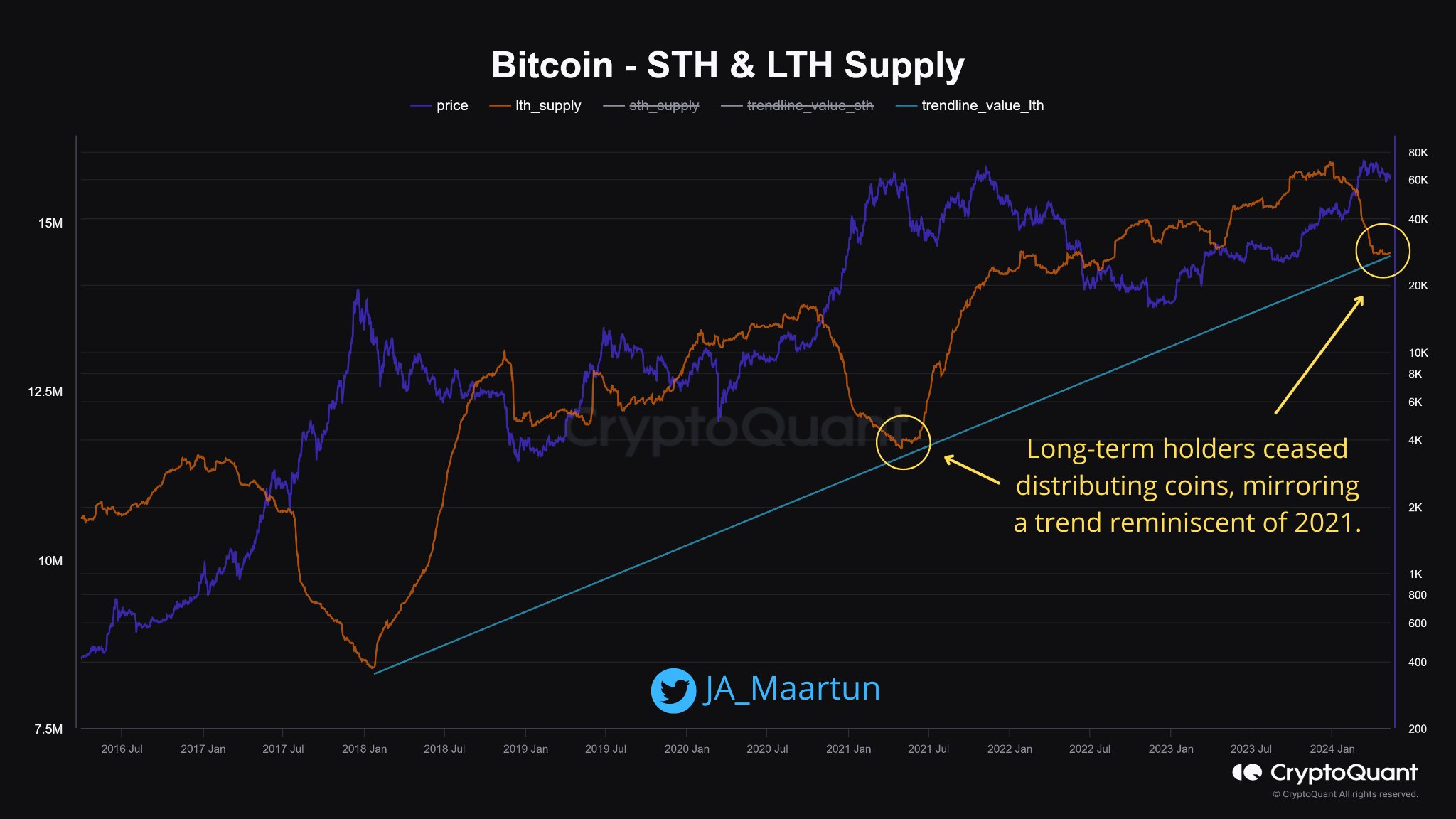

Bitcoin Long-Term Holder Distribution Appears To Be Ending

According to Maartunn, the community manager at CryptoQuant, the behavior of Bitcoin’s long-term investors mirrors the pattern observed in 2021.

As a Bitcoin analyst, I would describe long-term holders (LTHs) as individuals who have kept their Bitcoins stashed away in their digital wallets for over six months without any signs of transaction activity.

As a long-term crypto investor, I can tell you that the longer I hold onto my coins, the less inclined I am to sell or transfer them. Therefore, those of us with extended holding periods are often referred to as “long-term hodlers” or “LTHs.” Our unwavering commitment to keeping our assets in place makes us the steady hands in the market.

Even the most steadfast investors, who typically ignore broader market fluctuations such as rallies or crashes, have been compelled to sell this year due to the significant price surge approaching a new record high (ATH).

As a crypto investor, I’d interpret this chart as follows: Over the past few years, I’ve observed how the amount of Bitcoin stored in long-term holder (LTH) wallets has evolved. This data point can provide valuable insights into the behavior of these investors and their impact on market dynamics.

The graph indicates that Bitcoin long-term holders (LTHs) amassed more coins during the price drop in May 2021 and the subsequent rally. However, as the price surged toward its new all-time high (ATH), the number of these dedicated HODlers has begun to decrease instead.

A noteworthy point is that this indicator imposes a 155-day waiting period before purchases can be made based on its data, with only fully developed inventories being taken into account.

When the metric increases, this doesn’t signify current accumulation but instead indicates that purchases were made 155 days prior, and these coins have only recently met the criteria for being considered long-term holders (LTHs).

When it comes to transactions for selling, there’s no waiting period involved since coins leave the group instantly upon being moved across the network. Consequently, the most recent price drop can be attributed to current market selling activity.

In recent times, the price of Bitcoin has experienced a plateau, leading to a decrease in selling by long-term holders (LTHs). Consequently, the supply has remained relatively stable, as shown in Maartunn’s chart, resembling the trend seen in 2021.

The cessation of Large Token Holders (LTHs) distributing their tokens may indicate a peak in the current cryptocurrency bull market. This pattern was observable during the 2017 bull run as well, implying that the recent stagnation in LTH supply could potentially signal the end of this market uptrend.

If the LTH distribution has indeed come to an end, as indicated by the chart, we observe that large-scale sellers (LTHs) initiated significant selling during the early stages of the previous two bull markets. However, this was followed by a period of more gradual distribution.

As a crypto investor, I’ve noticed that the downtrend in Bitcoin’s long-term holder (LTH) supply has been gradual for several months now. This prolonged decline brought us to the consolidation phase where the asset’s price reached its peak. However, it is still uncertain whether this latest trend shift in LTH supply corresponds to the earlier consolidation phase or the preceding downtrend.

BTC Price

As I analyze the current market situation, Bitcoin hovers near the $62,700 mark with a nearly 2% decrease in value over the last week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- OSMO PREDICTION. OSMO cryptocurrency

2024-05-14 01:57