As a seasoned Bitcoin investor with several years of experience under my belt, I find the recent on-chain data extremely intriguing. According to the analysis by James Van Straten, Bitcoin investor cohorts have been accumulating BTC at an astounding rate that far outpaces the current mining output. This is a clear indication of strong demand for Bitcoin and a bullish sign for its price.

As a researcher studying the Bitcoin market, I’ve noticed an intriguing trend in on-chain data. Specifically, investors have been acquiring Bitcoin at a rate that is approximately five and a half times greater than the current production rate by miners.

Bitcoin Investor Cohorts Have Been Busy Accumulating Recently

In a recent post on X, financial analyst James Van Straten explored the trend of Bitcoin investors amassing holdings and contrasted this with the volume of investments into the latest Bitcoin-linked ETFs.

As a crypto investor, I’m referring to various groups of fellow investors in this context, differentiated by the quantity of cryptocurrencies they possess. However, it’s not about focusing on one specific group at present, rather acknowledging the combined influence and dynamics of all these cohorts as a whole.

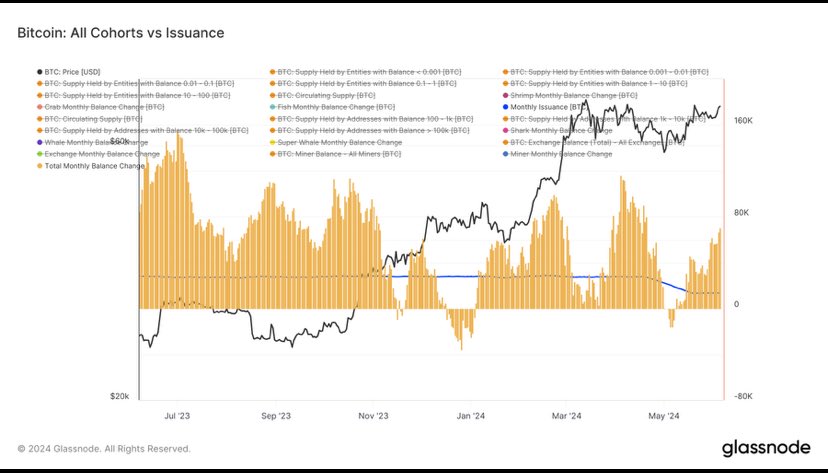

The following chart, provided by Straten, illustrates the recent trends in the inflows of Bitcoin investments into the wallets of investors.

Based on the presented graph, it is evident that Bitcoin investors collectively have been transferring more coins into their wallets than they have been withdrawing, indicating a prevailing trend of accumulation.

An analyst has included the Bitcoin network’s monthly production data in the same graph for your reference. This “Issuance” figure signifies the quantity of new Bitcoins generated each month as a result of miners solving blocks. Consequently, the “Monthly Issuance” represents the total amount produced over the past month.

Based on the graph’s representation, it is clear that Bitcoin investors have more recently acquired larger quantities of Bitcoin than the monthly issuance. In simpler terms, this signifies that investors have been purchasing Bitcoin at a quicker pace than new coins are being mined and released into circulation.

As a researcher studying Bitcoin transactions, I’ve discovered that approximately 71,000 Bitcoins have been purchased by investors within the last thirty days. This is nearly five and a half times the amount of Bitcoin mined during the same timeframe, which was roughly 13,000 Bitcoins.

The graph indicates that over the last 12 months, investors have consistently bought more Bitcoin than miners have produced, with only a few exceptions.

It’s puzzling how investors have acquired more Bitcoin than what’s being produced. Where does this additional Bitcoin come from? The solution lies in exchanges. Exchanges, distinct from groups of investors, serve as the platform where Bitcoin is withdrawn by holders.

In my analysis, I’ve observed a significant downward trend in the Bitcoin Exchange Reserves over an extended period.

With regard to the Bitcoin investment demand versus recent ETF inflows, Straten observed that these investment tools have added approximately $1.4 billion of Bitcoins to their holdings in the latest surge. Conversely, Bitcoin investors’ monthly net accumulation exceeds $5.1 billion.

Despite the significant increase in investments in ETFs, the market’s demand has remained substantial in recent times.

BTC Price

After experiencing a significant increase in value earlier in the week, Bitcoin’s price has since leveled off and remains at approximately $71,000.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-06-08 07:11