According to on-chain analysis, the appetite for Bitcoin among long-term investors (HODLers) now exceeds the rate at which new coins are being released through mining – a significant milestone that has not occurred before.

Bitcoin Demand From Accumulation Addresses Is Higher Than Miner Issuance

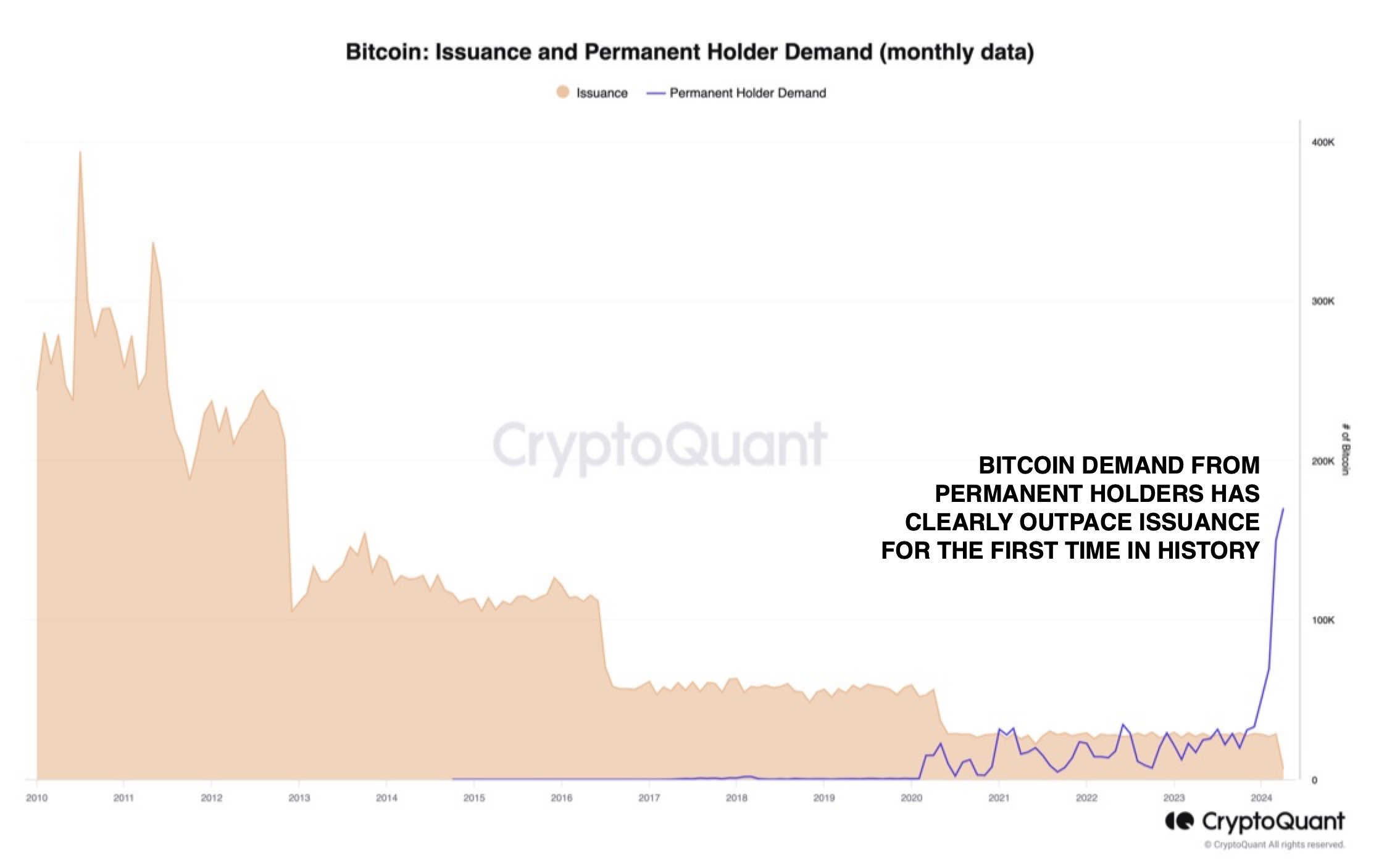

According to Julio Moreno, the head of research at CryptoQuant, there’s been a remarkable increase in the desire for the asset as of late, as depicted in the following chart he posted on X. This chart illustrates the demand coming from the category of long-term investors.

Here, “permanent holders” can be paraphrased as “individuals who own Bitcoin wallets with a record of exclusively purchasing Bitcoins and not selling them.”

These investors are notorious for holding onto their assets rather than selling them. Consequently, any new stock they acquire might become just as hard to sell in the future. Therefore, purchasing from these long-term investors could indicate a bullish trend, implying that the available supply of the asset may decrease.

The chart measures the demand from these HODLers based on the increase in their collective balance. Notably, their purchasing increased substantially in 2020 and has sustained this growth trend through the following years.

Moreno additionally included the “Bitcoin new coin production” figure in the graph. This indicator represents the overall Bitcoin supply generated by miners within the network.

Miners generate Bitcoins by resolving complex mathematical puzzles and are awarded with new Bitcoins as remuneration. These newly minted Bitcoins represent the sole method for expanding the existing Bitcoin market supply.

According to the graph, there are periods of a few years where the issuance rate stays relatively stable. However, between these periods, there are sudden drops in value, which can be attributed to the halving events.

On the Bitcoin network, every few years there’s an automatic process called halving. During this event, the reward for creating a new block gets reduced by half. The next halving is expected to happen within the next ten days.

According to the chart, the demand from accumulation addresses began increasing significantly in 2020; however, it never surpassed the rate at which miners were issuing new cryptocurrencies.

Lately, the increase in accumulated addresses has seen exponential growth. Not only does this number exceed the new coins being released, but it significantly outvalues it as well.

In simpler terms, the number of Bitcoin holders acquiring more than what miners are producing indicates robust demand for Bitcoin. CryptoQuant’s CEO emphasizes that this is merely a segment of the overall network demand, revealing the significant buying interest in Bitcoin over the recent period.

The increasing interest in Bitcoin can be attributed to the introduction of Bitcoin spot ETFs, which offer a more conventional investment avenue for those who prefer the traditional exchange-traded fund structure.

BTC Price

At the time of writing, Bitcoin is trading at around $68,400, up more than 4% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD CLP PREDICTION

- RBX PREDICTION. RBX cryptocurrency

- USDV PREDICTION. USDV cryptocurrency

2024-04-10 05:11