As a seasoned crypto investor with a knack for recognizing market trends and patterns, I find myself optimistic about Bitcoin’s current position at $66,800. The robust demand, as evidenced by the increased trading volume, coupled with the strong support level we’re seeing, paints a bullish picture for BTC.

Right now, Bitcoin is being bought and sold at approximately 66,800 dollars following a week filled with considerable price fluctuations. The cost has held steady above the important 65,000 dollar support point, indicating strength as the market experiences a pause after numerous weeks of intense enthusiasm. This period of stability below the significant 70,000 dollar mark indicates that Bitcoin might be gearing up for its next major price shift.

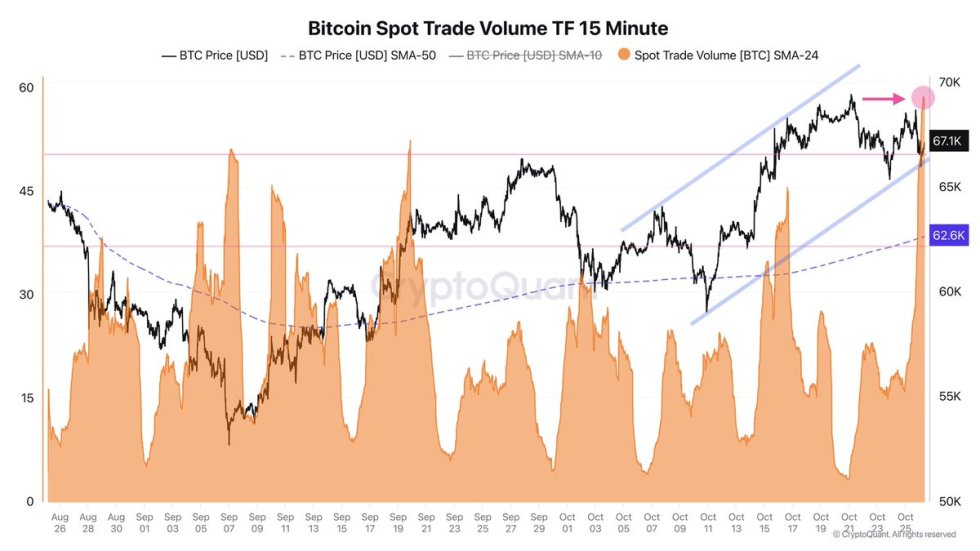

According to CryptoQuant, Bitcoin’s demand remains high, even though its momentum seems to be slowing down. This strong demand is a good sign, indicating that investors are buying Bitcoin now, hoping for more price increases in the future. In essence, analysts believe this data suggests that Bitcoin could surge once market conditions become favorable.

Over the last 24 hours, the typical trade volume per 15-minute period has been approximately 60 Bitcoins, setting a recent two-month peak. This significant surge in trading activity suggests heightened engagement and growing curiosity about the current price range, bolstering the possibility of an imminent breakout.

As Bitcoin continues to stay within its current price range, the significant barrier at $70,000 remains crucial. Overcoming this hurdle would likely spark increased interest from buyers and mark the start of a longer-lasting upward trend. Given the present market dynamics, it’s possible that BTC could leverage this momentum to reach new record highs.

Bitcoin Trading Volume Indicates Strong Demand

From my perspective as an analyst, I’m observing Bitcoin displaying resilience with a bullish outlook. The spot trading volume has surged to levels not seen in about two months, which is quite significant. Notably, top analyst and investor Axel Adler has provided crucial insights on this matter. He revealed that the average trading volume per 15-minute interval over the past 24 hours was approximately 60 Bitcoins, reaching a local high. This spike in trading activity suggests a robust demand, implying strong interest in Bitcoin despite recent market difficulties.

The increase in trading activity follows the apprehension caused by Friday’s USDT situation, potentially leading to selling or hesitation among individual investors. Yet, the escalated volume might indicate that experienced investors, often known as “smart money,” are actively purchasing Bitcoin at its current prices. This accumulation stage usually signals a larger price change, as these high-volume buyers tend to position themselves before substantial price fluctuations.

Experts view this surge in trading activity as an indicator that Bitcoin might be at a crucial stage, boosting optimism throughout the market. If the volume stays high, it could ignite further growth and potentially enable Bitcoin to surpass obstacles in its path, such as resistance levels, within a short period. The intense interest in Bitcoin under the present circumstances hints that another surge, possibly toward $70,000, might be imminent if key resistance levels are broken.

If the volume continues at these high levels, Bitcoin might validate its bullish signs and move towards record-breaking heights. This momentum could be fueled by a strong base of strategic buying and restored faith among investors.

BTC Support Holding Strong

At present, Bitcoin is maintaining its position above $66,000, following a period of market turbulence. This price point, which is a significant area of liquidity, previously acted as a barrier for Bitcoin in late September but has now transformed into support. This shift suggests that Bitcoin’s trend may be strengthening. If Bitcoin continues to hold its ground above this critical level, it seems more probable that we will witness fresh record highs, given the growing buying momentum and renewed market confidence.

If Bitcoin (BTC) dips beneath $65,000, there’s a chance it may move sideways for a while as it searches for more buying power. This period of stagnation could act as a reset, allowing both bulls and bears to adjust their strategies. To preserve the bullish outlook, Bitcoin must maintain its position above the 200-day moving average (MA), which stands at $63,250 at present. This significant MA level is closely monitored by market participants, as a fall below it might change sentiment and trigger bearish tendencies.

For a while, keeping Bitcoin’s price above $66,000 might serve as the trigger for further growth, possibly pushing it towards testing significant resistance levels on its journey towards fresh record-highs.

Read More

- XRP PREDICTION. XRP cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- EUR MYR PREDICTION

- USD MXN PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- EUR CAD PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- GBP RUB PREDICTION

- USD BRL PREDICTION

2024-10-27 17:42