As a seasoned analyst with over two decades of experience navigating volatile financial markets, I have witnessed my fair share of bull and bear runs. The current state of Bitcoin is reminiscent of a rollercoaster ride that keeps me on the edge of my seat.

Recently, Bitcoin‘s behavior has been erratic and fluctuating significantly. Its price movements have challenged both psychological and technical barriers. However, despite not being able to surpass the highly desired $100,000 threshold, it has maintained its position strongly above $90,000. This narrow band of movement has kept traders and investors on tenterhooks, eagerly awaiting a clear signal.

Despite the market’s instability, there’s an extraordinary surge of interest in cryptocurrencies overall, suggesting a positive trend that may prolong the “Bitcoin celebration” for several more months.

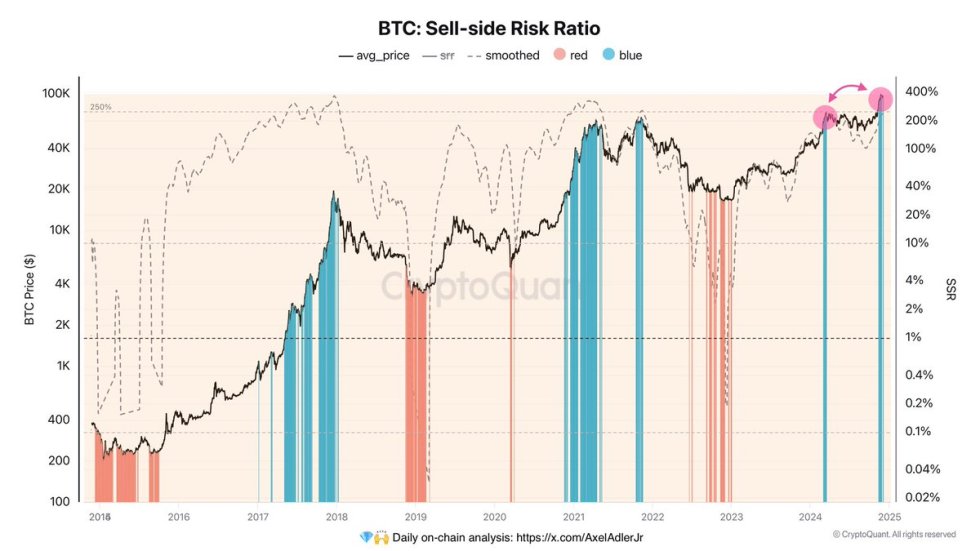

As a crypto investor, I’m constantly monitoring market trends, and lately, I’ve been keeping a close eye on data from CryptoQuant. It appears that there might be heightened risks of coin sell-offs by current holders, which could potentially pose challenges ahead. Despite the growing demand that seems to be propelling the market forward, these indications suggest potential obstacles in our path.

As Bitcoin gathers strength, it seems ready for its significant next step. Whether Bitcoin can surpass $100,000 or experience a more substantial drop below $90,000 will hinge on how the current trends unfold. The upcoming weeks are crucial as investors and traders navigate this volatile period and evaluate Bitcoin’s potential to steer the market towards new records.

Bitcoin Showing Selling Signals: What’s Different This Time?

Since November 5, Bitcoin has been on an impressive climb, gaining around 50% as it neared significant milestones like the $100K mark. However, following this significant surge, BTC experienced a dip of approximately 8%, probing crucial support levels. Yet, even with this temporary setback, the price continues to show robust strength, underpinned by a growing number of new market participants.

As per CryptoQuant analyst Axel Adler’s analysis, there’s a significant chance that some coin holders might decide to sell, especially those who have a long-term investment strategy. However, it’s important to note that the current market dynamics differ from the ones experienced in March.

During that period, the selling by long-term investors overpowered the demand, leading Bitcoin’s price to drop. Contrastingly, today, the interest from new investors is efficiently counteracting the sales of long-term holders, reducing pressure for a decline and supporting the ongoing upward trend.

It appears this information indicates that Bitcoin (BTC) might continue its upward trajectory, with experts predicting it could reach between $100,000 and $110,000 in the near future. However, as prices climb higher, there’s an increasing chance of increased selling activity, which could potentially lead to a major price drop.

During this current phase, it’s not a matter of whether but when Bitcoin might experience its first significant downturn. The blend of intense interest and growing urge among investors to liquidate their holdings is likely to lead to a substantial correction. This correction could present itself as an opportunity for those aiming to profit from Bitcoin’s future prospects. Keeping an eye on how demand manages these sell-offs will be crucial.

Testing Demand Before A Breakout

At present, Bitcoin is attempting to maintain its position near the crucial support point of approximately $95,000. If this level can be sustained in the upcoming days, it might pave the way for Bitcoin’s price to potentially reach $100,000. This particular price point has shown significance for temporary resilience, and if it manages to hold, Bitcoin could surge past $100,000, indicating a possible continuation of the bullish momentum.

On the 4-hour chart, the $95,000 mark plays a significant role as a support level. If Bitcoin manages to maintain this price point, it indicates there’s enough buying interest to drive Bitcoin towards new record highs. Conversely, if Bitcoin can’t hold onto this level, it might face more downward pressure, possibly testing demand at around $90,700 or even $87,602. This lower price range coincides with the 4-hour 200 exponential moving average (EMA), a valuable technical indicator that frequently signals potential support zones during market corrections.

Over the coming hours, the focus will be intensely on the $95,000 support level. If Bitcoin falls below this point, it could signal a shift towards a downtrend. Conversely, if it manages to maintain its position above $95,000, it might propel Bitcoin towards breaking the $100,000 barrier and continuing its strong upward trajectory. The price movements around $95,000 will be crucial in predicting Bitcoin’s next direction.

Read More

- Marvel Rivals Announces Balancing Changes in Season 1

- “Fully Playable” Shenmue PS2 Port Was Developed By SEGA

- Marvel Rivals Can Earn a Free Skin for Invisible Woman

- EUR CAD PREDICTION

- What Borderlands 4 Being ‘Borderlands 4’ Suggests About the Game

- DMTR PREDICTION. DMTR cryptocurrency

- Elden Ring Player Discovers Hidden Scadutree Detail on Second Playthrough

- Valve Announces SteamOS Is Available For Third-Party Devices

- Christmas Is Over: Bitcoin (BTC) Loses $2 Trillion Market Cap

- Kinnikuman Perfect Origin Arc Season 2 New Trailer and Release Date

2024-12-02 19:42