On January 4, 2025, Bitcoin’s immediate price was around $91,219, but the market for Bitcoin futures and options suggests traders aren’t getting nervous. Instead, they’re continuing to invest, with a high level of open interest and a lot of contracts focused on specific price points.

Bitcoin Derivatives Positioning Tightens Ahead of Major Options Expiries

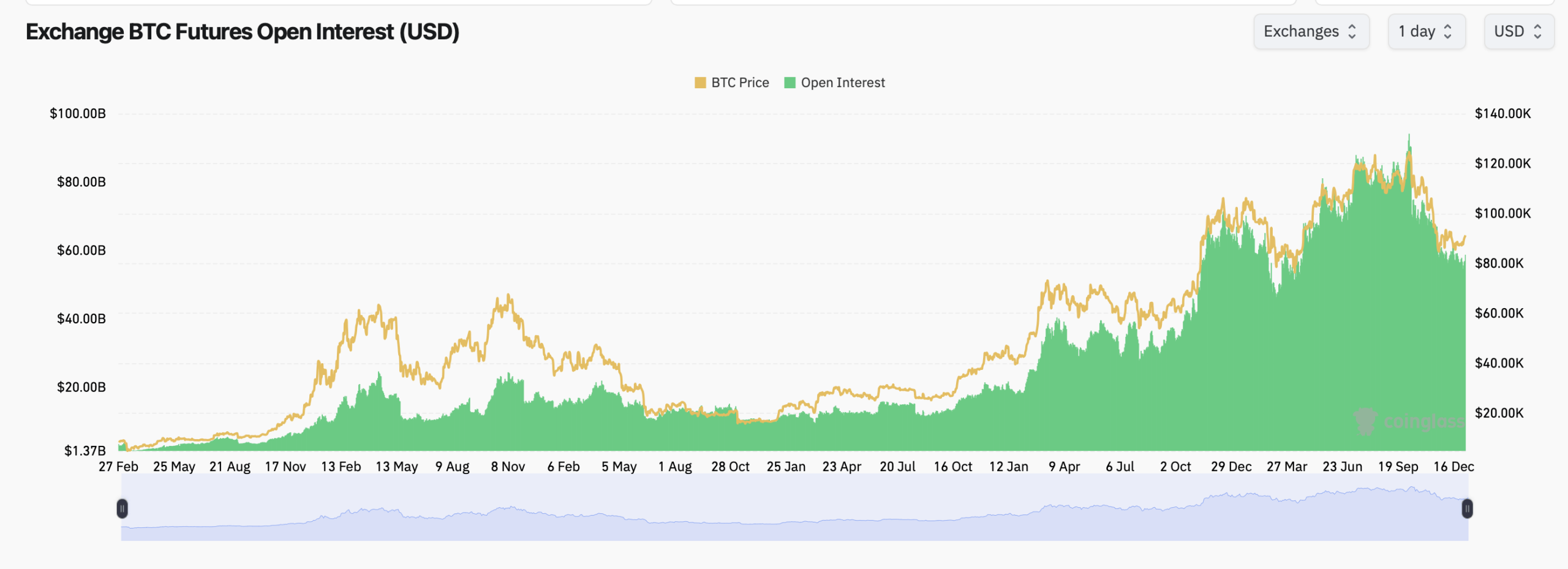

Coinglass stats show aggregate bitcoin futures open interest sits at $58.74 billion, representing 643,670 BTC in outstanding contracts. Over the past 24 hours, total open interest climbed 3.99%, suggesting fresh positioning rather than a quiet unwind. Short-term changes remain modest, indicating traders are adding exposure with measured intent rather than panic.

Binance is currently the leading platform for futures trading, with $11.90 billion in open interest – over 20% of the total market. CME comes in second at $9.80 billion, remaining a popular choice for institutional investors. Bybit and Gate both have over $5 billion in open interest, and OKX completes the top five with $3.64 billion.

Recent trading activity in futures markets is sending mixed signals. While the CME exchange saw a small decrease in activity over the last four hours, Binance and OKX also experienced slight declines. However, Bybit, Gate, and MEXC all saw more significant increases over the past 24 hours, suggesting that traders are shifting their focus to these platforms instead of exiting the market completely.

The longer-term futures data points to just how elevated positioning has become. Bitcoin futures open interest has expanded dramatically since mid-2024, tracking price higher while remaining historically elevated even during recent consolidations. That persistence suggests leverage has not been meaningfully flushed out, keeping the market sensitive to sharp price moves in either direction.

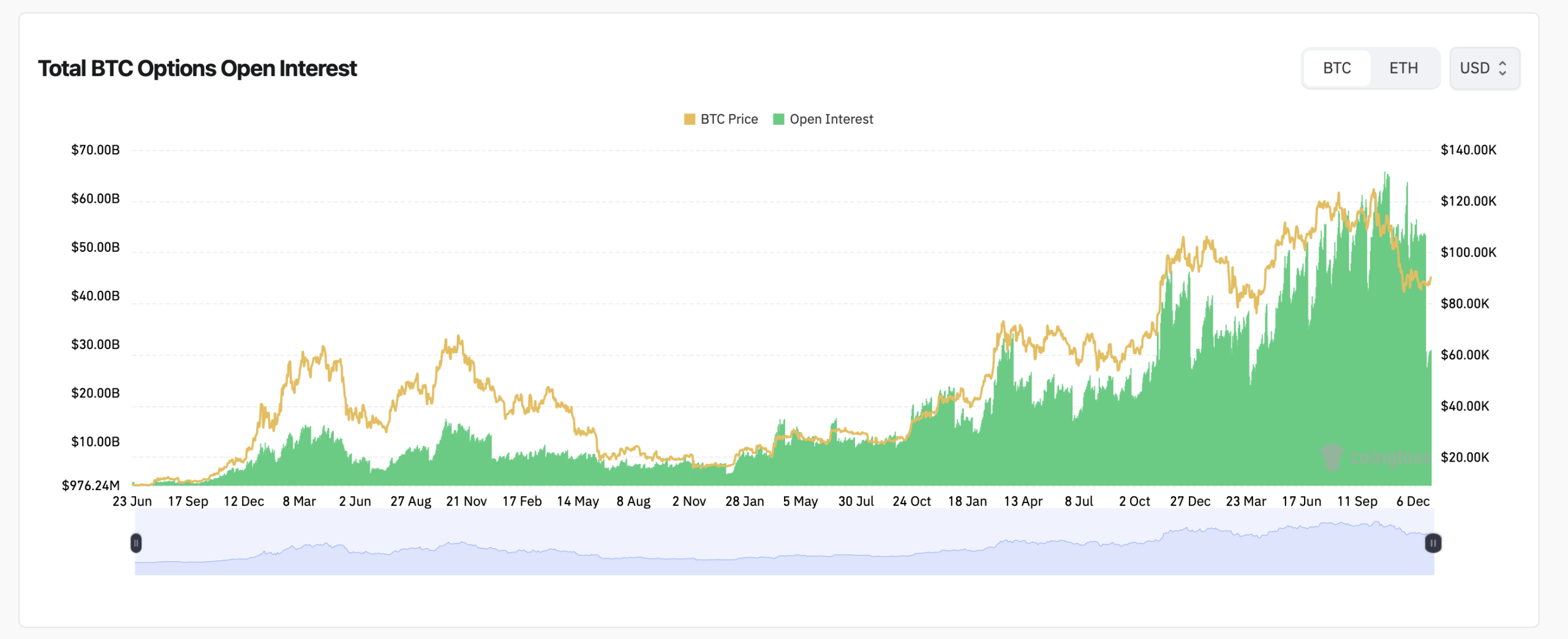

Options markets tell a similarly crowded story. Total bitcoin options open interest continues to climb, with calls dominating positioning. Calls represent 56.88% of open interest at 172,616 BTC, while puts account for 43.12%, or 130,848 BTC. Volume over the past 24 hours mirrors that skew, with call contracts once again outpacing puts.

Deribit remains the center of gravity for options activity. The largest open interest sits in the BTC-30JAN26-100000-C contract, holding 8,806 BTC, followed by heavy positioning in January and March expiries spanning strikes between $80,000 and $110,000. Volume data shows traders actively rotating through near-term January strikes, including both puts and calls, rather than abandoning exposure.

Max pain levels across major options venues cluster notably below the current spot. On Deribit, max pain trends near the $90,000 region for several upcoming expirations, while Binance and OKX display similar profiles. In each case, the largest notional concentrations sit just beneath the current price, creating a gravitational zone where options writers would face minimal payout.

The stacked expiration profile reinforces that theme. January and March expiries carry the heaviest notional weight, with visible bulges in open interest around late January and late March dates. That structure suggests traders are bracing for volatility without committing to a single near-term directional bet.

Taken together, bitcoin’s derivatives market looks crowded but composed. Futures traders continue to add exposure incrementally, while options players remain tilted toward upside participation, albeit with clear hedging below spot. With open interest still elevated and max pain lurking under $91,000, the next decisive move may be less about conviction and more about who blinks first.

FAQ ❓

- What is bitcoin futures open interest right now?

- Bitcoin futures open interest stands at approximately $58.74 billion, representing over 643,000 BTC in outstanding contracts.

- Which exchange leads bitcoin futures positioning?

- Binance holds the largest share by notional value, followed closely by CME and Bybit.

- Are bitcoin options traders leaning bullish or bearish?

- Options data shows a call-heavy structure, with calls making up nearly 57% of total open interest.

- Where are max pain levels across major options venues?

- Max pain levels on Binance, OKX, and Deribit cluster near the $90,000 price zone.

Read More

- All Carcadia Burn ECHO Log Locations in Borderlands 4

- Enshrouded: Giant Critter Scales Location

- Best Finishers In WWE 2K25

- Best ARs in BF6

- Top 10 Must-Watch Isekai Anime on Crunchyroll Revealed!

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- All Shrine Climb Locations in Ghost of Yotei

- Top 8 UFC 5 Perks Every Fighter Should Use

- Keeping Agents in Check: A New Framework for Safe Multi-Agent Systems

- Scopper’s Observation Haki Outshines Shanks’ Future Sight!

2026-01-04 22:23