As a seasoned researcher who has navigated through the tumultuous seas of cryptocurrency markets for over a decade now, I find it fascinating to delve into the intricacies of Bitcoin’s long-term holder dynamics. The fact that nearly one-third of the Bitcoin supply hasn’t been moved in more than five years is indeed a testament to the unwavering resilience and conviction of these diamond hands.

The data indicates that a significant portion of Bitcoin, approximately one-third, has remained static in the hands of long-term holders over the past five years.

Bitcoin Has A Notable Part Of Its Supply Dormant Since Over Five Years

On their latest update on X, the market analysis platform IntoTheBlock delves into the recent activity surrounding the oldest Bitcoin supply. Specifically, they focus on the Unspent Transaction Outputs (UTXOs) that are more than five years old.

To put it simply, this stockpile consists of coins that investors have kept for over five years, meaning they haven’t sold or transferred them out of their digital wallets.

Investors who possess cryptocurrency for over 155 days are commonly referred to as “Long-Term Holders” (LTHs). Consequently, this five-year-old supply would be attributed to the holdings of these seasoned long-term holders.

Investors who hold onto their assets for a longer period tend to be less inclined to sell them at any given time. Consequently, long-term holders (LTHs) are often viewed as the steadfast part of the market. The LTHs who have been dormant since over five years ago would then undoubtedly be considered the most resilient among the resilient – the ‘diamond hands’ among the ‘diamond hands’.

It’s important to understand that not all of this supply could be a sign of HODLing. Over time, some tokens might have been lost due to being forgotten or the access to their keys becoming unavailable.

Therefore, since some of the supply in question is more than five years old, there’s a good chance that portion will never re-enter circulation again. On the other hand, the remaining part has likely reached this stage due to its longevity or durability.

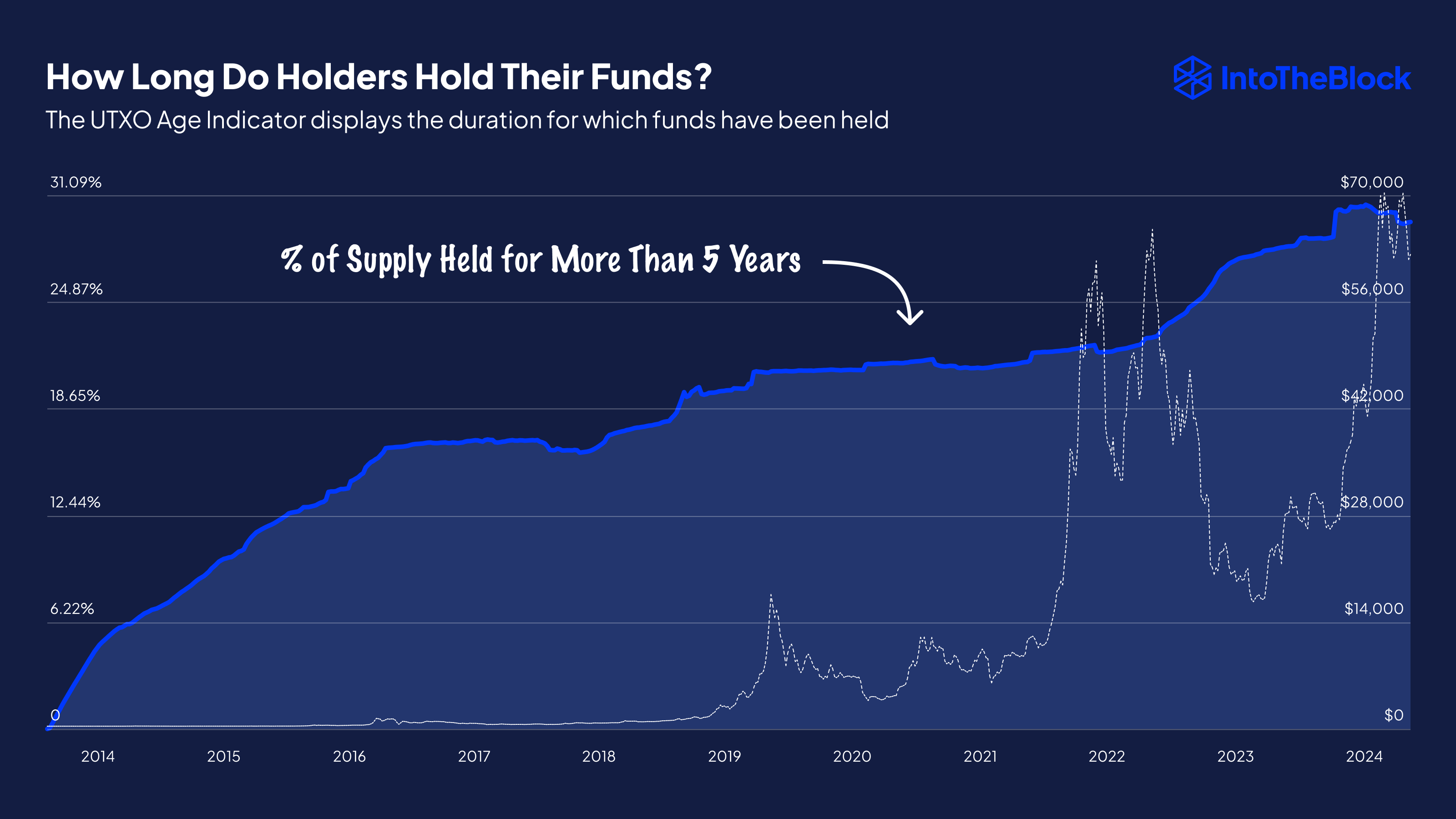

Here’s a chart illustrating how the proportion of Bitcoins in this age group has evolved throughout the history of cryptocurrency.

From the provided graph, it’s clear that the supply of Bitcoins held by long-term investors (LTH) for more than 5 years showed a decrease earlier in the year. This drop occurred as some veteran investors cashed out their earnings from the rally. However, this decrease was minimal, and since then, this indicator has been trending horizontally, indicating stability.

Currently, the metric is at 30.7%. This indicates that around one-third of all the existing cryptocurrency has not been transferred for over five years.

From a different viewpoint, the five-year limit sets the latest purchasing opportunity for these coins to August 2019. Consequently, these investors have weathered through the COVID-19 crash, the 2021 market surge, the 2022 market downturn, and now, the ongoing rally that started in 2023.

Under such robustness, it’s highly improbable that the majority of these investors would offload their Bitcoins except for unusually favorable conditions.

BTC Price

Over the past day, Bitcoin experienced a drop of nearly 4%, causing its current value to be approximately $58,100.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- SBR PREDICTION. SBR cryptocurrency

2024-08-31 02:42