Right then, settle in for the US Morning Crypto News Briefing—the only rundown you’ll need, mostly because it’s the only one I’m writing today. ☕

Grab a Pan Galactic Gargle Blaster…or, fine, coffee ☕…and brace yourselves as we plunge headfirst into the financial markets. It seems a broader global risk-off shift might be brewing, like a particularly nasty cup of tea. Asia and the West are tightening their monetary belts, which is never a good sign for anyone’s intergalactic travel budget.

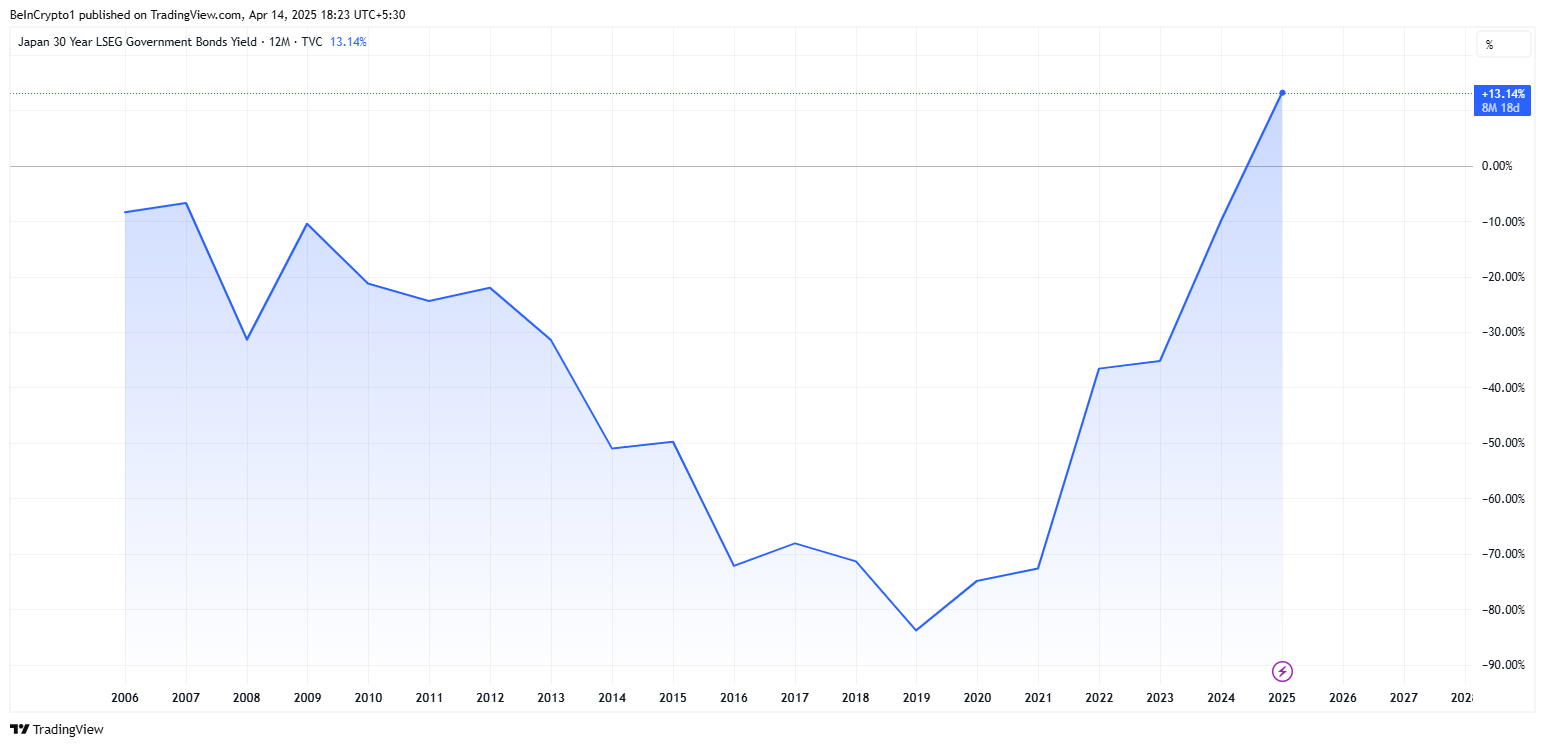

Japan’s 30-Year Bond Yield: Higher Than My Tolerance for Bureaucracy! 🤯

Yes, you read that right. Japan’s 30-year bond yield has galloped to the highest level in 20 years. Apparently, this is big US crypto news today. Specifically, it’s leaped a whole 12 basis points (bps) to a dizzying 2.345%, the highest since 2004. This, according to people who know about these things, signals “deepening stress” in global fixed-income markets. I suspect that’s code for “hide under the duvet”.

And guess what? It’s bearish on Bitcoin (BTC) and other risk-on assets. Agne Linge, director of growth at WeFi, a decentralized on-chain bank (whatever that is), agrees that these bond yields are like a Vogon constructor fleet for crypto in the short term. 🚧

In an email to BeInCrypto (which, let’s face it, sounds like a cry for help), Linge suggested a major shift might be lurking in the pipelines for all those lovely risk assets. She blamed good ol’ macroeconomic trends in Japan, as they relate to the surging 30-year bond yield.

“With the bond yield jumping 2.345% to its highest level in 30 years, more risk-averse institutional investors might shun Bitcoin and other speculative assets,” Linge declared. Because nothing says “stability” like a cryptocurrency based on algorithms and hope. ✨

As Japan’s long-term bond yields go all space-hopper on us, the Bank of Japan (BoJ) is feeling the heat to respond with a possible interest rate hike. Analysts (who are often wrong, but we humor them anyway) say this could happen as early as the end of April.

If the BoJ actually tightens policy, it would be a significant shift for a central bank that has been maintaining ultra-loose monetary conditions for decades. It’s like a sloth suddenly deciding to enter a marathon. 🦥

“If this forecast plays out as expected, it might lead to dried-up liquidity in the traditional financial market. Since crypto thrives more on excess monetary liquidity, this could also influence the performance of the asset shortly,” she added. In other words, if the money tap gets turned off, things could get a bit…parched. 🏜️

Linge cited the yen carry trade as one of the risk mechanisms. This, apparently, is where global investors borrow yen at ridiculously low interest rates to invest in higher-yielding assets abroad. It’s like robbing a bank to buy a slightly better sandwich. This trade thrives when Japanese rates are low and the international risk appetite is strong. (Narrator: The international risk appetite was about to order a stiff drink).

What Does It Mean for Bitcoin? (Besides Existential Dread) 🤔

As Japanese yields rise and the BoJ rate hike looms like a Vogon constructor ship, the incentive to borrow yen diminishes. This could lead to an unwinding of the carry trade, potentially draining liquidity from global markets. Think of it as the universe running out of towels. 🌌

Such an outcome would amplify downside risk for crypto and other risk assets, aligning with BeInCrypto’s report that Bitcoin’s price is at risk. It’s like finding out your spaceship has a slight dent just before entering hyperspace. 🚀

“The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind,” said Michael A. Gayed, some award-winning portfolio manager. In other words, the free lunch has been revoked. 🍽️

Meanwhile, the Federal Reserve (Fed) is facing increasing pressure to cut interest rates. Consumer inflation data from the US CPI and PPI (Consumer Price Index and Producer Price Index, respectively) support this push. Linge observes that dovish signals in the US could partially offset this emerging hawkish stance from Japan. It’s like a cosmic tug-of-war, only with more money at stake. 💰

“Since the US is a bigger market, the world may respond more toward the country’s monetary policies than Japan,” Linge added. Basically, America shouts louder. 📢

The Fed’s move to ease monetary conditions while Japan tightens could create a mixed global liquidity environment. This could spur volatility as investors reassess cross-border capital flows. In short, chaos. Utter, glorious chaos. 💥

Nonetheless, the yen carry trade remains especially vulnerable to the BoJ’s decisively hawkish shift. This could trigger a repricing of risk globally, curbing speculative flows and weakening the liquidity backdrop that crypto markets have benefited from in recent years. So, you know, buckle up. 🎢

Amidst these concerns, however, traders and analysts remain optimistic. Analysts at Deribit recently observed that markets switched from capitulation to aggressive bounce. Or, as I like to call it, the “oh dear god, we’re all doomed…wait, maybe not!” phase.

“Protective/Bear play BTC 75-78k Puts were dumped, and 85-100k Calls were lifted as BTC surged from 75-85k,” they wrote. Which, translated into plain English, means some people are betting Bitcoin might actually do alright. Or they’re just very, very confused. 🤔

Deribit data corroborates this observation, showing the $100,000 call strike price was the most popular call option as of this writing, recording the highest open interest. This suggests bets that Bitcoin could draw toward this psychological milestone. Or, you know, maybe everyone just really likes round numbers. 🎱

Chart of the Day (Because Why Not?) 📊

Crypto Equities Pre-Market Overview (For Those Who Haven’t Already Fled the Planet) 👽

| Company | At Close April 11 | Pre-Market Overview |

| Strategy (MSTR) | $299.98 | $312.00 (+4.00%) |

| Coinbase Global (COIN) | $175.50 | $180.42 (+2.80%) |

| Galaxy Digital Holdings (GLXY) | $15.28 | $15.30 (+0.13) |

| MARA Holdings (MARA) | $12.51 | $13.03 (+4.16) |

| Riot Platforms (RIOT) | $7.06 | $7.06 (+3.97%) |

| Core Scientific (CORZ) | $7.07 | $7.26 (+2.69%) |

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- REPO: How To Fix Client Timeout

- How to Unlock the Mines in Cookie Run: Kingdom

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

2025-04-14 17:03