As an analyst with over two decades of experience in the financial industry, I have seen markets rise and fall, trends come and go, and technologies disrupt entire sectors. The recent surge in institutional investment in Bitcoin ETFs is nothing short of remarkable. With my eyes on the charts and fingers on the pulse of the market, it’s clear that this isn’t just a fad or a flash in the pan – it’s a sea change, a paradigm shift, a tectonic movement in the world of finance.

Investment in Bitcoin ETFs by institutions saw a significant surge of 27% during the second quarter of 2024, which underscores an increasing trust among institutional investors in the digital currency market. This rise indicates a growing confidence.

According to data from K33 Research, a staggering 260 additional companies entered the U.S. market for Spot Bitcoin Exchange-Traded Funds (ETFs) by the end of June, bringing the total number of professional firms managing these ETFs to an impressive 1,199.

Retail Vs. Institutional Investors

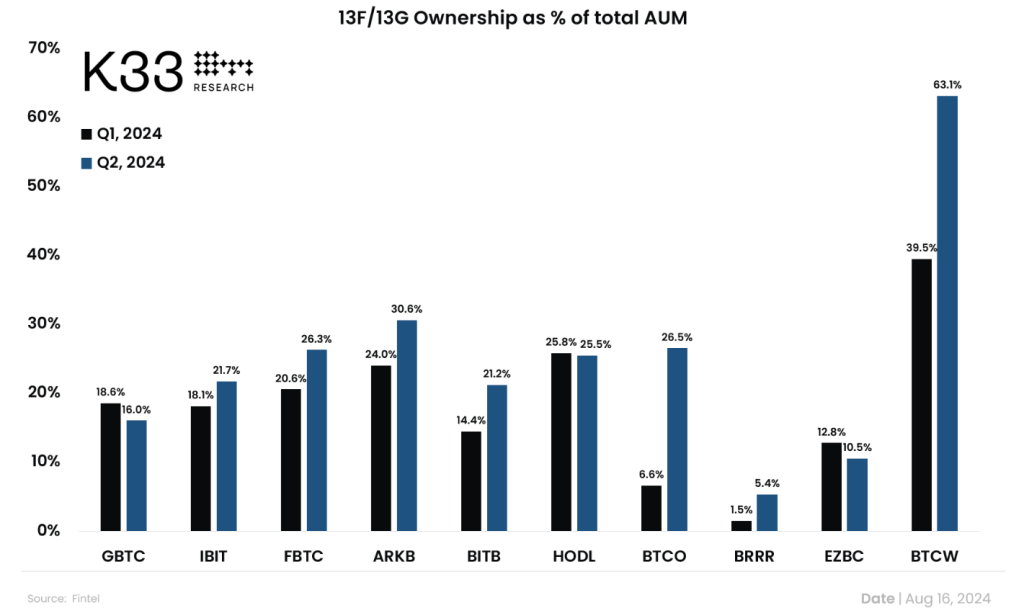

While there’s a significant level of institutional interest, it’s individual investors who hold the majority of Bitcoin ETFs. In fact, institutional ownership climbed to 21% of total Assets Under Management (AUM) in June, rising from 18% in Q1. This trend suggests that retail investors continue to dominate the market, despite institutions making strides.

Institutional ownership of BTC ETFs grew solidly in Q2!

Based on data from 13F filings, it was found that a total of 1,199 institutional investors owned shares in U.S. exchange-traded funds focusing on spot markets as of June 30. This represented an uptick of 262 institutions compared to the previous quarter.

While retail investors still hold the majority of the float,…

— Vetle Lunde (@VetleLunde) August 16, 2024

As a crypto investor, I’m excited to see established firms like Goldman Sachs and Morgan Stanley significantly investing in Bitcoin ETFs. For example, Goldman Sachs alone holds approximately 7 million shares, which equates to around $418 million, while Morgan Stanley has amassed 5.5 million shares worth roughly $190 million. This trend underscores the growing recognition and acceptance of digital assets in traditional financial circles.

Slumping Bitcoin Price Against Soaring Adoption

As an analyst, I’ve noticed that despite growing institutional endorsement, the value of Bitcoin has failed to keep pace, currently hovering around $59,190, struggling to surpass the $60,000 mark as of August 17.

One possible explanation for the current price standstill might be reduced ETF investments, which are currently below the usual level. For instance, on August 15th, ETF inflows amounted to only $11 million, a slight improvement from an $81 million outflow the day before. As long-term investors resume buying, they could potentially cause pricing issues that disrupt market dynamics.

The Road Ahead

Moving forward, the key to a new direction for Bitcoin and the broader cryptocurrency market might lie in increasing institutional adoption. The influx of $4.7 billion into spot Bitcoin ETFs during Q2 could indicate that major financial institutions are finally recognizing Bitcoin as a distinct asset class rather than merely a tool for speculation.

Instead, let’s focus on the significant factor influencing Bitcoin: its sustained rise above the $60,000 mark. Analysts are keeping a close eye on potential resistance levels, particularly at $61,700 and $59,000. If the price manages to surpass these two levels, it could spark a chain reaction of short position liquidations, potentially pushing prices even higher.

Price Status

Bitcoin Exchange-Traded Funds (ETFs) have shown some instability despite growing institutional interest. The fate of Bitcoin is ultimately dependent on this delicate balance between institutional and individual investors. This balance could dramatically shift, paving the way for broader acceptance and integration of cryptocurrencies into investment portfolios as traditional finance embraces digital assets.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- Kaspa Price Analysis: Navigating The Roadmap To $0.2

2024-08-17 23:12