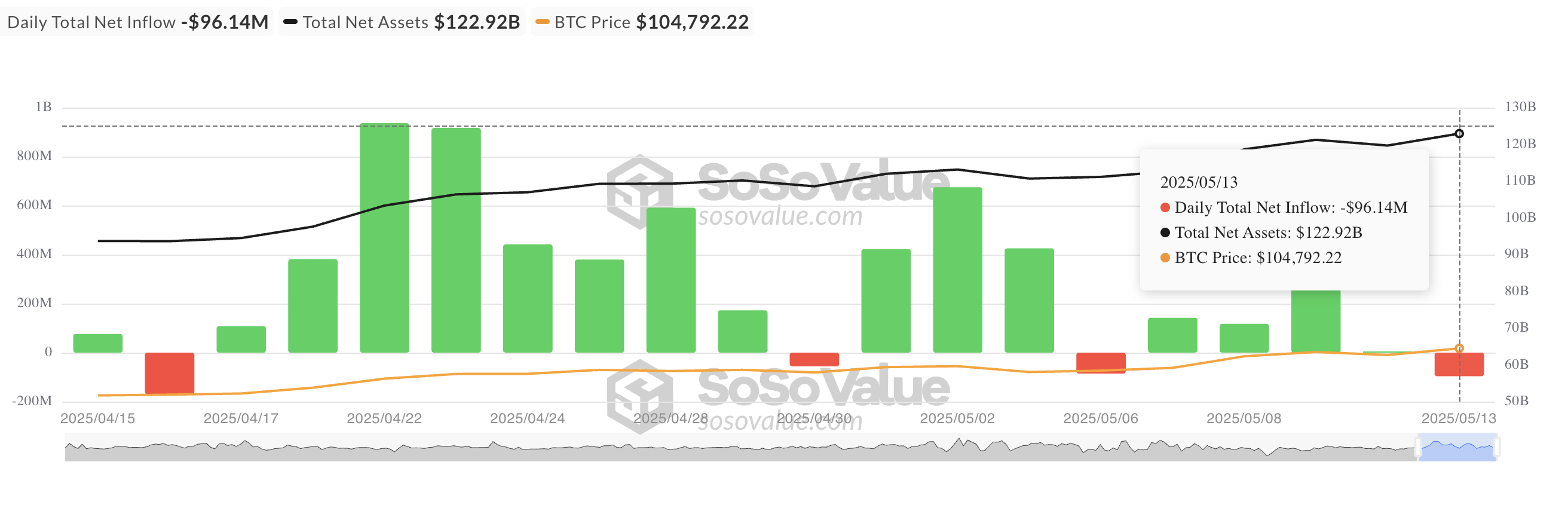

Tuesday: the day all twelve Bitcoin Spot ETFs decided en masse to throw their toys out the pram, recording a glamorous collective net outflow of $96.14 million—while not a single soul bothered to throw money back in. The ETFs stood there, hat in hand, ignored by even the most dedicated penny pinchers.

Apparently, the universe had a “mild pullback” on the menu, nudging Bitcoin’s price down to a tragic, Dickensian low of $101,429. That’s right, absolutely dire—somewhere out there, Scrooge McDuck updated his resume.

Bitcoin ETFs: Outflow Olympics Edition 🏅

Tuesday’s exodus saw Bitcoin-backed ETFs channel the spirit of “everybody out of the pool!”—losing $96.14 million, their greatest escape act since April 16. As crypto markets shrugged and BTC slid moodily to that humble $101,429, Wall Street’s finest apparently stared slack-jawed at their screens and reconsidered life choices.

Institutional investors had previously been waiting to see if Bitcoin might defy gravity and pop over $105,000—possibly assuming US-China trade relations might unironically matter for a decentralized coin invented by a pseudonymous entity with a cartoon avatar.

The most spectacular “nope” came courtesy of Fidelity’s FBTC, which led the exit with a $91.39 million vanishing act. That’s a lot of zeroes, though it’s still worth remembering that their all-time net inflow sits at $11.61 billion: essentially meaning that Fidelity lost less than the change under their regulatory couch cushions.

Twelve BTC ETFs, zero inflows, one vibe: caution, tinged with existential boredom.

BTC Derivatives: Still Dreaming Big (on 1%) 🚀

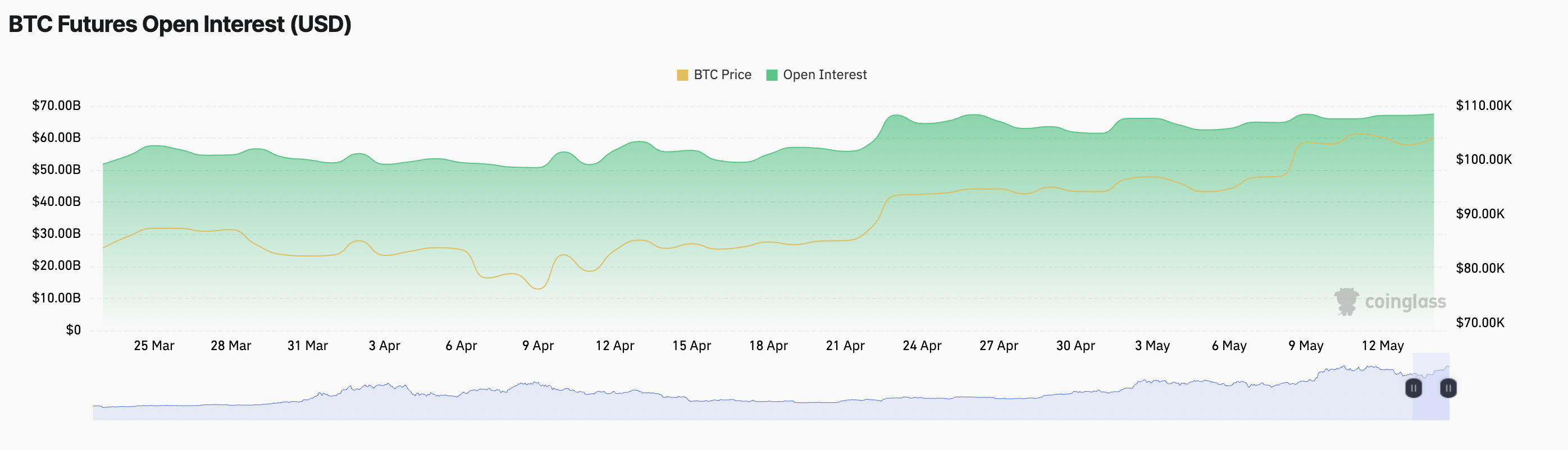

But wait! At the back of the market, hope scuttles on. BTC managed a daring 1% climb in the past 24 hours—a move so subtle you’d need a microscope and a Red Bull to notice. Trading activity perked up very slightly, and Bitcoin’s futures open interest now sits at $67.47 billion (also up 1%), proving again the market’s unending fascination with moving nearly nowhere, but doing so confidently.

This slow-motion optimism means traders might—possibly, maybe—be considering the re-entry of their cash into the market, all while glancing nervously at their phone’s battery percentage.

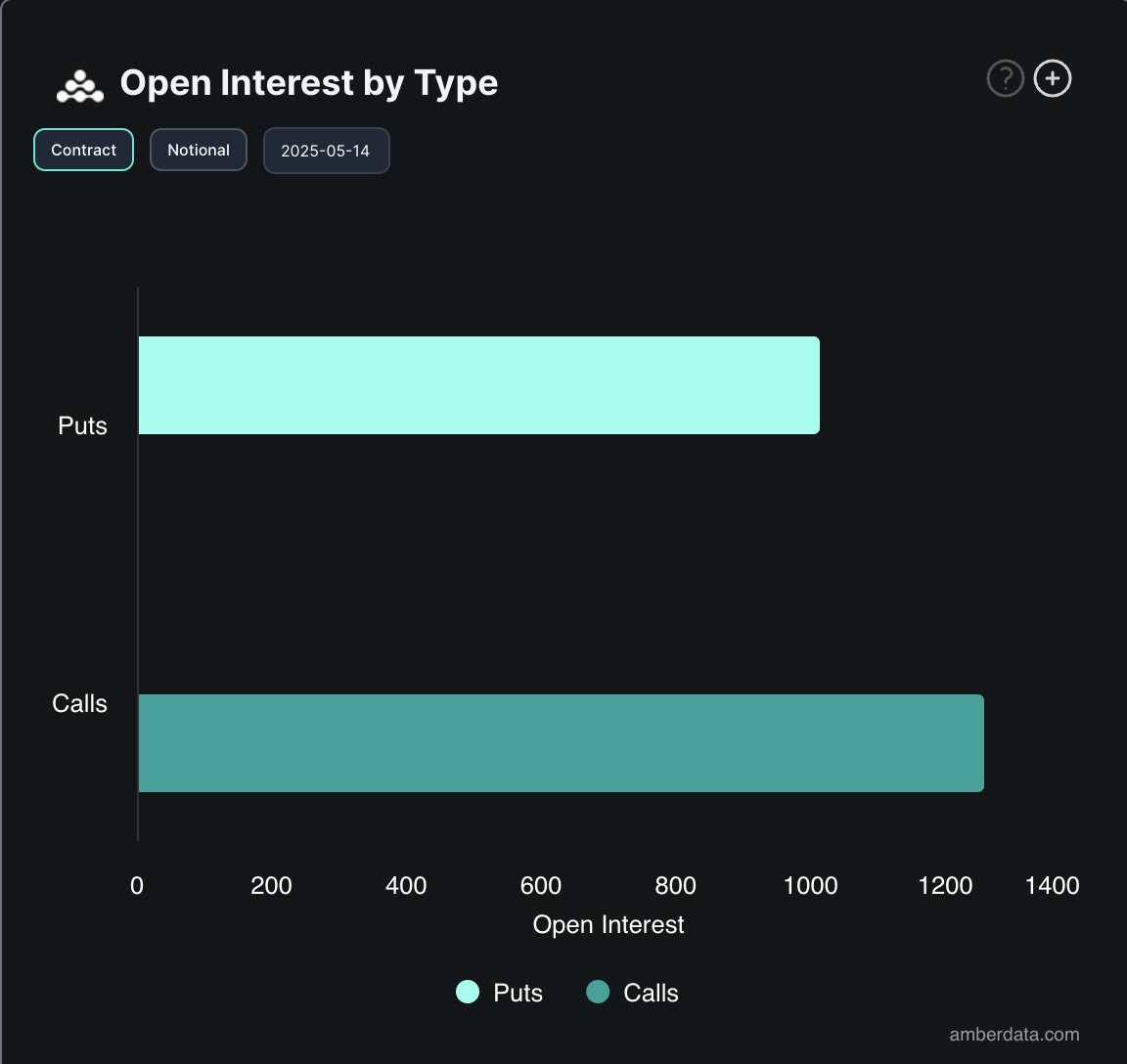

Evidently, today’s action in the BTC options market can be described as “more people want call options than puts,” which in financial astrology apparently signals bullishness. Why not? After all, it worked for the Romans and chicken entrails.

The resilience shown by BTC derivatives suggests the market is bracing to chase “positive momentum,” or at the very least, something more interesting than a $96 million ETF temper tantrum. Stay tuned—probably nothing will happen, but it’ll be hilarious when it does.

Read More

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Silent Hill f 2025 Release Date Confirmed, And Pre-Orders Are Already Open

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Silent Hill f Reveals Release Date and Terrifying New Monsters

- Hollow Knight: Silksong Steam Update Excited Fans

2025-05-14 10:56