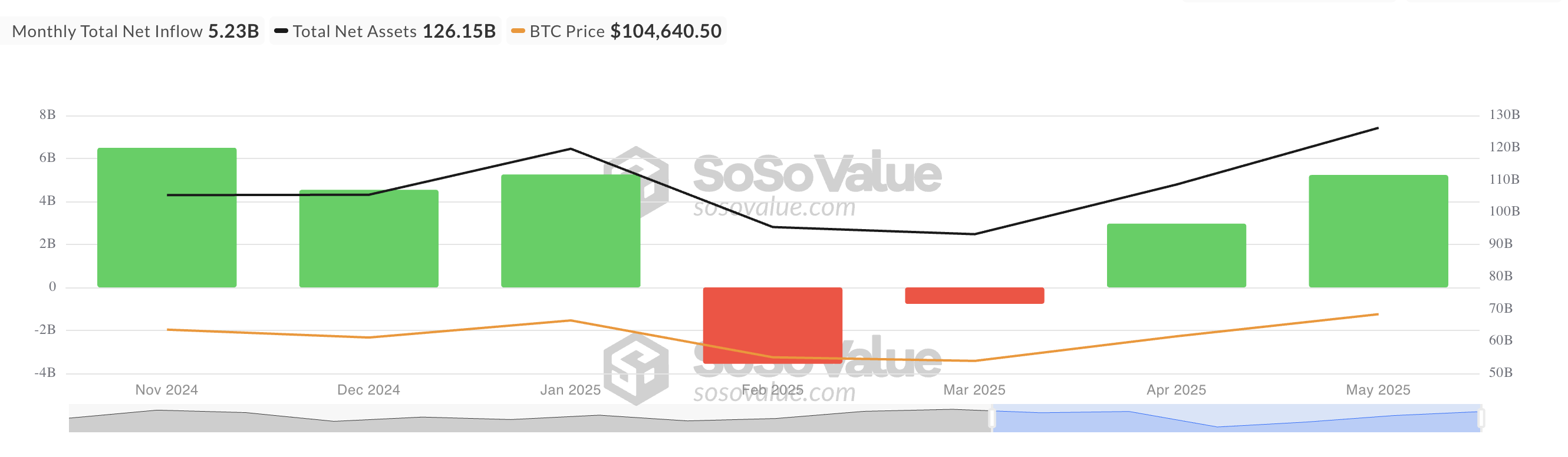

Well, well, well! It seems like the Bitcoin exchange-traded funds (ETFs) are enjoying a lavish feast of demand this May, with a mind-boggling net inflow of $5.23 billion. Who knew digital coins could bring in more cash than your average fortune cookie?

This marks a staggering 70% leap from the measly figures in April. And what’s that? Institutional interest? Yes, you heard it right. The king of coins just broke its own records, soaring to a brand-new high. Can you imagine how much it would take to pry institutional wallets open? Apparently, more than we thought!

BTC ETF Inflows Surge 76% in May (Not a Typo!)

According to data from SosoValue, the demand for BTC ETFs exploded in May like a firecracker at a midnight fiesta, with a net inflow of $5.23 billion. That’s a 76% increase from April’s $2.97 billion. It’s like watching a snail win a 100-meter sprint—slow, but surely impressive.

This influx of green paper came right as BTC shot up to a new all-time high of $111,968. Who needs a magic wand when retail momentum and institutional hype can conjure such spells? Now, everyone’s hopping on the digital train, hoping it doesn’t derail. 🚂

As BTC climbs higher, ETFs are looking like that delicious dessert at the end of the banquet for big investors itching for a taste of digital assets. We just hope they didn’t skip the appetizers!

Sustained institutional participation like this doesn’t just bring in fresh capital—it also brings price stability. But who are we kidding? Stability in the world of Bitcoin is like calling a tornado “gentle breeze.” But hey, one can hope it sets the stage for even crazier rallies come June.

BTC Market Shows Signs of Chaos (But Wait, It’s Not All Bad)

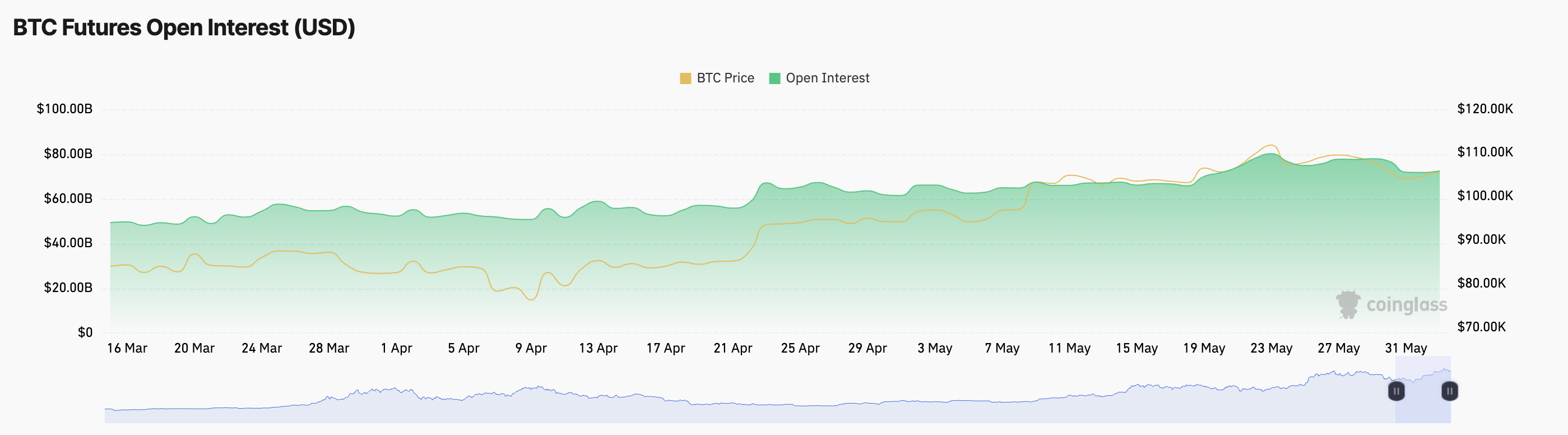

Today, BTC is up by a modest 1%. A whole 1%! Guess we can all breathe easy as we watch it hover at $105,216. Well, it’s something. 🤷♂️ The futures open interest is now at $72.47 billion, climbing 1% over the past day. That’s a lot of zeros, folks!

Now, let’s break it down: open interest refers to active derivative contracts—futures and options—that are still waiting to be settled. If this number keeps climbing, it means the market is waking up, and more capital is charging in. But don’t let that fool you—when it comes to crypto, the market could flip on you faster than a pancake at breakfast.

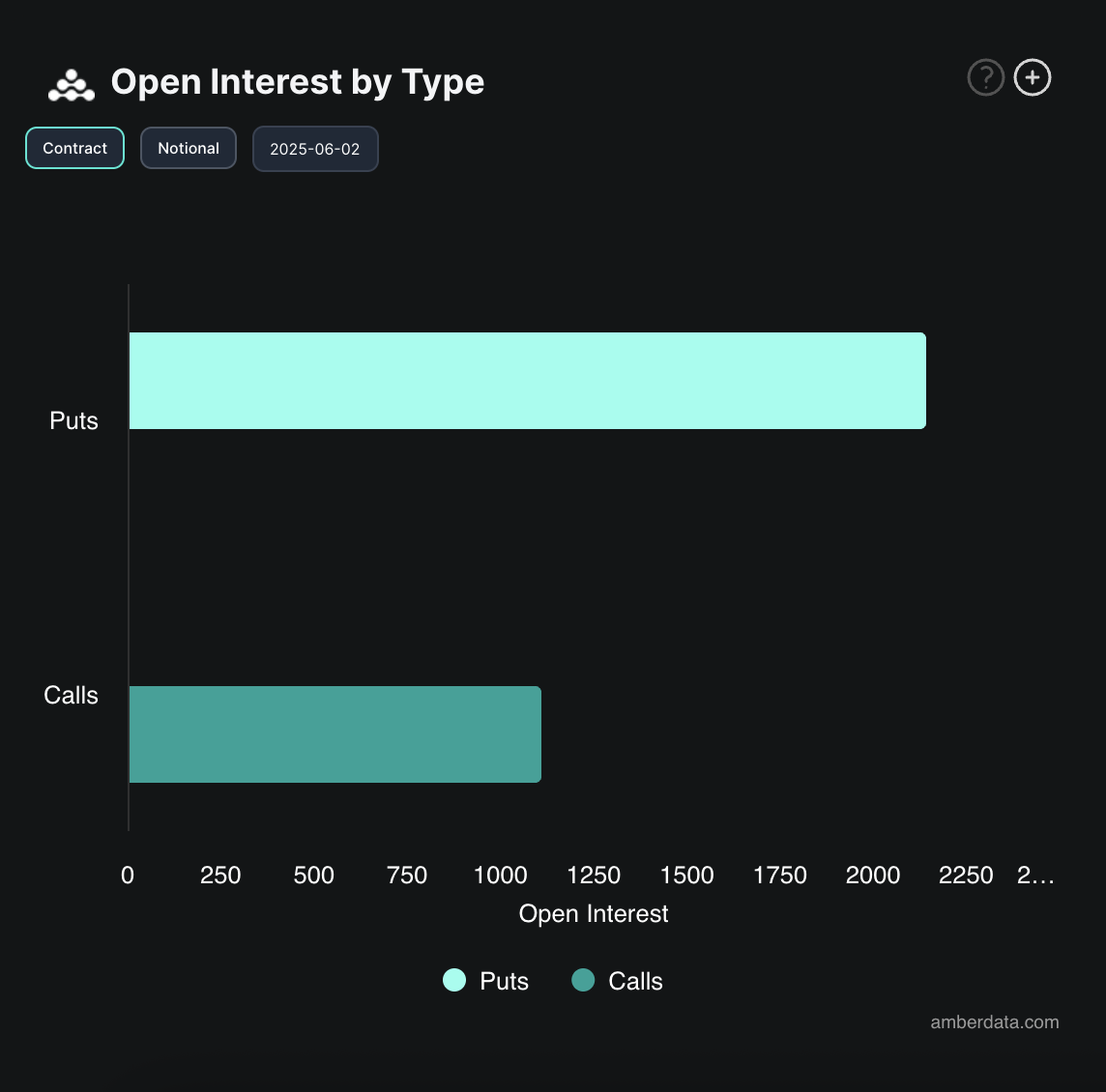

The momentum is building, yes, but let’s not forget those ominous signs in the options market. According to Deribit, today’s market is marked by a surge in demand for put contracts. That’s right, traders are betting that BTC might just take a tumble. Maybe they’re hedging their bets, or maybe they’ve just been burned too many times by digital asset rollercoasters.

It’s a classic case of mixed signals: the long-term outlook looks bright, but the short-term jitters are like watching a soap opera in slow motion. Who knows what comes next? Grab your popcorn, because it’s about to get even more interesting. 🎬

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-02 16:36