As the cosmic dance of August concluded, Bitcoin ETFs found themselves in a state of existential confusion, while Ethereum funds waltzed into the spotlight. But now, the universe has settled into a more predictable rhythm, and capital is once again flowing into the black hole of crypto investment products. 🌌💸

It appears that Bitcoin ETFs have once again caught the attention of US investors, who, like a curious child, can’t resist the siren call of the cryptocurrency market. September, that most enigmatic of months, has seen a resurgence in interest, with some rather impressive performances over the past two weeks. 🧠🚀

Bitcoin ETFs Close Week With $642-M Inflow

According to the latest market data, the US-based Bitcoin ETFs posted a total net inflow of $642.35 million on Friday, September 12. This single-day performance marked the fifth consecutive day of positive capital influx for the exchange-traded funds. 📈💰

Surprisingly, Fidelity Wise Origin Bitcoin Fund (with the ticker FBTC) led the pack on Friday, closing the week with a net inflow of over $315 million. Meanwhile, BlackRock’s iShares Bitcoin Trust (with the ticker IBIT) came in second with a daily net inflow of $264.71 million on Friday. This impressive daily performance pushed the largest Bitcoin exchange-traded fund closer to reaching a net assets valuation of $90 billion. 🏆🧠

Bitwise Bitcoin ETF (BITB) with a $29.16 million net inflow and ARK 21Shares Bitcoin ETF (ARKB) with a $19.37 million net inflow also added value in double digits on Friday. Grayscale Bitcoin Mini Trust (BTC) and VanEck Bitcoin ETF (HODL) were the only Bitcoin ETFs that recorded any activity, with $5.69 million and $8.24 million, respectively, on the day. 🧩💸

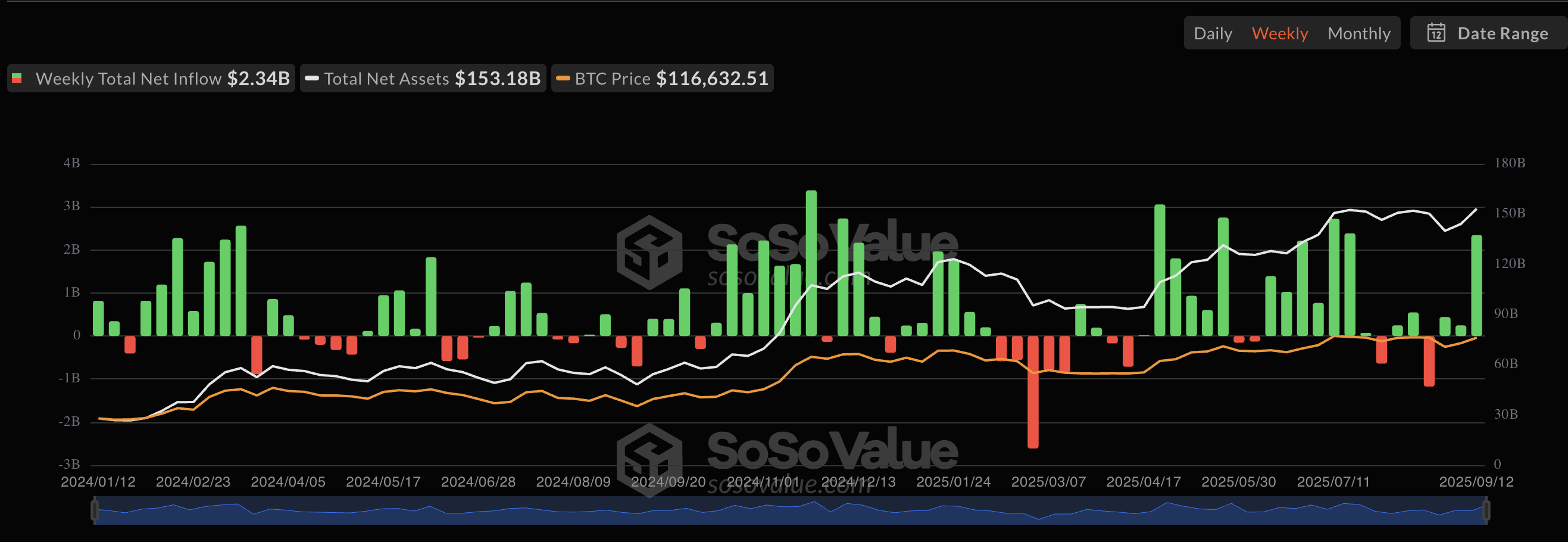

As inferred earlier, Friday’s $642-million performance was only the latest in a line of strong performances by the US-based Bitcoin ETFs. The latest market data shows that the BTC exchange-traded funds added $2.34 billion in value over the past week. 🚀📈

This past week’s performance represents the first time that the Bitcoin ETFs would be crossing the billion-dollar mark on the inflow chart. Also, the BTC-linked investment products outperformed the US Ethereum ETF market, which closed the week with a net weekly inflow of $637.69. 🧠⚡

Bitcoin Price At A Glance

This positive performance of the spot Bitcoin ETFs is a reflection of the resurgence that the BTC price went through over the past week. According to data from CoinGecko, the premier cryptocurrency is up by more than 5%. As of this writing, Bitcoin is valued at around $115,990, with no substantial price change in the past 24 hours. 📊📉

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-09-14 12:15