Ah, the 7th of March, a day that shall be etched in the annals of financial folly! On this fateful day, the Bitcoin exchange-traded funds (ETFs) found themselves in a veritable maelstrom, witnessing outflows that could make even the most stoic investor weep—$409 million, to be precise, as reported by the ever-watchful SoSoValue. Such a sum! It is as if the very essence of hope had been siphoned away, leaving behind only the hollow echoes of despair.

Among these unfortunate funds, the ARK 21Shares Bitcoin ETF stood out, not for its resilience, but for its staggering withdrawal of $160 million. One might imagine the fund manager, clutching his pearls, exclaiming, “What have we done to deserve this?” Meanwhile, BlackRock’s IBIT ETF, that titan of finance, also succumbed to the tides of misfortune, losing a mere $39.85 million—pennies in the grand scheme of existential dread.

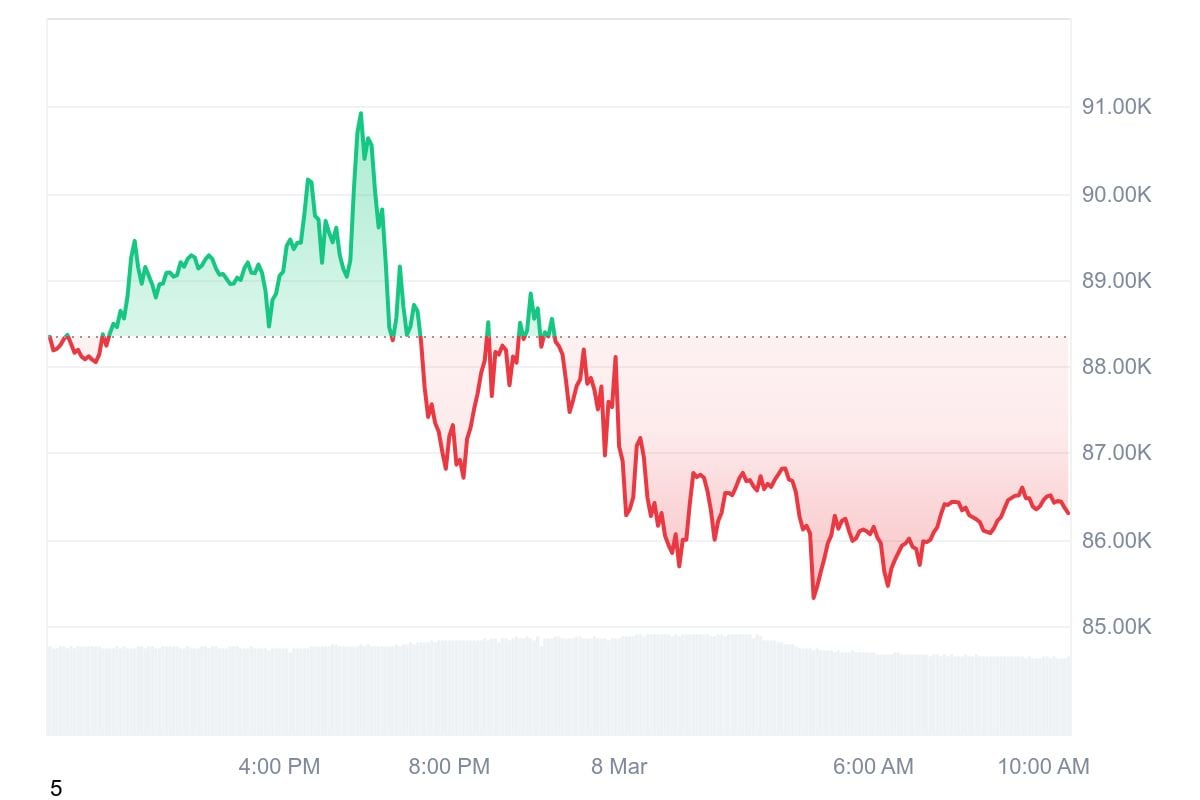

In a curious twist of fate, Ethereum ETFs, those less glamorous cousins, experienced only moderate withdrawals, totaling a paltry $23 million. Perhaps they were spared the full brunt of the storm, or perhaps they simply lacked the allure to attract such dramatic exits. The selling pressure on the ETF market coincided with Bitcoin’s own descent into the abyss, as its price plummeted below the once-coveted threshold of $86,000, all while the White House convened a summit on cryptocurrency—a gathering of the titans, if you will.

By the 8th of March, the broader cryptocurrency market lay in ruins, reflecting the aftermath of these withdrawals. The total market capitalization, once a robust $1.7 trillion, now stood diminished, a 3.35% decline that echoed the collective sigh of investors everywhere. Yet, in a twist that would make even the most cynical smile, trading volume surged to $49.35 billion in just 24 hours—a 15.13% increase! It seems that in the world of crypto, despair and exuberance dance a peculiar waltz.

As for Bitcoin, its fully diluted valuation (FDV) reached a staggering $1.8 trillion, with a volume-to-market cap ratio of 2.87%. The total and circulating Bitcoin supply remained steadfast at 19.83 million BTC, a mere whisper of the maximum 21 million BTC that could ever grace this earth. A cruel reminder of scarcity, perhaps?

Despite the U.S. president’s executive order to construct a strategic crypto reserve—a noble endeavor, one might say—market sentiment remained as bleak as a winter’s night. The White House, in its infinite wisdom, hosted a cryptocurrency summit, gathering the luminaries of the industry: MicroStrategy CEO Michael Saylor, Coinbase cofounder Brian Armstrong, the Winklevoss twins, and Ripple CEO Brad Garlinghouse, all under one roof, discussing the administration’s grand plans for a government-owned digital asset reserve.

Treasury Secretary Scott Bessent, with the gravitas befitting his office, reiterated the U.S. commitment to the dollar as the global reserve currency. He spoke of integrating stablecoins into the financial system, as if to say, “Fear not, dear citizens, for we shall tame this wild beast!” The government’s crypto holdings, it seems, may extend beyond Bitcoin, perhaps even to include assets like XRP—a veritable cornucopia of digital delights!

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- USD ILS PREDICTION

- How to Get 100% Chameleon in Oblivion Remastered

- Invincible’s Strongest Female Characters

- How to Reach 80,000M in Dead Rails

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

2025-03-08 17:30