Right, so this Monday, Bitcoin ETFs decided to play Houdini with $109 million like it was a magic trick – three days running! Meanwhile, Ether ETFs stayed as silent as your phone during a boring meeting. 🙄

Bitcoin’s Money Drain Marathon and Ether’s Epic Radio Silence

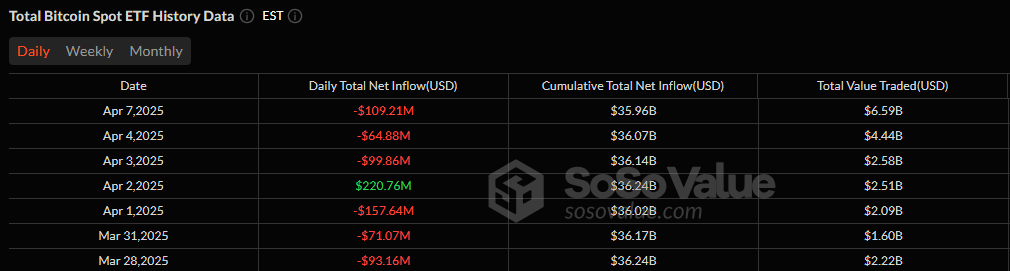

Monday rolled in with Bitcoin ETFs in full drama mode: a gut-punch outflow of $109.21 million, marking day three of crying over spilled crypto. Investors were clearly in “meh” mode, fleeing the scene while trading volumes pretended everything was fine.

Grayscale’s GBTC got the worst hangover, bleeding a staggering $74.01 million. Not far behind, Invesco’s BTCO did its own disappearing act with $12.86 million. The rest of the casts had their minor roles: Wisdomtree’s BTCW lost $6.23 million, Vaneck’s HODL shed $6.10 million, Valkyrie’s BRRR dropped $5.32 million, and Ark 21shares’ ARKB whispered goodbye to $4.69 million.

The remaining six ETFs, including the big league names like Blackrock’s IBIT and Fidelity’s FBTC, were just there – neither gaining nor losing a cent. In spite of the wild money escape, trading volume was out here acting like a rock concert crowd. 🤷♀️

Total trading value jumped to a solid $6.59 billion, making Friday’s $4.43 billion look like a mere warm-up act. Yet, the overall net assets for bitcoin ETFs dipped under the infamous $90 billion line, ending the day at $87.86 billion. Talk about an identity crisis!

For ether ETFs, it was the most uneventful day since silent films were cool – all nine reported a grand total of zilch net flows. Could be hesitation, could be the calm before another crypto rollercoaster. Either way, keep your popcorn ready!

With global trade jitters and geopolitical drama adding to the mix, ETF flows seem set to keep us on our toes all week. Buckle up, folks! 😜

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-08 18:57