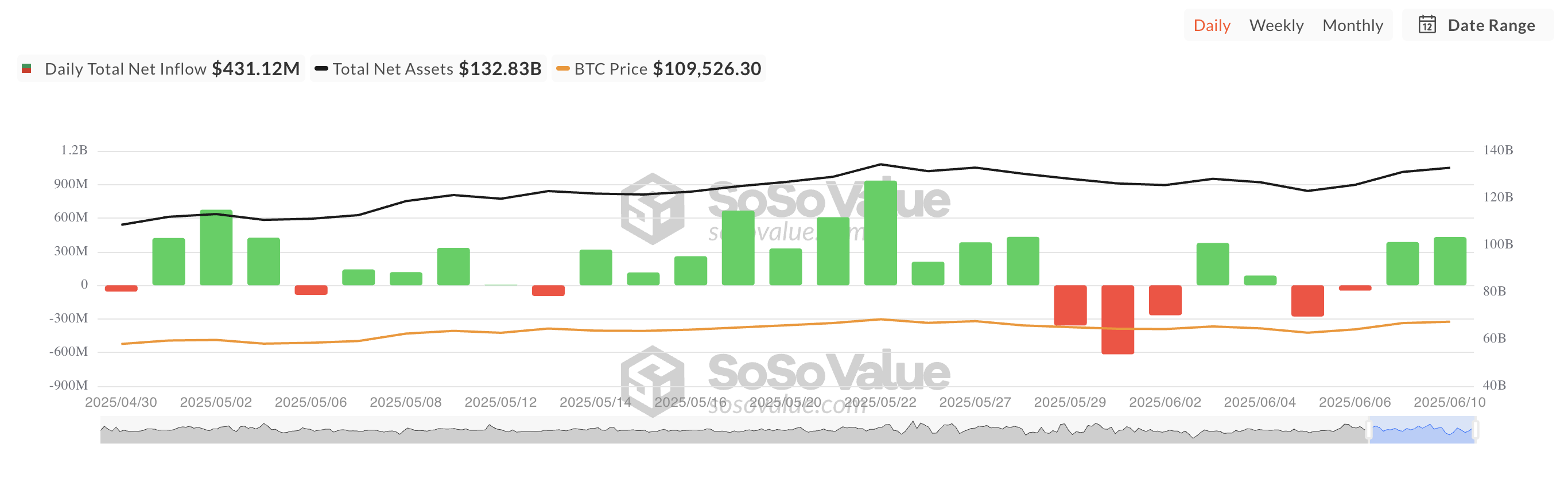

In a twist worthy of a Dostoevskian plot, Bitcoin exchange-traded funds (ETFs) have miraculously recorded over $400 million in net inflows yesterday. This astonishing feat marks the largest single-day net inflow these funds have registered since the fateful day of May 28.

Ah, the inflows! They highlight a renewed confidence among institutional investors, reigniting bullish sentiment across the crypto markets like a phoenix rising from the ashes—or perhaps just a particularly enthusiastic chicken. 🐔

Bitcoin ETF Demand Rises Sharply

On Tuesday, the demand for US-listed spot Bitcoin ETFs surged like a caffeinated cat, with net inflows climbing to a staggering $431.12 million, a delightful 12% increase from the previous day’s $386 million. Who knew money could flow so freely?

This capital influx into ETFs serves as a leading indicator of broader market appetite, suggesting that institutional players are positioning themselves for further upside. The surge in demand comes amid growing optimism that the leading coin, BTC, could soon reclaim the elusive $110,000 level, with some traders eyeing a potential return to its all-time high. It’s like watching a soap opera, but with more zeros! 📈

Yesterday, BlackRock’s IBIT led the charge with the highest daily inflows, totaling a jaw-dropping $337 million, bringing its total historical net inflow to a staggering $49.11 billion. Meanwhile, Fidelity’s FBTC recorded the second-highest daily net inflow at $67.07 million, bringing its total historical net inflows to a mere $11.68 billion. Just pocket change, really.

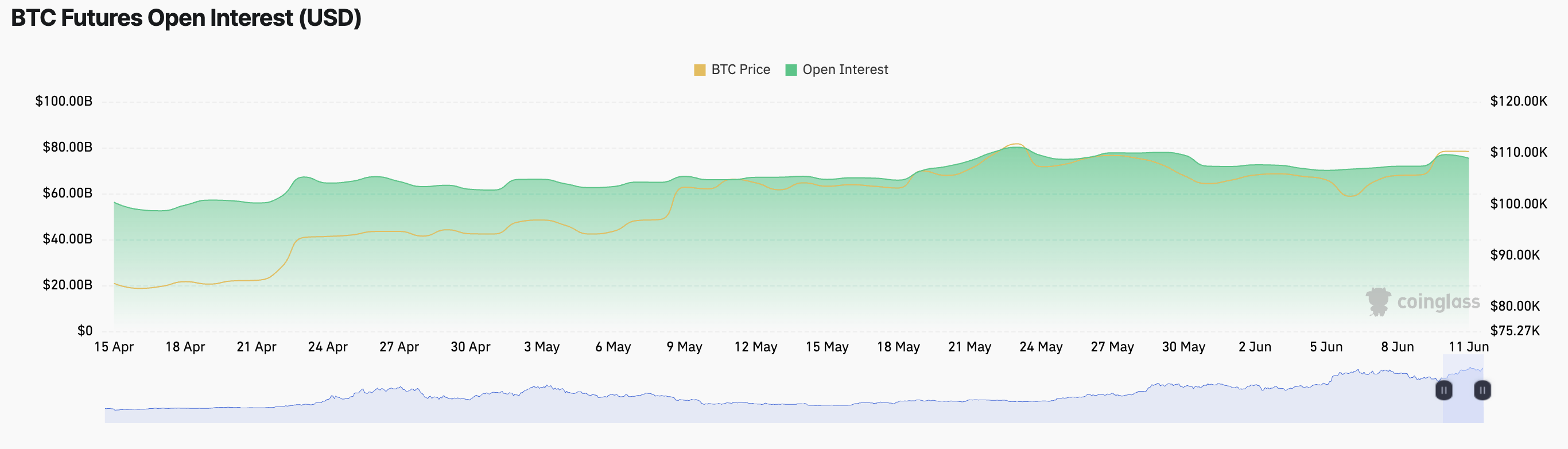

BTC Price Holds Steady, but Futures and Options Signal Caution

As profit-taking activity gradually gains momentum, the BTC spot price has remained as flat as a pancake over the past 24 hours. As of this writing, the king coin trades at $109,601, noting a modest 0.11% gain. Not exactly a thrilling rollercoaster ride, is it?

Meanwhile, open interest in the coin’s futures has declined, signaling a pullback in trading activity. At press time, this is at $75.33 billion, falling 1% over the past day. It seems the traders are taking a breather, perhaps sipping tea and contemplating their life choices.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. A decline in open interest signals reduced trading activity or profit-taking, as traders close out existing positions. It’s like watching a game of musical chairs, but with more spreadsheets.

In BTC’s case, the slight dip in futures open interest indicates early-stage profit-taking among traders who had positioned long during the recent rally. If this trend persists, the downward pressure on the coin will strengthen. Oh, the drama!

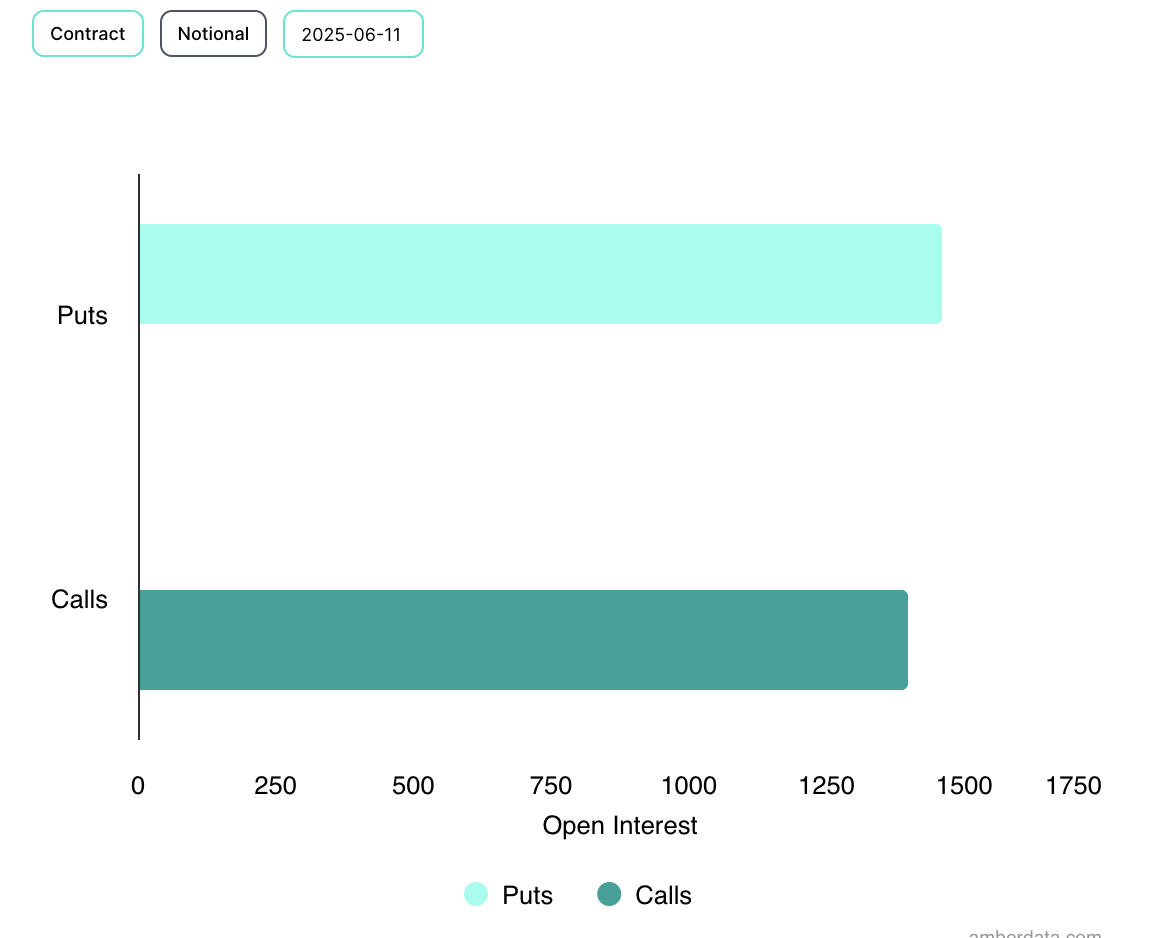

Furthermore, sentiment is also cautious in the options market. Demand for put options has risen, suggesting a subtle resurgence of bearish expectations. It’s like a storm cloud hovering over a picnic—nobody wants to get wet! ☔

Therefore, while ETF inflows paint a bullish macro picture, near-term price action and derivatives positioning indicate a potential cooling-off period as investors take profit. It’s a classic case of “make hay while the sun shines”—or in this case, while the Bitcoin is hot!

Read More

2025-06-11 10:26